Pound Can "Hold the Line" against the Dollar post-BoE say Analysts

- Written by: Gary Howes

Above: File photo of Andrew Bailey. © Pound Sterling Live, Still Courtesy of Bloomberg.

The Bank of England has done enough to ensure the British Pound remains supported against the Dollar say analysts, although it would be at risk were UK economic growth to slow later in the year and prompt an early end to the interest rate hiking cycle.

The British Pound initially jumped against the Dollar in the wake of the Bank of England's decision to raise interest rates by 25 basis points at its February policy meeting, although gains were tampered after Governor Andrew Bailey sounded caution regarding the outlook.

The Bank of England raised rates by 25 bps to 0.50% and also initiated quantitative tightening, the process whereby it would not repurchase expired bonds accumulated under its quantitative easing programme.

"GBP-USD can probably hold the line at around 1.36 after the BoE hiked the bank rate and started unwinding QE, although BoE Governor Andrew Bailey stressed that it would be a mistake to assume that rates are on an inevitable long march up," says Roberto Mialich, a currency strategist at UniCredit Bank.

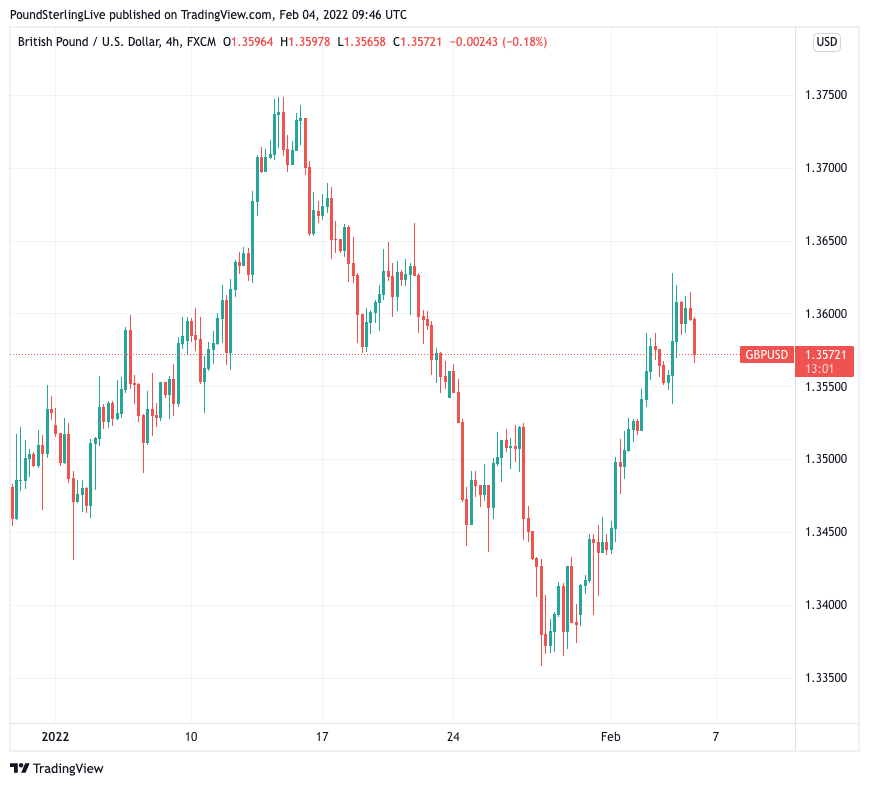

The Pound to Dollar exchange rate rose to a high at 1.3628 in the wake of the meeting but has subsequently slipped back to 1.3575.

Above: GBP/USD at four hour intervals showing 2022 price movements.

- GBP/USD reference rates at publication:

Spot: 1.3552 - High street bank rates (indicative band): 1.3176-1.3270

- Payment specialist rates (indicative band): 1.3428-1.3482

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

Four out of the nine MPC members voted for a 50 bps increase and inflation is now expected to peak at more than 7% vs 5% previously, suggesting that further near-term rate hikes are likely.

The Bank's projections showed that were it to follow the market policy rate path, which sees Bank Rate going to 1.5-1.75% by mid-2023, inflation would still be above 2.0% in 2023.

But that is where the 'hawkishness' ended and the Pound lost some steam when Governor Andrew Bailey spoke to the press, where he made it clear that the UK was about to see a significant drop in living standards as inflation ravages real incomes.

"A downbeat growth outlook and inflation expected to drop below target in three years suggest that markets have priced in too much action this year," says David Alexander Meier, Economist at Julius Baer.

UK energy bills are set to rise by 54% from April, leading a consensus of economists to anticipate the country's headline inflation rate would top at least 7.0% before turning lower again.

"We expect one more hike in May or earlier and possibly one more in the summer, followed rather by a hold until next year," says Meier.

For the Pound, such an outcome would be bearish given the market has priced in over 100 basis points of rises over the course of the coming twelve months.

"The GBP may be supported by further action in the near-term, but is likely to lose its advantage when reality sets in and its peers are in normalisation mode," says Meier.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“In our view, it is reasonable to assume that UK rates will continue to rise, with the next hike possibly coming as early as March. But we think that the peak will be around 1% this year," says Dean Turner, Chief Eurozone and UK Economist at UBS Global Wealth Management’s Chief Investment Office.

A peak - or terminal rate - at 1.0% implies there are just two more hikes to come, after which we can expect a pause.

Bailey told the assembled press the path for interest rates would ultimately remain dependent on the data that comes in.

"We expect that sterling can hold onto its gains for now, and should trade largely in line with the US dollar," says Turner.

Strategists at ING Bank now expect rates to be raised again in March and May, which can keep the Pound supported they say.

"While market pricing on tightening appears a bit too hawkish, this may not be challenged until later in the year, which should leave the pound able to withstand any appreciating pressures in the dollar and the euro," says Francesco Pesole, FX Strategist at ING.