Pound-Dollar Rate On Front Foot Even as Risk Appetite Fades, Geopolitical Tensions Rise

- Written by: James Skinner

- GBP/USD advances on lesser Brexit concerns as risk appetite wanes.

- Brexit optimism lifts GBP but geopolitical tensions rising as BoE looms.

- GBP still stymied by 200-day moving average, vulnerable to correction.

Image © Pound Sterling Live

Achieve up to 3-5% more currency for your money transfers. Beat your bank's rate by using a specialist FX provider: find out how.

The Pound advanced on a resilient Dollar Tuesday even as investors turned more cautious amid an increase in geopolitical tensions, with Sterling drawing a bid from lessening concerns about the Brexit trade talks, although it risks crumbling later in the week.

Sterling was higher against all major rivals other than safe-havens on Tuesday as investors continued to reward Prime Minister Boris Johnson's bullish statements on the outlook for trade talks with the EU following a Monday meeting with European Commission President Ursula Von der Leyen.

The bid continued even as risk appetite softened Tuesday increased geopolitical tensions in some parts of the world, most notably between India and China after a border dispute between the two erupted in clashes.

"It has helped to lift cable back towards its’ 200-day moving average at 1.2690 up from yesterday’s low of 1.2455," says Lee Hardman, a currency analyst at MUFG. "The improvement in the mood music alone should be supportive...The next hurdle for the pound to extend its advance is the BoE’s upcoming policy meeting on Thursday. There is scope for the relief rally to extend if the BoE refrains from further encouraging market speculation over negative rates."

The UK and EU agreed to inject fresh energy into the process with a number of new negotiating rounds now planned, amid speculation suggesting the EU may soften its demands about fishing rights. But European Council President Charles Michel remained insistant on a so-called level playing field, which has been a major stumbling block in the talks so far. Sentiment might be vulnerable to a reminder of the deadlock that still prevails.

Above: Pound-to-Dollar rate at hourly intervals alongside S&P 500 stock index (black line).

"Neither side wants to cast aside a trade deal in favour of WTO terms on trade, but for the UK in particular a messy and confusing system of tariffs and border checks next year could upset the economic recovery and investor flow. In turn this would impact BoE policy expectations and weigh on the pound," says Jane Foley, a senior FX strategist at Rabobank. "Politics and economics are both set to remain drivers for the pound in the months ahead."

Sterling's resilience also followed a better-than-expected jobs report for May that saw the unemployment rate defy the volcanic increase in numbers of individuals claiming welfare benefits or furlough payments. Welfare claims more than doubled to 2.8 million in the three months to the end of May but many idled workers aren't included in the official tally because it only covers those "who have been actively seeking work within the last four weeks and are available to start work within the next two weeks."

The Pound was edging higher against the Dollar on Tuesday but remained below the 200-day moving-average that it ceded last week and is strongly correlated with stock markets that are highly susceptible to geopolitical tensions that have been ratcheting higher in Asia. Clashes on the border between India and China were said to have resulted in fatalities for both sides while tensions were rising between North and South Korea too.

"We still like selling GBP/USD rallies at the 200d MA, at 1.2692. Better resistance comes at the June 10th high of 1.2813," says Bipan Rai, North American head of FX strategy at CIBC Capital Markets.

Above: GBP/USD at daily intervals with Fibonacci retracements of March fall, moving-averages, S&P 500 (black line).

Sterling entered the new week on the back foot initially but has since rallied alongside other risk assets to test its 200-day moving average, after the Federal Reserve significantly expanded the scope of its corporate debt facility in a move that picked stock markets up off the floor. Risk assets had crumbled ahead of last weekend after the Fed neglected to provide further justification for a rally that had all but wiped the coronavirus off the charts.

The Fed gave investors a shot in the arm and so too had reports suggesting the White House is eyeing a substantial infrastructure spend, both of which had helped to lighten the mood in the market before geopolitical tensions dominated in the European morning. Risk appetite picked up in the noon session however, after U.S. retail sales were reported to have rebounded sharply from their earlier collapse during May. But Sterling's gains have been built on flimsy foundations that could crumble later in the week as the market focus turns away from Brexit.

From an inevitable reminder of the deadlock that still exists in the Brexit trade talks and the resulting uncertainty it produces, to the live risk that geopolitical tensions or a second wave of coronavirus infections in China and U.S. pull the rug out from under stock markets again.

