Pound-Dollar Rate Lower as Chinese Market Sell-off Incites Demand for Safe Havens

- Written by: Gary Howes

- Markets spooked by Chinese tech sell-off

- USD bought in safe-haven bid

- But JP Morgan says concerns are well priced

- Morgan Stanley says GBP/USD is cheap

- Credit Agricole model says to buy GBP/USD

Image © Adobe Stock

- GBP/USD reference rates at publication:

- Spot: 1.3776

- Bank transfers (indicative guide): 1.3390-1.3490

- Money transfer specialist rates (indicative): 1.3655-1.3683

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Dollar's safe haven credentials are once again in demand amidst a global sell-off in stocks, although some investors say the Pound is now starting to look cheap against its U.S. cousin.

However any rebound in the Pound-to-Dollar exchange rate (GBP/USD) remains some way off as the Dollar is bought against the Pound and other major currencies amidst a bout of stock market declines, which appear linked to developments out of China.

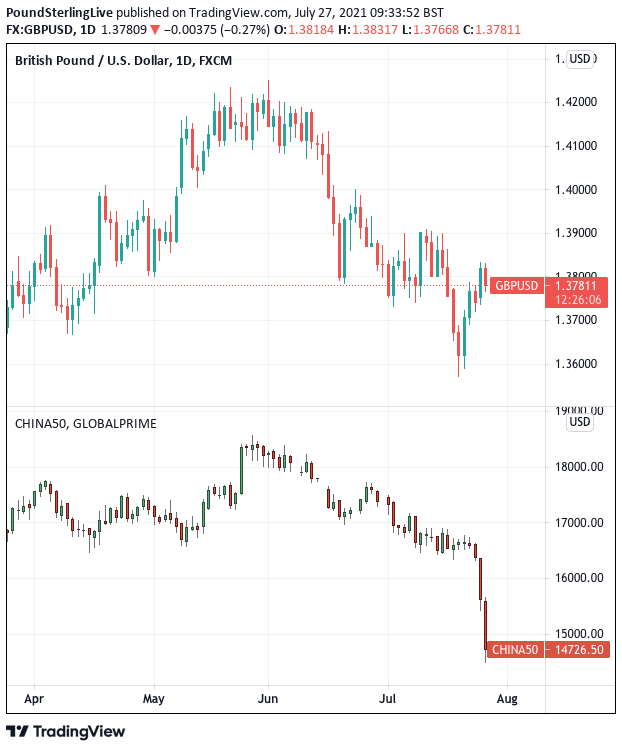

Chinese regulatory moves against technology stocks as well as an Asian wave of the Covid-19 Delta variant are said by analysts to be prompting declines in Chinese shares, which has since spilled over into the global investor sphere.

China's leading A50 stock index has fallen 6.0% on Tuesday alone, adding to Monday's 4.0% decline, amidst a crackdown by authorities on technology companies.

Tech giant Tencent has fallen by over 10% on Tuesday.

"Recent actions include tech giant Tencent being ordered to end a plethora of global music licensing contracts, as well as the implementation of a ban on education firms raising capital on equity markets, which will also prevent foreign investment in the sector," says Michael Brown, Senior Market Analyst at CaxtonFX.

Above: GBP/USD daily and the China A50.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The move on Tencent by authorities is just the latest move in a campaign to crimp the power of China's sizeable technology companies, a perennial reminder that investing in China is fraught with regulatory risk.

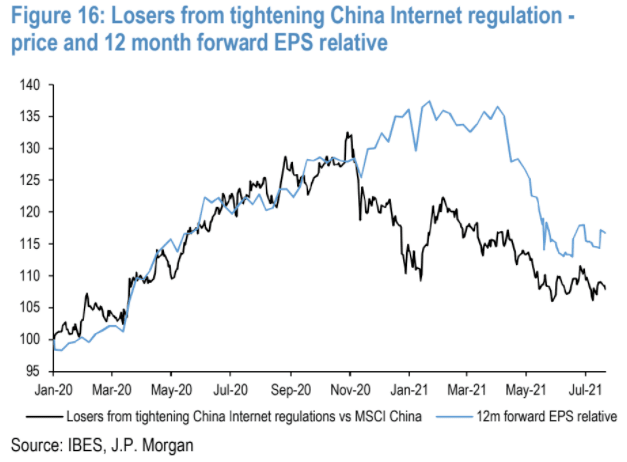

"The China Internet space has been weighed down by regulatory uncertainties since the Ant IPO suspension in November last year. The recent crackdown on ride-hailing app Didi ahead of its US listing, adds to the list of actions taken by the Chinese regulators to curb anti-competitive practices by companies in this space," says Mislav Matejka, an analyst with JP Morgan.

