Pound-Dollar Rate Slumps Amidst Deteriorating Investor Sentiment and More Losses Possible say Analysts

- Rising investor fears spark USD demand

- EU, US see record covid-19 rates

- Election anxieties to keep sentiment soft

Image © Adobe Images

- GBP/USD spot rate at time of writing: 1.2924

- Bank transfer rate (indicative guide): 1.2572-1.2662

- FX specialist providers (indicative guide): 1.2724-1.2808

- More information on FX specialist rates here

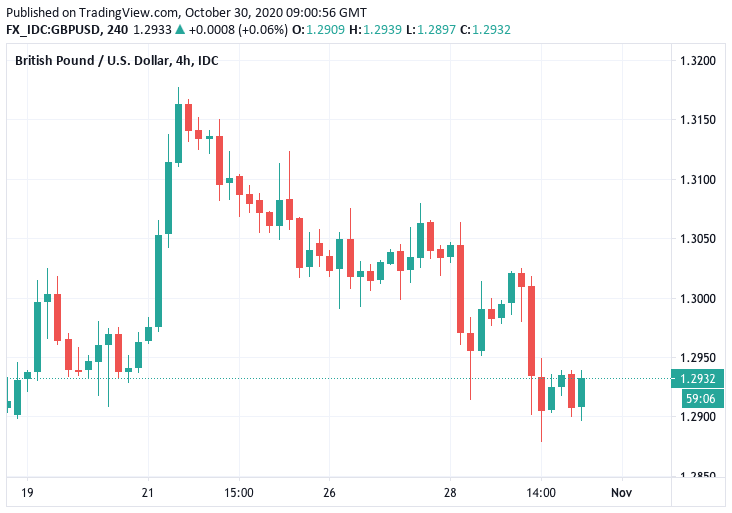

The Pound-Dollar exchange rate is nursing a weekly loss of 0.78% having fallen below the 1.30 level to trade at 1.2935 ahead of the weekend, a move that is almost exclusively attributed to a broad rally in the U.S. Dollar.

The Dollar has risen against the majority of the world's major and minor currencies this week and is being tipped by analysts to remain supported in the short-term given a host of worries for investors that include European economic lockdowns, a looming U.S. election and the market's negative reaction to earnings from major U.S. technology companies.

"USD and JPY to stay supported today," says Chris Turner, analyst at ING Bank. "It is likely to be another tough day for risk assets... following the disappointing results from the US technology firms. Adding to this the US Presidential election looming next week and the deteriorating situation in Europe."

The Dollar, Yen and Swiss franc are considered safe haven assets that find support when stock markets and other 'risk on' assets are falling, as is the case at the turn of the month. The world's major stock indices have registered sizeable losses over the course of the past five days and sentiment is expected by analysts to remain subdued given the potential for political uncertainty following next week's U.S. vote and the rising covid-19 case load.

"Global risk sentiment was disrupted late in October by surging virus cases in Europe, concerns about a delay in the US fiscal stimulus, and the uncertain outcome of the US elections. The latest wave of increasing new cases in Europe has brought new restrictions to activity and mobility, bringing downside risks to the growth and recovery outlook," says Juan Prada, FX Strategist at Barclays.

Above: Two-week overview of the GBP/USD. If you are concerned about your international payments budget, learn how you can lock in today's rate for use over coming months. Find out more here.

This week has seen Germany and France announce major restrictions to counter the rising covid-19 case load that is hitting Europe, decisions that are likely to have a material negative impact on growth.

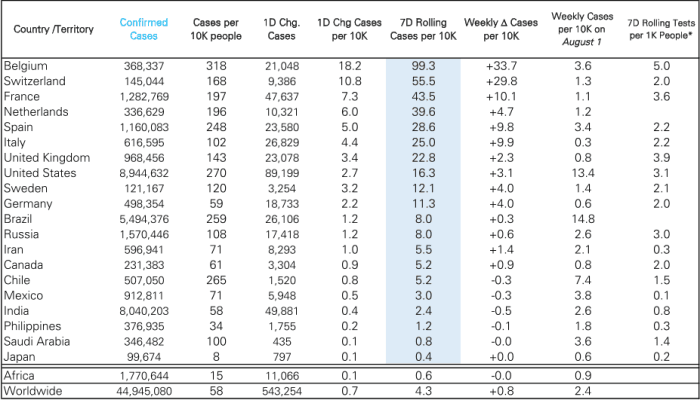

"Hospitalisation rates in some countries are approaching peak levels seen during the first wave. Belgium reported 5,924 patients currently hospitalised, surpassing its previous peak from back in April. While in Portugal, the number of ICU patients is now 269, just short of its previous peak of 271. Similarly in Italy, there are now 17,615 patients in hospitals, though capacity still remains there compared to the nearly 29,000 back in April. This is why countries throughout Europe have been enacting new restrictions to try to flatten the curve again," says Jim Reid, an analyst at Deutsche Bank.

Reid notes that Sweden, whose actions have been among the most scrutinised, has announced that residents in Stockholm are to avoid shops, gyms and any other indoor venues that don’t provide essential services. This comes as the country has seen around 3,000 new cases, a record daily rise.

But it is not just Europe where covid-19 concerns are centred.

"In the US, weekly cases have hit record highs as the virus continues to spread through the Southern and Midwestern regions. However yesterday there was troubling news out of the northeast, which had been resistant to a second wave, as New Jersey’s and New York’s positivity rates of covid-19 tests hit their highest levels since May," says Reid.

Image courtesy of Deutsche Bank.

Political anxieties will likely remain elevated as the U.S. enters election week, with investors seemingly unwilling to shake off the fear that positive polling for Biden is off the mark and that a messy, contested outcome is possible.

"As polls tighten and election day in the US approaches, investors seem to be turning cautious, as the size and scope of fiscal stimulus also likely depends on the timing and outcome of the elections. Equity markets have sharply sold off in the past few sessions, more than offsetting the previous week’s gains, while bond market values were up across the board. The risk-off environment led to stronger a USD and JPY, while G10 commodity currencies took the largest hit," says Prada.

Foreign exchange analysts have been of a view that a contested result would likely weigh on investor sentiment, reinforcing the conditions favourable to a stronger U.S. Dollar.

Under such an outcome the GBP/USD and EUR/USD exchange rate pairs could be set to establish fresh multi-week lows. (For the median, mean, high and low GBP/USD and EUR/USD forecasts from the world's leading investment banks, please see the latest report from our partners Global Reach. You can also view the targets set at bank such as Citi, Barclays, Lloyds, JP Morgan and Morgan Stanley).

"The U.S. election campaign enters its final stretch. We think the main bias will be for the market to reduce risk and unwind positions when given the opportunity. This could see the USD firm near-term," says Mark McCormick, a foreign exchange strategist with TD Securities in New York.

Market participants will remain cautious on the outcome given a persistent refusal to fully believe what the polls and models are implying (a strong Biden win and Democrat win of the Senate), and even those who are inclined to watch polls will have noted that 'poll of polls' collations do show Trump's performance to have improved of late.

RealClearPolitics conduct one such 'poll of polls' and a tightening is evident:

Is the tightening enough to mean a margin of error becomes relevant? This question is all that is needed to keep markets on edge.

"Former Vice President Biden has a strong chance of winning, but his victory is not guaranteed," says Carol Kong, Associate International Economics and Currency Strategist at CBA. "Exit polls and early votes could show opposing signals which can lead to heightened volatility."

CBA strategists say one scenario that could lead to market volatility is where exit polls are skewed towards a Trump victory, because they judge more republicans will vote in person, but Biden wins once postal votes are considered.

Adding to the reasons to be cautious and buy Dollars ahead of the weekend was a decline in U.S. technology stocks overnight. Two leviathans of the global equity market - Apple and Amazon - declined in after-hours trade following the release of third quarter results which were all came in better than expected but crucially hinted at difficult conditions ahead.

Apple beat estimates with record sales of Macs and services but reported iPhone revenues fell -21% with revenue in Greater China fell by 29% to the lowest level since 2014.

Amazon was down after it reported revenue and earnings both solidly beat analyst estimates but warned covid-related expenses will go up to $4 billion.