Dollar Weeps amid Virus Slowdown but The Great Depreciation is Only at Its Very Beginning

- Written by: James Skinner

Image © Adobe Images

- GBP/USD spot at time of writing: 1.2256

- Bank transfer rates (indicative): 1.2016-1.21021

- FX specialist rates (indicative): 1.2163-1.2286 >> More information

The Dollar suffered heavy losses against all major rivals Tuesday as investors serenaded an ongoing decline in the number of new coronavirus cases across some major economies which, if sustained, could produce a much steeper and more protracted depreciation of the U.S. currency in the months ahead.

Austria and Denmark set out plans on Monday to gradually lift the 'lockdown' of their people, companies and economy from mid-month onward, at a time when markets were digesting official figures that showed the coronavirus hotspots of Spain and Italy experiencing a sustained run of declines in the number of new coronavirus infections. Other countries including the U.S. and more in Europe have also seen declines, although over a lesser number of days.

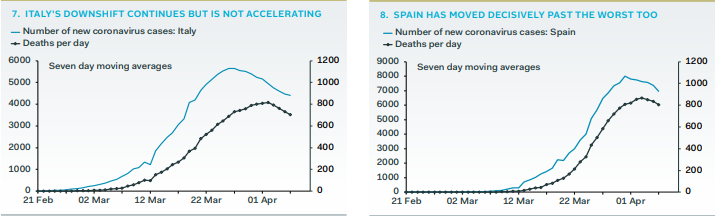

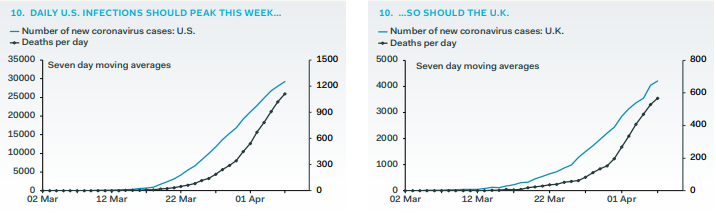

"The downshift in U.S. confirmed case growth reported Sunday continued into Monday," says Ian Shepherdson, chief economist at Pantheon Macroeconomics. "The 7-day rolling averages for new cases and deaths are now clearly falling in Spain and Italy too; Germany's deaths will start to fall this week. The U.K. likely will have to wait another week for cases to fall and a further week for deaths to follow."

Above: Pantheon Macroeconomics graph showing new coronavirus infections and deaths for the Italy and Spain.

Successive declines in the number of new cases are indicative of waining momentum behind the coronavirus and have given markets hope that other governments, especially those in the major economies, could soon be able to contemplate lifting so-called lockdowns that are expected to drive unprecedentedly huge falls in GDP for this quarter and create double-digit budget deficits that could lift debt-to-GDP ratios by 20 percentage points in a worst case scenario for some countries.

This is decidedly bad news for a Dollar that benefited so much from the historic March meltdown of financial markets that was set in motion by the slow but steady realistion among investors that the world's major financial centres would soon begin to resemble a Western Wuhan, the Chinese city where the outbreak is said to initially have been found and which was the first place see citizens confined to homes under a draconian, prison-style 'lockdown.'

Above: Pantheon Macroeconomics graph showing new coronavirus infections and deaths for the U.S. and UK.

"The USD is getting whacked across the board, and this time, even the EUR is participating a bit," says Bipan Rai, head of FX strategy at CIBC Capital Markets. "With the EUR now participating in USD weakness, we're expecting that broad market gauges will catch up to what the trade-weighted measures have been indicating for the USD (in terms of weakness). The inverse correlation between the greenback and risk continues to hold and as such, watch for the USD to continue trading defensively into the long weekend."

The Dollar has seen huge swings in recent weeks that took all other currencies trading against it along for the ride as investors dumped stocks, commodities and even typically safe-haven bonds amid a great dash-for-cash that sent a tidal wave of capital toward the only unit on the planet sizeable enough to accomodate even a portion of that wave. This lifted the Dollar Index more than 8% from trough to peak in the first three weeks of March, a move so violent and vicious it prompted intervention from the Federal Reserve and an equally unprecedented cavalry of other central banks.

Above: AUD/USD rate shown at daily intervals.

