Pound-Dollar Rate Vulnerability Grows after Breakdown on Charts

- Written by: James Skinner

- GBP/USD finding support, steadying at 1.3730

- But sell-off reinforces bearish picture on charts

- Heightens risk of slide back to 1.3571 & below

- USD in driving seat as Fed’s taper draws closer

Image © Adobe Images

- GBP/USD reference rates at publication:

- Spot: 1.3760

- Bank transfers (indicative guide): 1.3378-1.3475

- Money transfer specialist rates (indicative): 1.3636-1.3664

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Pound-to-Dollar rate stabilised above an important level of technical support in the mid-week session but its earlier sell-off earlier has left a bearish picture in its wake on the charts, one which renders Sterling vulnerable to fresh losses without a relent from a recently resurgent greenback.

Sterling was sold steadily from the outset on Monday but with losses building significantly on Tuesday in price action that pulled the Pound-Dollar rate below the 1.38 handle that had arrested its declines last week and beneath its 200-day moving-average located at 1.3785 by Wednesday.

Tuesday’s falls came amid widespread gains for Dollar rates that have since ebbed, but were enough to push the Pound-Dollar rate far enough below its 200-day average to keep it there overnight and into the mid-week session in what some analysts say is a bearish signal for Sterling’s outlook.

“GBPUSD has suffered a sharp sell-off for a clear and closing break below key support from the rising 200-day average to warn of a potentially more serious turn lower” says David Sneddon, head of technical analysis at Credit Suisse.

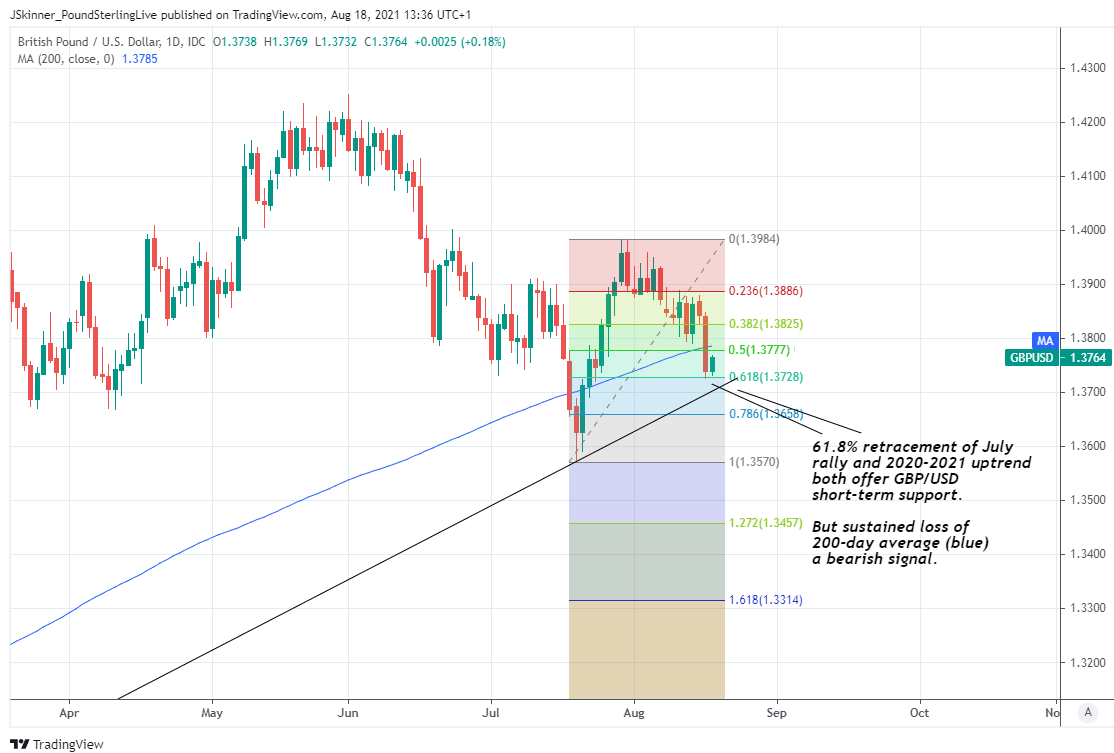

“We see support next at the 61.8% retracement of the July rally at 1.3730/20 and with the potential uptrend from early 2020 not far below at 1.3702 we would look for this to ideally hold at first,” Sneddon adds.

Above: Pound-Dollar rate shown at daily intervals with 200-day average in blue, Fibonacci retracements of July recovery and 2020-2021 uptrend line indicating possible areas of support for GBP/USD.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Sneddon told Credit Suisse clients on Wednesday that any loss of the mid-week support level around 1.3730 would leave the Pound-Dollar rate wide open for a decline to 1.3648 and then subsequently the 1.3571 area, the low from mid-July.

