Euro Outlook Hinges on Merz's 'Agenda 2030'

- Written by: Gary Howes

Image: conceptphoto.info

Germany’s economic trajectory – and by extension, the euro’s stability – could depend on whether Friedrich Merz’s "Agenda 2030" can inject fresh momentum into Europe’s largest economy.

The Christian Democratic Union (CDU) leader has outlined a pro-growth reform package that includes tax cuts, deregulation, and energy cost reductions, aiming to pull Germany out of what some economists have dubbed its "lost decade."

"The performance of the German economy is relevant for EUR exchange rates," says Ulrich Leuchtmann, Head of FX and Commodity Research at Commerzbank, "because it affects the overall growth of the euro area and thus possibly the ECB's monetary policy."

Agenda 2030 recognises that "Germany has lost three years... we need a policy shift that restores competitiveness and prosperity."

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

A key pillar of Merz’s economic strategy is reducing the corporate tax rate to 25% while abolishing the solidarity surcharge – a move intended to boost business investment and reverse the country’s deindustrialisation trend.

However, whether Merz is able to deliver his package will depend on the willingness of the SPD party to adopt reforms.

The CDU/CSU is set to enter negotiations with the left-of-centre SPD in the hope of forming a government and ideological positioning will mean many reforms will fail to be adopted by the incoming government.

Euro 'bulls' would likely want to see as much of Agenda 2030 survive the negotiations.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Leuchtmann says the quality of German debt - Bunds - also matters for the Euro. "The 'safe-haven' quality of Bunds is weakened if concerns about persistently anaemic growth erode the perceived credit quality and crisis resilience of the German treasury," he explains.

The CDU/CSU alliance also pledges to cut income taxes, particularly for low and middle-income earners, and exempt overtime pay from taxation to incentivise labour market participation.

"Hard work must pay off again," the CDU manifesto states.

Additionally, Merz aims to slash bureaucratic hurdles, including repealing Germany’s Supply Chain Act and reversing excessive compliance with European regulations, which he argues has stifled growth.

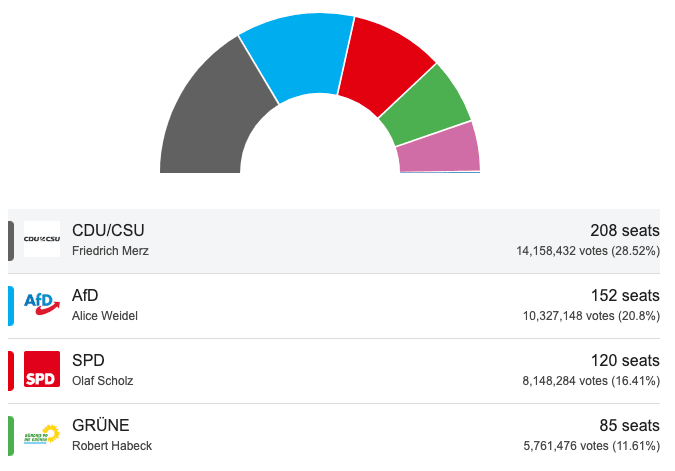

Above: The election result breakdown. Image courtesy of Google.

Merz’s economic plan also takes aim at soaring energy prices, which have burdened German industries and households. His proposal includes lowering electricity taxes and grid fees while expanding renewable energy and nuclear research.

"If Conservative front-runner Friedrich Merz secures a coalition with the Social Democratic Party and potentially the Greens, investors expect a wave of economic reforms and a possible relaxation of the debt brake, setting the stage for a sustained bull run," Green said. "Germany’s election result could spark Europe stock boom."

Most controversially, Merz has called for reviewing the possibility of reopening Germany’s most recently closed nuclear plants, arguing that the country's reliance on expensive energy imports is hurting industrial competitiveness.

"We need an energy policy that works with the people, not against them," the CDU/CSU platform reads.

Beyond tax and energy reform, Merz’s "Agenda 2030" promises to prioritise innovation through a federal digital ministry and increased spending on artificial intelligence, cloud computing, and aerospace technology. The CDU/CSU aims to ensure that Germany spends at least 3.5% of its GDP on research and development by 2030.

Merz’s plan includes a ‘start-up protection zone’ to encourage startups, largely exempting new businesses from bureaucratic constraints in their early years.

On social policy, Merz proposes abolishing Germany’s welfare scheme (Bürgergeld) in favour of a stricter income support system aimed at pushing the unemployed into the labour force. The CDU/CSU also seeks to maintain the current retirement age but offers tax-free earnings of up to €2,000 per month for pensioners who keep working.

With Germany accounting for nearly 30% of the eurozone’s GDP, the success of Agenda 2030 could have broad implications for the European economy and the euro.

However, challenges remain. Critics question whether Germany can afford tax cuts while maintaining strict debt rules, and the political feasibility of reviving nuclear power remains uncertain.

Still, with the eurozone’s largest economy facing stagnation, investors and policymakers alike will be watching closely to see whether Merz’s plan gains traction.

"Some of the measures are not ambitious enough, and many will not be implemented in full by the next government. And government policy simply cannot eliminate some of the structural headwinds to growth. Accordingly, the German economy looks set to grow only very slowly even after the upcoming general election," says Franziska Palmas, Senior Europe Economist at Capital Economics.