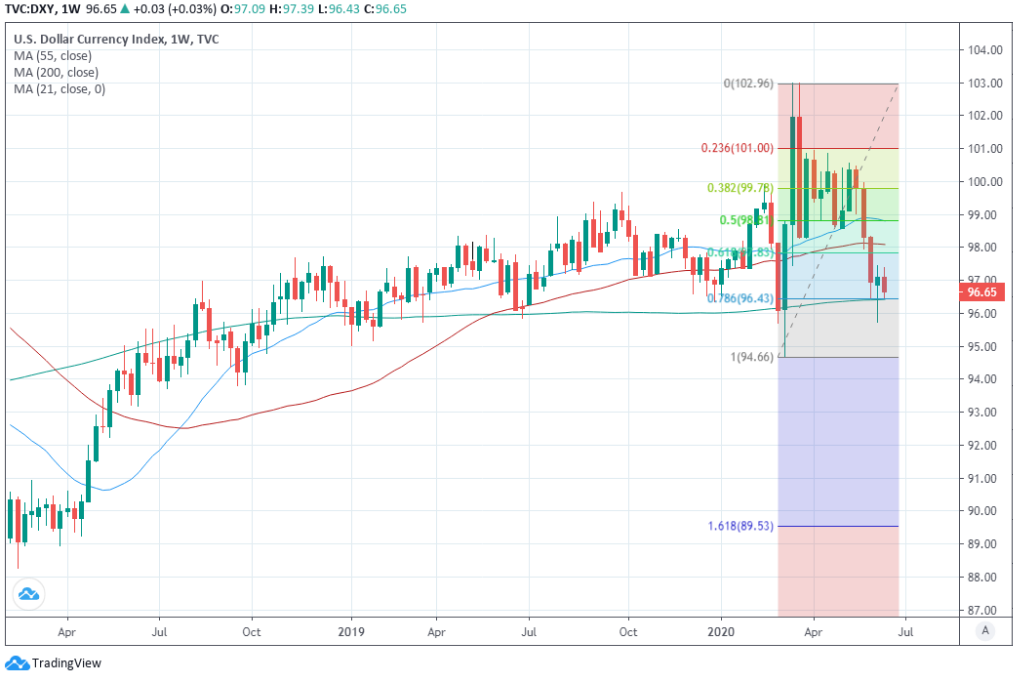

"Dips lower have found initial support at 1.2468/86 ahead of the short term uptrend at 1.2411, which is expected to hold the downside. It is possible that the market is already attempting to reassert its bull trend and we have tightened the stops on our remaining short positions. A daily chart close above the 78.6% Fibonacci retracement at 1.2818 is needed to target the 200 week ma at 1.2924," says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank. "We would expect the [Dollar Index] to fail between here and the downtrend at 99.11."

Sterling wouldn't take kindly to a wobble in stock markets, although it will also be tested in the days ahead by a Dollar that's attempted to recover from its own steep correction and a Bank of England (BoE) policy update. Thursday's announcement is the bank's first scheduled opportunity to respond to GDP data that revealed what some called "the biggest UK economic slump ever seen" took place in April, the first full month of 'lockdown'. It's also an obvious opportunity for Governor Andrew Bailey to provide further clarity on the bank's newfound interest in negative interest rates as a policy tool.

Above: Dollar Index at weekly intervals with Fibonacci retracements of March uptrend. Risking 18-month lows.

Markets expect another dose of quantitative easing from the BoE this week, with consensus favouring an additional £100bn of bond purchases to take the total amount acquired by the bank to £745bn. But it's possible the Bank could announce more than that at 12:00 Thursday.

"We expect the MPC to sign off an extra £100B of QE for Q3, leading to a slowing in the pace of purchases. QE appears to have been calibrated with regard to gilt issuance, which will fade in Q3. Don't expect a decision, or a strong hint, on negative rates just yet, but the TFSME could be enhanced," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics. "We think the MPC won't commit to, or hint at, any course of future action this week, preferring instead to keep its options open."

The BoE has been buying close to £14bn of government debt per week since the coronavirus came along, which is close to £60bn per month and equal to around 2.6% of GDP. Government borrowed more than that during the month of April, with the total having come in at £62.1 after HM Treasury took unprecedented action to limit the longer-term damage done to the economy by the 'lockdown' used to contain the coronavirus.

Any Federal Reserve-like commitment to continue buying bonds "at least at the current pace" for any period of time, or any fresh discussion of the perceived merits of a negative interest rate policy might not be taken well by Sterling.