Retail Sales Boost Offers Pound Sterling a Temporary Floor

- Written by: Gary Howes

- Retail sales beat expectations

- Helps GBP recover some of its weekly losses

- ABN AMRO forecasts Pound-Euro as high as 1.22

Image © Adobe Images

Pound Sterling was steadier ahead of the weekend following the release of some better than expected retail sales data, although a number of analysts tell us the selloff following the midweek inflation release is not yet complete.

UK retail sales rose 0.7% month-on-month in June, exceeding the 0.2% expected by the market and representing a ramp-up from May's 0.1%. On an annual basis, sales were -0.1%, better than the -1.5% expected and May's -2.3%.

The ONS reports increases in sales were recorded across all sectors.

Following the figures, the Pound to Euro exchange rate is quoted 0.20% higher on the day at 1.1590, narrowing the weekly loss to approximately 0.70%, and the Pound to Dollar exchange rate is up 0.20% at 1.2890 with the weekly loss at 1.70%.

"We expect sales volumes to rise further in the second half of this year, as real disposable incomes start to recover. Month-to-month increases in wages will outpace price rises in Q3 and Q4, as energy prices fall back and the rate of increase in both food and core goods prices slows, in line with producer prices," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

The retail sales data aren't considered top-tier given the market's obsessive focus on the future of UK interest rates which places overwhelming influence on jobs, wage and inflation figures.

However, they will offer some insight into the underlying state of the economy and whether consumer-driven inflation can be something the Bank of England should be wary of when formulating upcoming decisions.

The Pound has fallen over the past two days as markets rapidly reduce expectations for a 50 basis point hike at the Bank of England's August 03 policy decision to around 40% odds, having seen such a move as a sure-fire bet just last week.

The peak in Bank Rate is now seen closer to 5.85% than the 6.5% expected earlier in June; a supportive development for the UK economic outlook but unsupportive of the Pound over near-term timeframes.

"Sterling has fallen back against the euro and the dollar as traders assess that the Bank of England won’t have to raise rates as far and as fast as feared," says Susannah Streeter, head of money and markets at Hargreaves Lansdown.

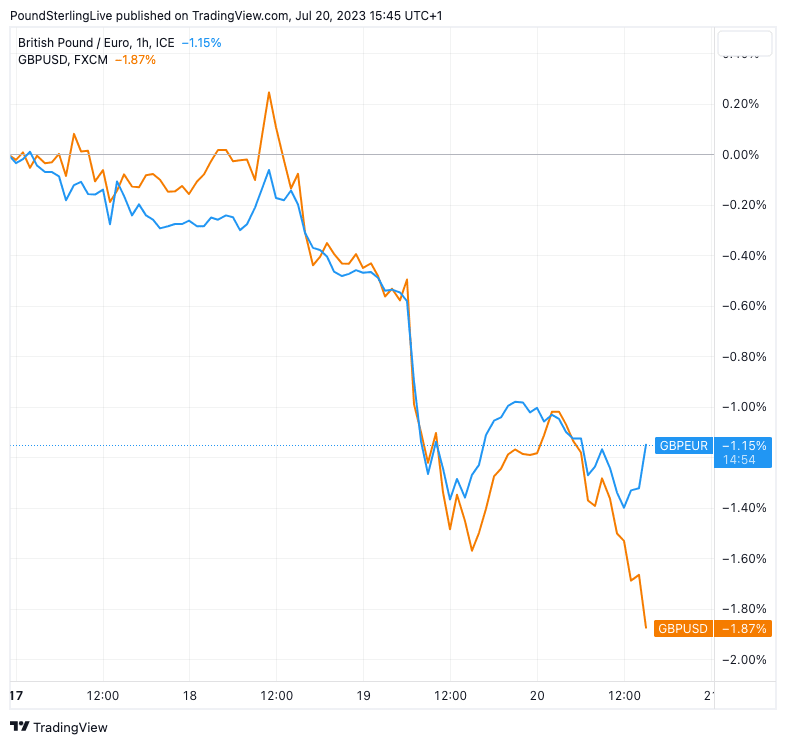

Above: GBPEUR (blue) and GBPUSD performance this week.

Foreign exchange analysts are looking for further weakness to play out as the air is let out of 2023's top-performing currency heading into August, a month that traditionally does not favour the Pound on a seasonal basis.

Dominic Bunning, a foreign exchange strategist at HSBC, quips that for the Pound "the price isn't right".

UK headline inflation undershot expectations when it read at 7.9% on Wednesday, below the market's consensus for 8.2% with all sub-components also undershooting.

"These numbers should add to the recent short-term downside momentum in GBP, which we think has further to run," says Bunning.

HSBC strategists look to express short-term bearish GBP views against non-USD crosses that will be less exposed to swings in broader risk sentiment.

"We recently opened trade ideas to sell GBP against both EUR and NOK," says Bunning. "The inflation print is likely to make it harder for the BoE to press ahead with quite as aggressive a hiking cycle as the market has priced in, especially as broader activity data has started to disappoint over the past month."

HSBC also notes the Pound was showing some signs of overvaluation after its persistent outperformance in 2023. "A softening in rates pricing would make elevated valuations less justified and should drag GBP lower on a tactical basis," adds Bunning.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Analysis from ABN AMRO Bank says to allow for further near-term weakness in the Pound ahead of a more sustained rally against the Euro later on.

"Sterling should do well in 2024, especially versus the euro as the market and our view on the ECB are far apart," says Georgette Boele, Senior FX Strategist at ABN AMRO.

The Dutch-based bank expects another 50-75bp of rate hikes from the Bank of England this year and modest rate cuts to start in the second half of next year.

"So, the market is moving in our direction," says Boele. "There is likely to be a further repricing of expectations, in our view. This will probably weigh on sterling this year, especially versus the US dollar."

For next year, ABN AMRO expects both the Federal Reserve and the ECB to ease substantially, far more than the Bank of England.

Boele's team forecasts the Pound-Dollar exchange rate back at 1.25 by year-end ahead of a rally to 1.28 by end-2024.

The Pound-Euro exchange rate is meanwhile forecast at 1.1628 by the end of 2023 and 1.22 by the end of 2024.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes