The Dollar Trend is at Risk after Yield Appeal Shot Away, Low Rates Here to Stay

- Written by: James Skinner

Image © Adobe Images

- GBP/USD Spot rate: 1.2921, up +0.39% today

- Indicative bank rates for transfers: 1.2568-1.2658

- Transfer specialist indicative rates: 1.2726-1.2804 >> Get your quote now

The Dollar Index has doubled over this week and its post-2018 uptrend could now be under threat just as the fundamental stars align for the Euro and Japanese Yen, two major constituents of the index, to strengthen meaningfully against the greenback over the coming months.

Investors have sold the Dollar en masse since the Federal Reserve (Fed) cut interest rates by 50 basis points to 1.25% on Wednesday, enabling even riskier prospects like Pound Sterling and the Australian Dollar to advance on the greenback even as safe-haven currencies like the Yen and Swiss Franc extended their own run on the Dollar.

The Fed’s rate cut has obliterated much of the Dollar’s yield advantage over other currencies and incoming Bank of England Governor Andrew Bailey’s suggestion on Wednesday that the BoE might wait a while before cutting its own rate has provided a temporary tailwind to the Pound-to-Dollar rate.

"The Fed reacted much faster than the other central banks. Whether this is due to its general predisposition or due to the fact that it was still able to react as a result of its larger rate cut scope, is irrelevant for all those who had praised the rate advantage of the dollar as recently as the beginning of the year. At least it can be assumed that we will not hear this dollar-positive argument being used for a while now, even if the dollar continues to have a not so insignificant rate advantage over the euro," says Thu Lan Nguyen, an analyst at Commerzbank. "What is more decisive is that the market is likely to be aware now that the central bankers will not hang around for long if only the faintest sign of further downside risks for the economic outlook were to emerge, which is likely to put pressure on the greenback in case of continued corona fears."

Above: Dollar Index shown at 4-hour intervals alongside the Pound-to-Dollar rate (black line).

Gains made by the likes of Sterling matter much less for the Dollar Index than the advances clocked up by the Yen and the Euro, which between them account for nearly three quarters of flows measured by the ICE Dollar Index which has fallen -1.57% in the last week.

The Euro, which accounts for 57% of the index, has risen 1.7% against the Dollar in the last five days while the USD/JPY rate has declined -2.67%. The Yen accounts for 13.6% of Dollar Index flows while Sterling has an 11.9% share and is up 0.25% for the week.

The rub for the Dollar Index is that even if the Pound does eventually weaken against the Dollar again, the Euro and Japanese Yen are increasingly expected to go on outperforming and this could see the post-April 2018 uptrend in the Dollar Index trend come under threat.

"Front-end USD carry is unlikely to recover meaningfully this year. Fed easing may look and feel like insurance cuts but irrespective of the ultimate economic consequences of COVID-19, these will be difficult to reverse in a Presidential election year unless inflation rises sharply," says Adarsh Sinha, an FX strategist at BofA Global Research. "We have expressed this view through a EUR/USD 1.13/1.17 call spread. We also expect USDJPY to weaken further once pension rebalancing runs its course in the coming weeks."

Above: Dollar Index shown at 4-hour intervals alongside the Euro-to-Dollar rate (black line).

The BofA Research team is betting the Euro trades largely between the 1.13 and 1.17 thresholds over the coming months, although both are far above the 1.1188 level quoted for the Euro-to-Dollar rate on Thursday. And the USD/JPY rate is also expected to continue its decline. Both those Dollar rivals are increasingly trading like safe-havens as investors exit bets on higher risk assets that had been funded in better times by the low-yielding Yen and Euro.

The Fed’s 50 basis point rate cut came as a surprise to markets although many investors are still expect further action from the central bank at its March meeting, while the bond market appears to be expecting the Federal Funds rate to return toward the ‘zero lower bound’ in the near future. Two-year U.S. government bond yields hit 0.58% on Thursday, far below the current 1.25% level of the U.S. cash rate that had offered investors best-in-class bond yields and the Dollar significant support until recently.

BofA Research says the Fed’s rate cuts could be here to stay because the Fed will find it difficult to reverse them in an election year even if the coronavirus does disappear. Three U.S. states had declared states of emergency as of Thursday as the number of domestic coronavirus cases hit 162, with both California and New York states impacted by the viral pneumonia outbreak. The UK, EU neighbours and more than 70 countries in total were also scrambling to contain outbreaks of the virus Thursday.

"The euro has benefited from the extreme risk-off that occurred last week that prompted some liquidation of euro funded positions," says Lee Hardman, a currency analyst at MUFG. "The euro weakened yesterday versus the dollar for a number of reasons – strong US data and Joe Biden’s showing on Super Tuesday are two such examples – but if investors begin to anticipate another large COVID-19 cluster to add to Italy, Iran and S. Korea emerging in the euro-zone, sharper euro falls could emerge quickly. Again, the situation is fluid of course and cases are picking up in the US too."

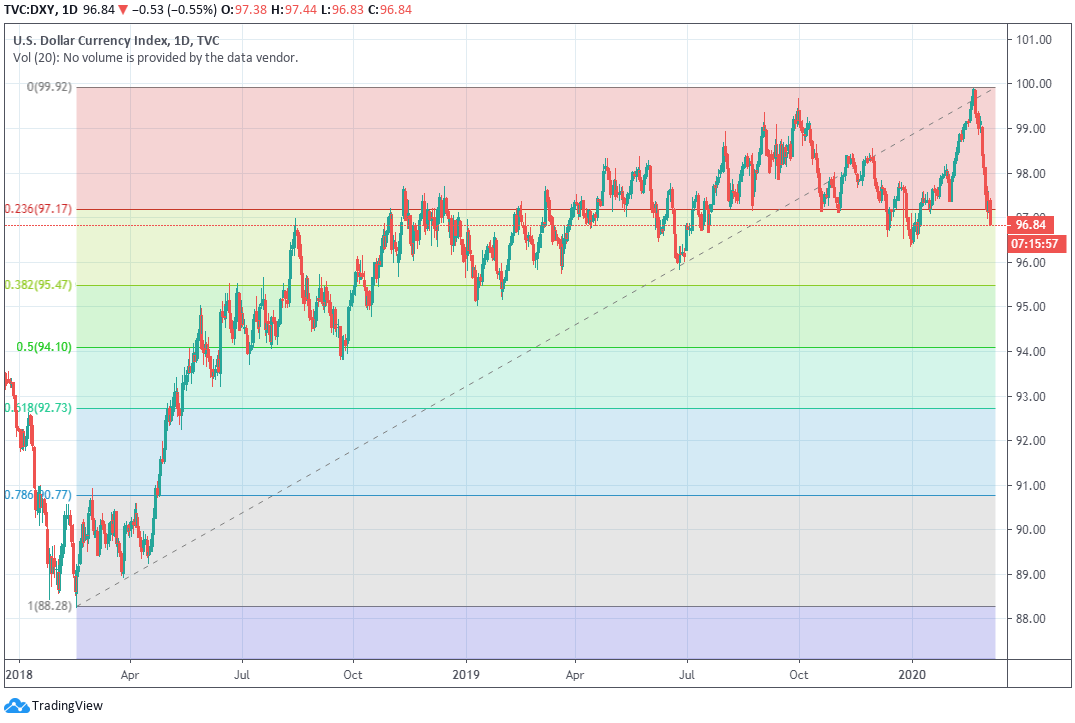

Above: Dollar Index shown at daily intervals with Fibonacci retracements of April 2018 trend marked out.

The Dollar has been wounded by the darkening rate outlook and safe-haven like qualities are expected by some to continue pushing the Euro and Yen higher up ahead, which could be a problem for the Dollar Index, although some strategists are advising clients to reduce their exposure to the two latter currencies after their strong run of gains. And if that advice is replicated elsewhere in days and weeks ahead the outlook for the greenback may become less bleak.

"No one can quantify how bad the impact on the real economy will be at this stage. Markets reacted favourably yesterday to aggressive monetary policy moves and spending on the fiscal front in the US, but bouts of volatility will keep things honest. That means... Stay long XAU. Reduce EUR and JPY longs, but net position should still be long for now. Stay tactical - there will be a time for strategic views, but now is not the time," says Bipan Rai, North American head of FX strategy at CIBC Capital Markets.

However, on Thursday the Dollar Index had erased almost all of its earlier 2020 gains and had committed itself to at least a partial retracement of its post-April 2018 uptrend. What matters for the Dollar Index going forward is whether gains over smaller and riskier index constituents like Pound Sterling, the Canadian Dollar and Swedish Krona - which account for only 25% of the index - will be enough to offset losses to the likes of the Yen and Euro.

“A rise in recessionary risks around the world is likely to support the JPY and the CHF, which are the established safe haven currencies. That said, we also see the USD as remaining firm against a broad range of currencies on this scenario as investors attempt to avoid any risk of a liquidity crunch. We see scope for a dip in EUR/USD back towards the 1.08 area on a 1 to 3 month view before a recovery towards the 1.13 area as the effects of the crisis diminish,” says Jane Foley, a strategist at Rabobank.

Above: Dollar Index shown at weekly intervals with Fibonacci retracements of April 2018 trend marked out.