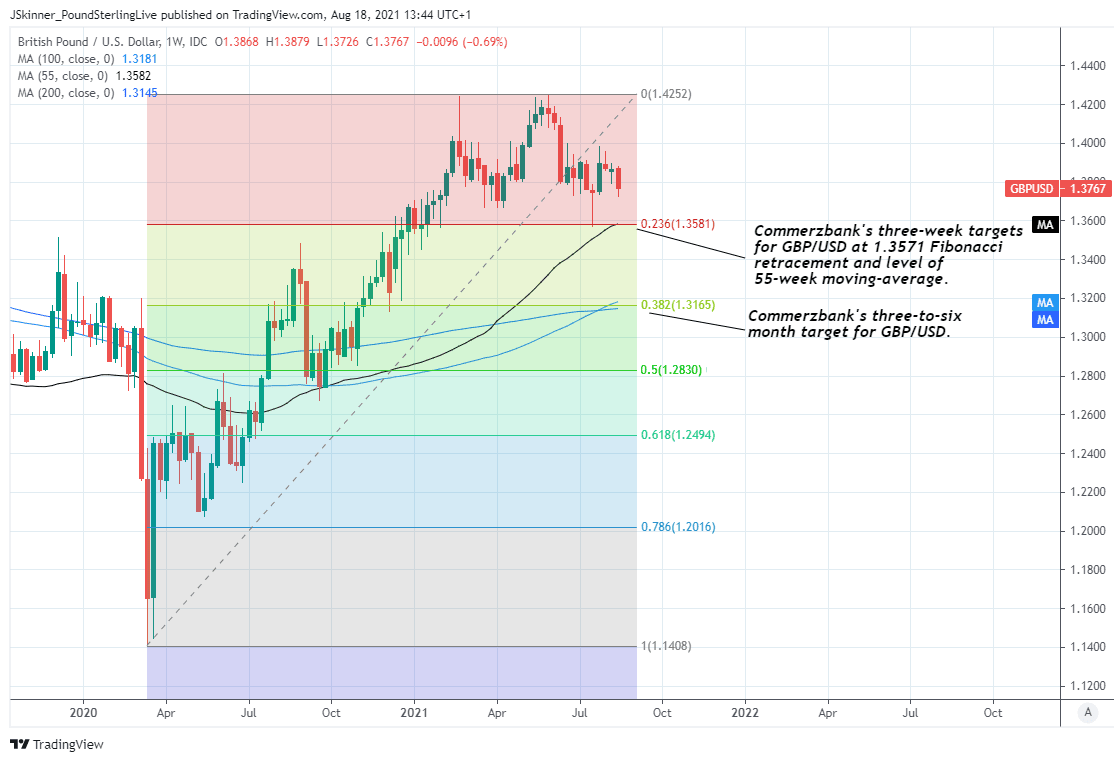

This coincides with the 23.6% Fibonacci retracement of the Pound-Dollar rate’s 18-month recovery from March 2020 lows as well as its 55-week moving-average of prices, which together already offered significant support during last month’s sell-off.

Sneddon and Credit Suisse colleagues look for the above levels to break Sterling’s fall in the event of further losses, although others at Commerzbank are actively targeting them and advocated this week that clients sell the Pound-Dollar rate in anticipation of much steeper losses in the months ahead.

“GBP/USD has sold off through the 200-day ma at 1.3785 and we look for losses to extend to the 1.3669 April low then the 1.3571 July low,” says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank.

“The long term trend (1-3 months) targets the 200 week ma at 1.3146 and 1.3090, but look for these to hold and provoke reversal,” Jones says.

Above: Pound-Dollar rate shown at weekly intervals with major moving-averages and Fibonacci retracements of 2020-2021 recover trend indicating possible areas of support.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Sterling was steadying on Wednesday despite July inflation figures that came in softer than was expected by many economists, and had fallen steeply on Tuesday despite June employment figures that suggested the labour market is recovering faster than most had expected.

Wednesday’s inflation figures could have been interpreted by some observers as a sign that the Bank of England (BoE) may not need to raise Bank Rate quite as soon as was indicated to be likely in August’s policy decision, making it if anything a bearish influence on the Pound, while the opposite is true of Tuesday’s employment numbers although on each day in question neither appeared to have any impact on Sterling.

