All Eyes on 1.2850 Support for GBPUSD says Forex.com's Weller

- Written by: Gary Howes

Image © Adobe Images

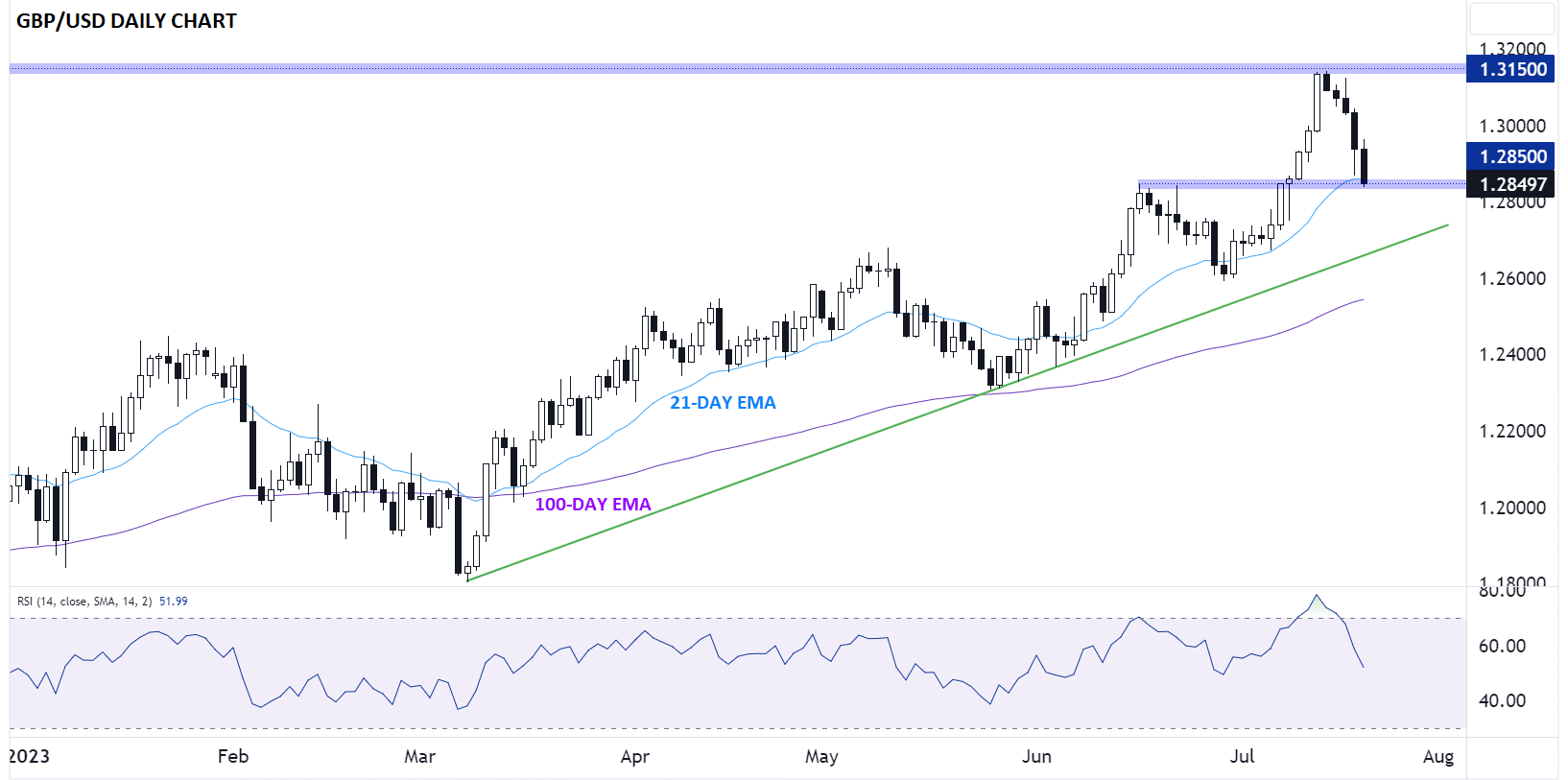

The Pound to Dollar exchange rate rose ahead of a key support level that must hold or risk a slide to 1.27, according to a new analysis.

"1.2850 support could lead to a bounce ahead of the weekend, but if that level gives way, a continuation to below 1.2700 could be at hand," says Mathew Weller, Global Head of Research for FOREX.com.

The call comes amidst a tentative rebound in Pound Sterling ahead of the weekend following the release of some stronger than expected UK retail sales, a release that coincides with GBPUSD bouncing in the vicinity of the aforementioned technical support level.

UK retail sales rose 0.7% month-on-month in June, exceeding the 0.2% expected by the market and representing a ramp-up from May's 0.1%. On an annual basis sales were -0.1%, better than the -1.5% expected and May's -2.3%.

Following the figures the Pound to Dollar exchange rate was seen up 0.20% at 1.2890 with the weekly loss at 1.70%.

Looking at the chart, Weller identifies 1.2850 as a logical area for Pound-Dollar bears to take profits ahead of the weekend, "so a bounce back above 1.2900 could be in the cards ahead of the weekend".

Image courtesy of Forex.com.

The Pound nevertheless still looks set to record a weekly loss in excess of 1.0% following a rapid deflation in investor expectations for the number of interest rate hikes yet to come from the Bank of England.

Expectations fell sharply following the release of UK inflation data that was weaker than the market was anticipating at 7.9% year-on-year.

"UK swap rates have fallen, with markets pricing in a peak Bank rate of just below 6% - a few weeks ago markets had priced in the possibility of 6.75% in Q1 2024. For markets the near-term question is over the 3 August MPC meeting, where 32bps of tightening is currently priced in," says Philip Shaw, an economist at Investec.

The market now sees a roughly 40% chance the Bank goes with a 50 basis point hike at its next meeting on August 03 in light of decelerating inflation.

Whether Sterling encounters further meaningful selling pressure depends on how much further these rate hike expectations can extend and to what extent an improved economic outlook can boost the currency.

"We expect sales volumes to rise further in the second half of this year, as real disposable incomes start to recover," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics following the release of the retail sales numbers.

"Month-to-month increases in wages will outpace price rises in Q3 and Q4, as energy prices fall back and the rate of increase in both food and core goods prices slows, in line with producer prices," he adds.

This week's inflation release has caused a turnaround in the direction of the Pound which was until this week 2023's best-performing major currency.

According to Georgette Boele, Senior FX Strategist at ABN AMRO, a further rerating lower in Bank of England interest rate expectations can continue.

"This will probably weigh on sterling this year," she says.

Dominic Bunning, a foreign exchange strategist at HSBC, quips that for the Pound "the price isn't right".

UK headline inflation undershot expectations when it read at 7.9% on Wednesday, below the market's consensus for 8.2% with all sub-components also undershooting.

"These numbers should add to the recent short-term downside momentum in GBP, which we think has further to run," says Bunning.

HSBC strategists look to express short-term bearish GBP views against non-USD crosses that will be less exposed to swings in broader risk sentiment.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes