Dollar Slumps, GBP/USD Spikes after Fed Cuts Rates to Zero and Restarts Quantitative Easing

- Written by: James Skinner

- Broad USD slumps after Fed slashes rates to zero, restarts QE.

- In another rare and surprise coronavirus-related decision Sunday.

- Buys $500bn bonds, $200bn mortgage bonds in "coming months"

- Does not disclose monthly purchase rate but that could be $60bn.

- Fed preannounced QE with $60bn March-April buy just last week.

- $60bn monthly purchase rate would take QE until year-end exactly.

- Such decision would imply from start a definitive end date to QE.

- Fed says U.S. banks should "use their capital and liquidity buffers"

- "Required reserve ratios" at 0% from March 26 to support lending.

- USD up Vs CAD and NOK but lower Vs GBP, JPY, EUR, CHF et al.

- In risk-off market as Spain, France join Italy in virus 'lockdown.'

Image © European Central Bank

- GBP/USD Spot rate: 1.2414, +1.30% on publication

- Indicative bank rates for transfers: 1.2081-1.2168

- Transfer specialist indicative rates: 1.2230-1.2304 >> Get your quote now

The broad Dollar slumped on Monday after the Federal Reserve (Fed) cut its interest rate back to zero and formally relaunch its quantitative easing (QE) program, prompting sharp gains for the Pound-to-Dollar rate.

The Federal Reserve said in a rare, unscheduled announcement on Sunday that policymakers voted in a split decision to cut the Federal Funds rate range back to between 0% and 0.25%, its financial crisis era record low, from between 1% and 1.25% previously. It also said it will buy at least $500 billion of Treasuries and $200 bn of agency mortgage-backed securities, without specifying a monthly quantum although if last week's announcement is anything to go by, that could be around $60bn.

"The coronavirus outbreak has harmed communities and disrupted economic activity in many countries, including the United States," the Fed says. "Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The effects of the coronavirus will weigh on economic activity in the near term and pose risks to the economic outlook. In light of these developments, the Committee decided to lower the target range for the federal funds rate to 0 to 1/4 percent."

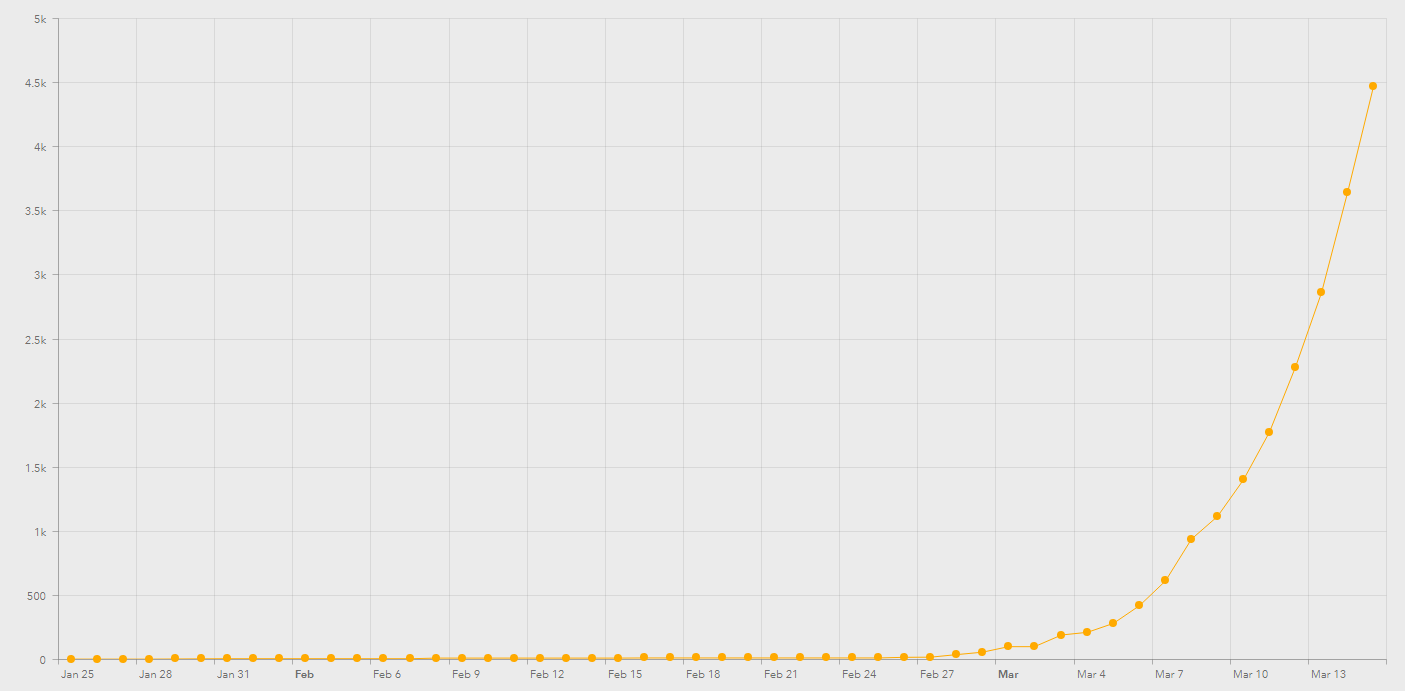

Above: U.S. epidemic curve. Source: World Health Organization.

"To support the smooth functioning of markets for Treasury securities and agency mortgage-backed securities that are central to the flow of credit to households and businesses, over coming months the Committee will increase its holdings of Treasury securities by at least $500 billion and its holdings of agency mortgage-backed securities by at least $200 billion," the Fed adds.

That marks the formal relaunch of the Fed's quantitative easing program, which had been pre-announced last week. A statement released on Sunday said that bond purchases under the QE program will be made "over coming months," although a $60bn monthly rate of Treasury purchase would enable the program to run from mid-March until exactly year-end. The Fed all-but said last week it was restarting QE with a $60bn bond buy between March 13 until April 13.

The Federal Reserve had great difficulty exiting its original QE program and one of the things that made it so was the prospect of an investor revolt and resulting exodus from bond and other financial markets, which might've risked inflicting a counterproductive wound on the economy. That could have to do with why this time the Fed has not announced a monthly purchase rate but rather a total quantum for the overall program, because revealing a monthly purchase rate later on implies almost from the start an end date to QE. End dates can always be extended if necessary but communicating one to the market could make the bank's life easier further down the line.

"We have been urging this action for some time and we’re very happy that the Fed did not wait until Wednesday’s meeting. Time is of the essence," says Ian Shepherdson, chief economist at Pantheon Macroeconomics. "We think the Fed has acted now to try to get ahead of what likely will be terrible news on the spread of the virus, both inside and outside the U.S., over the next couple of weeks. The lesson of Hubei and Korea is that lockdowns and social distancing measures take two or three weeks to bring about a clear downshift in case trajectory, with deaths then following."

Above: Dollar Index shown at daily intervals alongside 10-year U.S. bond yield.

The Dollar Index was -1.03% lower at 97.73 on the Asia Monday. The greenback eked out gains over the battered and bruised Canadian Dollar as well as Norwegian Krone amid high single-digit losses for oil price, but it was beating a hasty retreat from Pound Sterling, the Japanese Yen, Swiss Franc and Euro, with the Pound-to-Dollar rate having clocked up a 1.28% gain.

The Fed also fired another bazooka on Sunday when it went further than any other central bank to date when it told banks to "use their capital and liquidity buffers as they lend to households and businesses who are affected by the coronavirus." It said America's largest banks have $1.3 trillion of common equity and $2.9 trillion of high quality assets held as part of regulatory capital buffers and appeared to suggest it wants them to make that available to the real economy as the country grapples with coronavirus.

Above: Pound-to-Dollar rate shown at daily intervals alongside Euro-to-Dollar rate.

In addition to instructing banks to make "capital and liquidity" buffers available the Fed also cut "reserve requirement ratios" to zero from March 26. It said; "This action eliminates reserve requirements for thousands of depository institutions and will help to support lending to households and businesses."

Sunday's is the second surprise action from the Fed in as many weeks and comes after President Donald Trump declared a national emergency Friday, when coronavirus outbreaks were confirmed in 46 states. Republicans and Democrats have since reached a bipartisan agreement on support for companies and households who face seeing businesses and incomes disrupted amid efforts to contain the virus, which brought vast parts of Europe to a standstill this weekend. U.S. coronavirus cases reached 1,678 on Sunday, according to World Health Organization data, up from around 1,300 Saturday.

U.S. 2-year bond yields fell 48% to 0.28%, a new record low, after the Fed's announcement while the 10-year was down 30.8% at 0.69%.

Above: U.S. 10-year government bond yield shown at monthly intervals, alongside 2-year yield (blue line).

The AUD/USD rate was 0.30% higher at 0.6197 and the NZD/USD rate was up 0.51% 0.6069 despite a surprise and unscheduled Reserve Bank of New Zealand rate cut from 1% to 0.25% on Sunday morning. The USD/ZAR rate on the other hand, was unchanged at 16.28 while the USD/TRY rate was down -0.60% at 6.28. The NIKKEI 225 stock index was down -6.08% at 17,430 while the Shanghai Composite index was down -1.23% at 2,887.

"Our Fed preview had a lifespan of roughly three hours, but we seemingly called it right with a 100bp rate cut and a formal restart of QE," says James Knightley, chief international economist at ING.

Above: Japan's NIKKEI 225 stock index and China's Shanghai Stock index (blue line) shown at daily intervals.

"This action in itself is not going to rescue the US economy from recession, but it will help to mitigate the risks from financial tensions that could make the growth and jobs outlook far, far worse. It will also offer breathing room before an anticipated fiscal stimulus and a potential lending scheme provided by the Treasury materialise," ING's Knightley says.

France and Spain joined Italy in locking down citizens - which forbids all but essential travel from the home - at the weekend, risking unprecedented damage to their economies and likely necessitating a combined government and central bank response like no other seen in modern history.

Above: French epidemic curve. Source: World Health Organization.

Those steps were taken as UK government advisers extolled the benefits of so-called 'herd immunity' while a minister took to the tabloid papers to urge manufacturers including JCB and Rolls Royce to adapt their production lines so that they can produce ventilators for the National Health Service. Italy's experience in the north has been that 10% of coronavirus sufferers require mechanical ventilation and intensive care.

Britain has been fortunate enough so far to enjoy one of the lowest per-capita coronavirus infection rates but infection numbers have risen rapidly in recent days and government as well as broader society are increasingly bracing for a further surge as the outbreak truly gets underway. There were 1,372 UK infections as of 0900 Sunday, with 35 dead. Both numbers are up sharply from 387 infections and 6 deaths known on Wednesday 11, March.

All markets saw extreme volatility last week with Thursday's losses putting many stock indices on course for their worst week in history before Federal Reserve actions and a significant announcement from President Donald Trump saw them more-than reversing earlier losses.

Above: UK daily disclosures of new infections. Source: World Health Organization.