Pound-to-Dollar Rate Close Above 1.3102 Opens Door to December's Highs

- Written by: James Skinner

- GBP tops board on Tuesday but GBP/USD lags other pairs.

- GBP/USD can retest December highs, Commerzbank says.

- But it must achieve a daily close above 1.3102 level first.

- Marks top of "falling wedge continuation pattern" on charts.

Image © Adobe Images

- GBP/USD Spot rate: 1.3030, up 0.19% last week

- Indicative bank rates for transfers: 1.2661-1.2753

- Transfer specialist indicative rates: 1.2826-1.2900 >> Get your quote now

The Pound-to-Dollar rate is consolidating on the charts but it retains an upside bias and could still go on to retest December's highs in the coming weeks, according to technical analysis from Commerzbank, although the British currency will need to achieve a daily close above 1.3102 in order to do so.

Sterling was the best performing major currency Tuesday but gains in the Pound-to-Dollar rate trailed those of other pairs as investors were reluctant to bet too heavily against safe-haven assets like the Dollar amid renewed concerns about the possible economic impact of the new coronavirus.

British exchange rates were lifted Tuesday by better-than-expected data that showed the jobs market remained in rude health last month despite a sharp slowdown in the economy during the final quarter of 2019.

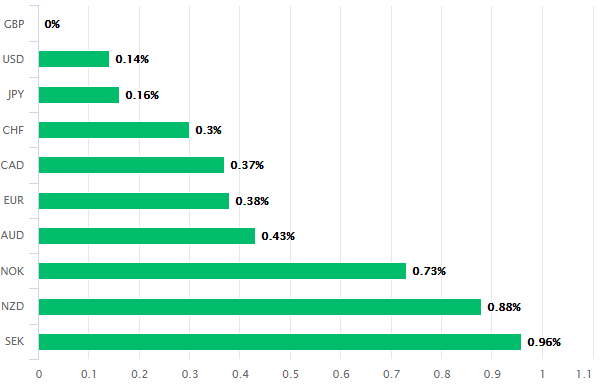

Above: Pound Sterling performance against major rivals on Tuesday. Source: Pound Sterling Live.

Strong growth in full-time employment has further eaten away at already-reduced wagers suggesting the Bank of England (BoE) will cut interest rates this year, helping to keep short-term British bond yields stable even as yields of other currencies tumbled. That boosted the relative attractiveness of the Pound.

Stability in bond yields has ensured the Pound-to-Dollar rate remains comfortably in the upper part of a 'falling wedge' pattern on the charts. But Sterling needs to achieve a daily close above the upper boundary of that pattern before any retest of December's highs can be assured.

"The overall pattern looks like a potential falling wedge (or continuation pattern) BUT this will only be confirmed by a close above the short term downtrend at 1.3102. This would confirm the move higher to initially 1.3285 and the 2015- 2020 resistance line at 1.3412," says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank.

Above: Pound-to-Dollar rate shown at 4-hour intervals, alongside 2-year GB government bond yield (red line, left axis).

"GBP/USD has so far been thwarted by the 55 day ma at 1.3065 and is easing back from here – this should be pretty limited," Jones says.

Pound Sterling's sideways post-election consolidation has now carved out what looks like a "falling wedge continuation pattern" which, without the technical parlance, is a bullish sign of things to come for the Pound-to-Dollar rate. Conventional thinking on technical analysis dictates that continuation patterns of any kind will reflect a price consolidation that eventually resolves in favour of the trend that was in place before the consolidation began.

"The falling wedge pattern is considered a bullish pattern in the context of an uptrend. The price objective is the height of the wedge from its widest point, projected from the breakout point," says George Davis, chief technical strategist at RBC Capital Markets in a January research note.

Davis says that falling wedge patterns should "slant against" the prior uptrend, forming a series of lower lows and lower highs during a period of consolidation before a breakout occcurs. With these patterns the consolidation can run all the way to the apex of the triangle shape.

"We still view any moves towards 1.27-1.25 as the bottom of a medium-term range," says Robin Wilkin, a cross asset strategist within the commercial banking team at Lloyds Bank. "Long term, we believe the cycle from the 2007 highs at 2.1160 completed at 1.1490 in 2016, with a higher low at 1.1950 in 2019. So post a medium-term range we see a recovery through 1.45 and towards 1.60 in the coming years."

Above: Pound-to-Dollar rate shown at daily intervals, alongside falling wedge pattern.