The moves have meant global investors have had to write down exposure to their Chinese investments which has knocked confidence more generally.

All global stock markets are in the red at the present time, which is in turn driving demand for the safe-haven Dollar, Yen and Franc.

The GBP/USD exchange rate is a third of a percent lower at 1.3784.

The Australia, New Zealand and Canadian Dollars are meanwhile the biggest losers alongside Emerging Market currencies, allowing pairs such as GBP/AUD, GBP/NZD and GBP/CAD to rise.

JP Morgan's analysis shows the weakness in the Chinese tech sector has contributed to the weakness in Emerging Market returns as the most affected stocks – Tencent, Alibaba, Meituan, JD, and PDD – add up to a third of MSCI China weight, which in turn is 40% of MSCI EM.

Although the market might have taken a hit on the latest drawdown in Chinese markets it must be noted that this theme has been around for a few weeks now, and is therefore hardly something new to investors.

The ability of this theme to inflict material damage going forward is therefore questionable, which in turn draws questions on how far this latest pulse of Dollar buying can extend.

Should the Chinese-related jitters fade before long the Dollar might be left searching for fresh impetus.

JP Morgan analysts tell clients they expect the Chinese assault on technology companies to have a fading impact:

"The affected companies are down 20-40% from their respective peaks last year, and earnings estimates have seen a similar adjustment. Following the underperformance in the past several months, we believe markets are pricing in a lot of the regulatory headwinds already."

Another key driver of risk jitters of late has been the spread of Covid-19 Delta variant. This sensitivity was on show at the start of the week commencing July 19 with sizeable declines in stocks and Pound exchange rates being recorded as the variant pushed global cases higher.

However, this too is seen to be having a waning influence on investor fears, particularly given developments in the UK where the Delta-driven third wave has reversed rapidly.

Pound Sterling Live has noted numerous economists saying of late that the UK's experience of the Delta wave will prove a litmus test for other nations with advanced vaccination programmes and could lessen the 'fear factor' amongst investors towards the variant.

"A significant development over the past few days is an inflection of COVID-19 delta cases in the UK. Many investors were watching in fear the fast rise of delta cases in the UK over the past month, looking for signs of a slowdown or inflection. With UK cases significantly down over the week, the peak appears to be behind us, which could be a signal for rotation back into value, reflation and reopening themes," says Marko Kolanovic, a strategist at JP Morgan.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Despite a rapid rise of cases to near peak levels in the UK, mortality is currently 95% lower than during the January peak.

"This should give confidence to investors that delta is not a serious threat to global growth," says Kolanovic.

Foreign exchange strategists at investment bank Morgan Stanley meanwhile say they now see the Pound-Dollar rate as being cheap following the June-July decline in the pair.

"GBP/USD trades weak versus the S&P 500 and monetary policy rate differentials. Both divergences are caused by the recent broader USD strength which began in June," says strategist Sheena Shah at Morgan Stanley in London.

Morgan Stanley look forward to the August Bank of England policy meeting as being a potential trigger for a correction higher in GBP/USD, saying even a neutral outcome from the Bank could refocus market attention on the positive interest rate story in the UK.

The Bank of England is seen as an early mover on interest rates relative to other central banks, which is reflected in yield curve trends that are seen to be favourable to the Pound.

"Should we hear a neutral to optimistic tone from the August 5 BoE monetary policy report then we would expect GBP/USD to rally," says Shah.

Foreign exchange strategists at French investment bank Crédit Agricole are meanwhile buyers of the Pound.

Crédit Agricole's positioning based model is now in favour of buying AUD/USD and GBP/USD, according to a client briefing out at the start of the week.

The model finds the Pound to now be oversold. "Subsequently, we have entered a long position in GBP/USD with a target of +3% and a stop-loss of -1.5%," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.