"We Recommend Investors to Stay Long the U.S. Dollar" - Julius Baer

- Coronavirus angst ensures USD is 2020's top performer

- U.S. economic outperformance supportive

- Dollar Index charts suggest upside

- Key exchange rates such as EUR/USD, GBP/USD pointed lower

Image © Adobe Images

The U.S. Dollar is likely to appreciate further as U.S. economic outperformance is enhanced by a global economic slowdown thanks to the coronavirus outbreak while a positive technical setup on the Dollar index chart advocates for further advances.

The U.S. Dollar is the best performing major currency of 2020, spurred on by safe-haven demand stemming from the coronavirus outbreak in China and the overall outperformance of the U.S. economy relative to the rest of the world, a situation that should ensure the U.S. Federal Reserve maintains interest rates at current levels for the foreseeable future. Meanwhile the incentive for other global central banks to cut interest rates will only rise as the cost of the outbreak becomes clearer, ensuring an interest rate dynamic that favours the Dollar.

Not only is the Dollar the defacto global currency, that sees demand rise when market anxieties grow, the U.S. economy has a relatively low exposure to swings in Chinese demand, making the Dollar a safe-haven that does not have potential collateral exposure, as does the Japanese Yen.

"Apart from benefiting from its status of a safe haven, the Dollar is also supported by the ongoing expansion of the U.S. economy. A fresh set of data published throughout last week confirmed that the US continues to outpace its G10 peers in terms of economic activity," says Piotr Matys, EM FX Senior Strategist at Rabobank.

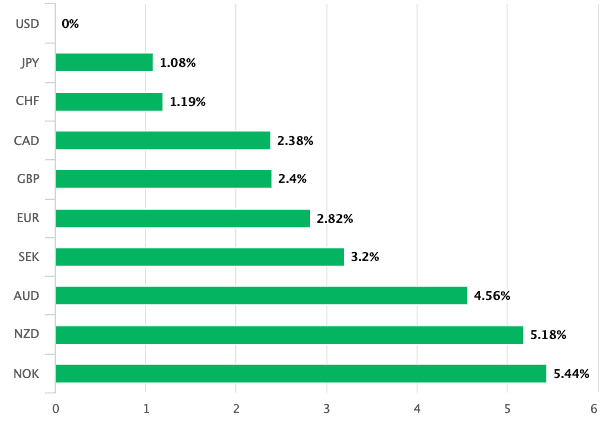

Above: Dollar performance in 2020

The ability of the rest of the world to generate the kind of economic growth to challenge the Dollar's dominance has been severely dented by the outbreak of the coronavirus which has shut down swathes of Chinese industry which has in turn had a negative knock-on effect on global supply chains.

While the coronavirus spread is slowing - the number of confirmed cases is levelling off around 43K - the wider impact to global growth will only be fully grasped in coming weeks when official data starts accounting for the slowdown.

"The novel coronavirus outbreak is a ‘black swan’ event, impacting our projections for global growth in 2020. We have downgraded our forecast for China’s 2020 growth to 5.8% from 6.1%. We now also lower our global GDP growth forecast to 3.2% from 3.3% previously," says David Mann, Global Chief Economist at Standard Chartered Bank in Singapore.

While fundamental considerations are supportive of the Dollar's outlook, so too are the charts with technical studies of the Dollar index - a measure of broad based Dollar strength against a basket of currencies - advocating for further advances.

Above: Short-term recovery in the Dollar index

"It is worth noting the Bloomberg Dollar Index broke above the downside trendline that capped gains since October. This constructive technical signal may embolden the USD bulls," says Matys.

If one takes a step back further, the bullish case for further U.S. Dollar strength is emphasised further.

Mensur Pocinci, Head of Technical Analysis at Julius Baer - the Swiss investment bank - says looking at a long-term chart of the U.S. Dollar index, finds him struggling to curb enthusiasm for the bullish pattern.

"After five years of difficult consolidation, the long-term momentum indicator is bottoming. Note as well that from the last peak, prices have only moved sideways and not corrected – one more sign that the peak in

2016 was a bull market consolidation," says Pocinci.

"Looking at the long-term chart, we see that the trendline from 2001 will be re-tested next. A new long-term momentum indicator gives us the confidence to call for a U.S. Dollar index above 103.80, the highs of 2016. Thus, we recommend investors to stay long the U.S. dollar," says Pocinci.

The Dollar's strength is obvious on a number of key exchange rates that have broken key levels of late, which in itself might advocate for further gains in the broader Dollar.

The Pound-Dollar exchange rate has spent much of the post-December 2019 period above 1.30 amidst ongoing strength in Sterling, but of late the Dollar's advance has been hard to resist forcing the exchange rate below 1.30.

"Prices have broken down out of the contracting range and through the 1.2905 previous reaction lows. Momentum studies remain in bear mode and our bias is still for a move towards support in the 1.2750-1.2700 region," says Robin Wilkin, Cross Asset Strategist at Lloyds Bank.

The Euro-Dollar exchange rate has fallen below the 1.10 level this week as a the short-term decline in place since January 01 accelerates.

"Prices remain under pressure after breaking the 1.0980 pivot support region. As such, our bias is still for a move to the 1.0880 previous reaction lows, if not a new low," says Wilkin.