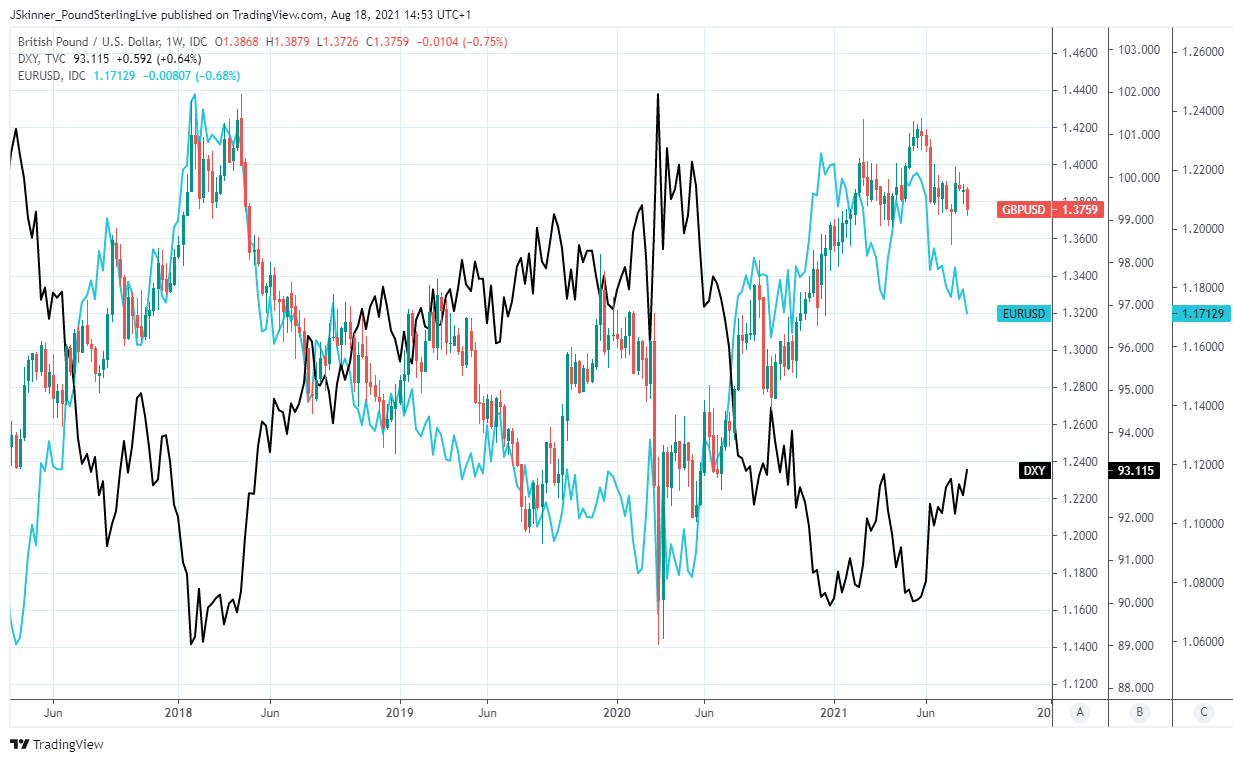

The one common denominator through all the highs and lows of this week’s price action has been the trajectory of the Dollar, which was softer against many major currencies on Wednesday but had risen strongly in the prior session after already entering the new week on its front foot this Monday.

“A more pointed indication that many share the view at the Fed that tapering should begin sooner rather than later (bolstered by the back-up in the Fed’s repo facility to well above a trillion dollars now) could help trigger an extension of the USD rally, a rally that is seeing resistance giving away in places,” says John Hardy, head of FX strategy at Saxo Bank.

Above: Pound-Dollar rate shown at weekly intervals alongside U.S. Dollar Index and EUR/USD.

“For trading USD strength, many will feel justified in focusing on EURUSD in particular, but also AUDUSD and NZDUSD. Note as well though that GBPUSD has now dropped back below its 200-day moving average and really only has the 1.3572 lows from July to support it ahead of the huge 1.3500 level,” Hardy writes in a Wednesday note to clients.

There are numerous candidates to explain this week’s rally by the Dollar including further signs on Monday that China’s economy is slowing and a surprise fall in U.S. retail sales for last month, which took the market by surprise on Tuesday, while throughout all of this the market has increasingly perceived that the Federal Reserve (Fed) is fast becoming ready to announce plans for a tapering of its quantitative easing programme.

These perceptions could solidify further overnight on Wednesday and would risk stoking renewed strength in Dollar exchange rates as well as further declines for the Pound-Dollar rate ahead of the weekend if minutes of July’s Fed meeting, due out at 19:00 London time, confirm that a growing number of policymakers feel able to begin winding down the programme without jeopardising the Fed’s coveted return to full employment for the job market.

“A special focus will also be on any discussion about the timeline for unwinding QE, especially after some members voiced their expectations for tapering to start already this fall. Any confirmation on this side should cement the view that the Fed will unveil more details of its tapering plan at the 26-28 August Jackson Hole symposium,” says Chris Turner, global head of markets and EMEA regional head of research at ING.