"The USD is too strong to everyone’s taste, but who can stop it from appreciating? The Fed has done a lot, but has it done enough? So far it doesn’t look like it is adequate, and a new Plaza Accord 2.0 could come in to play, if the USD gains more," says Andreas Steno Larsen, a strategist at Nordea Markets. "Once economies re-open around the globe, USD liquidity will start to increase both via global trade and via all the facilities from the Fed (they will be closed with a time-lag). This is ultimately a story that could bring the USD materially lower (10-15% scope in our view), but to really turn USD bearish already now, we would need a pick-up in global trade first, which is still not around the corner due to the lock-downs."

Last month's Dollar surge continued even after the Fed cut its interest rate to zero and offered up $700bn for a new quantitative easing programme as well as an increase in the size of the financial crisis era Dollar swap lines. Those were extended to six other major central banks as part of an emergency framework designed to keep international markets adequately supplied with the world's reserve currency, but they were not enough this time around. So strong was the demand for Dollar cash the that Fed extended new swap lines to nine more central banks, taking the total to 15, and upped its allocation for QE from $700bn to "unlimited" in a bid to put a lid on the Dollar.

Above: Pound-to-Dollar rate shown at daily intervals.

"It's almost three weeks since the Fed announced on 20 March that it was further enhancing the provision of liquidity through swap lines with other central banks. Since then, the Fed has sent out a further 19 press release with announcements about actions they are taking to tackle access to credit and liquidity in the domestic and international economies, as well as policy moves. And it's working," says Kit Juckes, head of FX strategy at Societe Generale.

Juckes says any "liquidity shock" like that which hit the Dollar in March would always benefit the U.S. currency at the outset only to weigh heavily on it once demand for cash has abated. He notes how the Norwegian Krone, Australian Dollar and Pound Sterling have led the riposte to the greenback in the major currency space, after suffering the most amid the Dollar surge, and flags parallels with the 2001-2003 period that followed the Asian financial crisis of the late 1990's and the new millenium dotcom collapse.

"That too, was a time when a US recession, and a mild one at that, came with a major shock to emerging markets. Then as now, the euro was dragged lower in the maelstrom even though at that time, European economies were out-performing the US," Juckes says.

Like CIBC Capital Markets' Rai, Juckes notes the move to the upside in the Euro-to-Dollar rate this week and flags that this preceded an eventual recovery against the greenback by emerging market currencies back in the early 2000's. He and the Societe General team tip the Euro-to-Dollar rate to go on rising, forecasting it to hit 1.11 by the end of June, 1.13 before the end of September and 1.14 as the curtain closes on 2020 - although the June projection doesn't preclude a period of EUR/USD "range-trading."

Above: Euro-to-Dollar rate shown at daily intervals.

"Support comes at the 1.0770 area, however, the pair has traded in a wide range since mid-February," says CIBC's Rai. "We are establishing a tactical EUR/USD long here with stop set below yesterday's low at 1.0760 and targeting a move back to the 1.12 handle."

Major currencies with a high 'beta' correlation to risk appetite, like the Aussie and Norwegian Krone, are always the first to benefit from a weaker Dollar but they're often followed by Sterling and the Euro before being joined later on by emerging market currencies. Emerging market currencies can exploit Dollar weakness alongside the likes of the Aussie outside of crises but when the going gets really tough, as it has done in 2020, they frequently find themselves at the back of the queue for a recovery.

The Euro-Dollar move higher is the most significant for the Dollar Index and the narrative around the greenback more broadly seeing as trading there accounts for a majority of flows measured by the ICE benchmark of the U.S. currency. A rising EUR/USD alone is enough to tip the broad Dollar lower and sometimes meaningfully so, although trade-weighted losses can snowball significantly if other majors participate and emerging markets also join the herd.

In other words, the widespread losses suffered by the Dollar Tuesday could be just the beginning of a broader and more protracted fall. A Great Depreciation. But this eventuality may be tied closely to the lifting of those 'lockdowns' in Europe's major economies and in the U.S. and in the meantime, the Dollar could periodically resist the downside against some rival currencies. The Dollar Index, meanwhile, is tipped by some to find support before reaching 98.10.

"US Dollar Index [is] under pressure near term and there is a risk of a return to the 55 and 200 day moving averages at 98.10/80. However it should hold there," says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank.

Above: Dollar Index shown at daily intervals.