U.S. Dollar on Path to Long-Term Weakness: ABN AMRO

Image © Adobe Images

- Dollar's long-term appreciation to end

- U.S. economic outperformance to wane

- Global currencies to play catch-up

Analysts at ABN AMRO - the Dutch-based lender and investment bank - say the Dollar will likely embark on a long period of decline in 2020, that should see the EUR/USD exchange rate recover to 1.16 and the GBP/USD exchange rate to 1.35.

"We think that the Dollar is on a path of long-term weakness and there are several reasons for this," says Georgette Boele, Senior FX Strategist at ABN AMRO.

Reason 1: Boele says the fundamental drivers for the US dollar have already been on a path of deterioration.

"For example, current account and fiscal deficit have widened. They have not weighed on the US dollar yet, but at some point, in time they will, especially if the cyclical picture is also deteriorating," says the analyst.

Reason 2: ABN AMRO's U.S. economist expects the U.S. economy to weaken in the coming months while strategists also expect one more rate cut in Q1 2020. "This should hurt the Dollar," says Boele.

Reason 3: ABN AMRO expects no sharp risk-off sentiment in currency markets, a condition that would typically weigh on the safe-haven Dollar.

The market has apparently grown used to President Donald Trump's management style, in particular his approach to foreign relations via Twitter. "The market impact of these tweets and comments will probably be lower," says Boele.

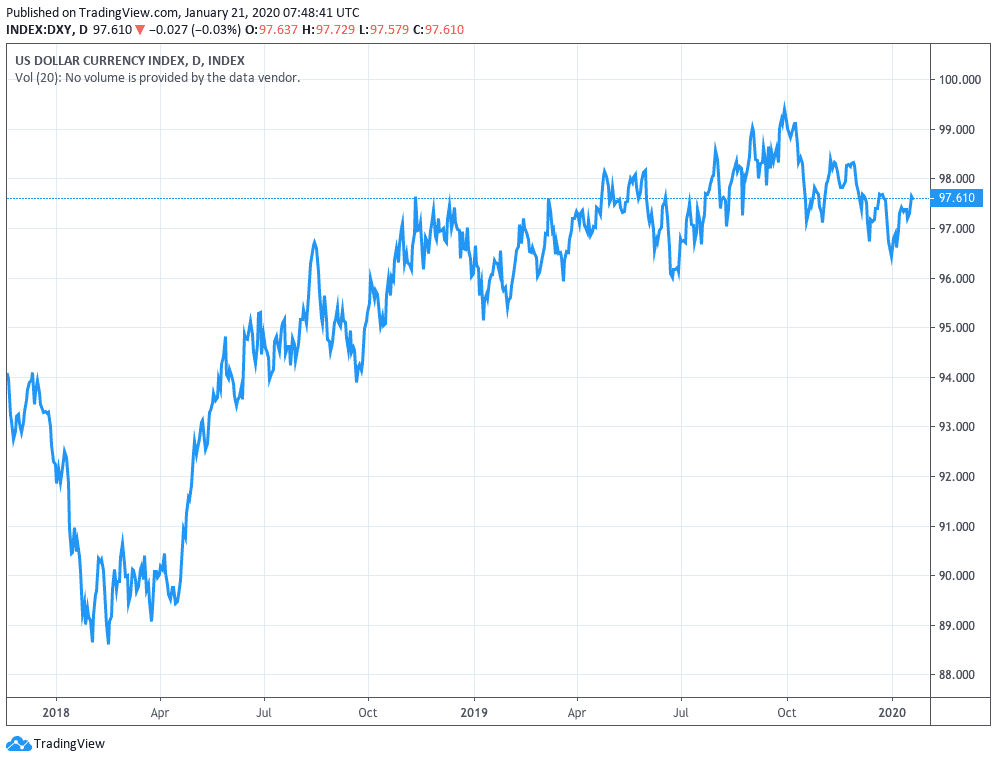

Above: The Dollar index - a broad measurement of overall USD performance - has been trending higher since 2018.

In addition, analysts expect a trade truce between the U.S. and China and a very low probability of a no-deal Brexit.

"There is reduced need for safe-haven demand for the dollar, the Japanese yen and the Swiss franc," says Boele.

Reason 4: The Dollar's strength or weakness must also be viewed as being a relative state to that of other currencies: in short, if other currencies are to strengthen, the Dollar could fall back.

ABN AMRO expects a stabilisation or some improvement in the outlook for other currencies such as the Euro, Sterling, Scandi’s and Dollar-block currencies.

"These currencies are undervalued on the metrics of purchasing power parity, while the US dollar is overvalued. In addition, investors are currently net-long the dollar and net-short most of these currencies. If our scenario plays out the dollar also becomes less attractive," says Boele.

The Euro-to-Dollar exchange rate is forecast to maintain an upward trend in 2020, rising from 1.14 at the end of the 1st quarter to end the year at 1.16.

The Pound-to-Dollar exchange rate is forecast to rally from 1.32 at the end of the first quarter to finish the year at 1.35.

Dollar-Yen is seen going from 109 at the end of the first quarter to 112, indeed, the Yen appears to be one of the losers against the Dollar, presumably owing to its 'ultra-safe haven' status.

The Australian-U.S. Dollar exchange rate is seen rising from 0.67 at the end of the first quarter to 0.70 by year-end.

"We expect Dollar strength to fade in the near-term, because of cyclical weakness and lower safe-haven demand. Further out a deterioration in longer-term fundamentals and somewhat more constructive outlook in other currencies will result in a weaker U.S. Dollar," says Boele.

Time to move your money? The Global Reach Best Exchange Rate Guarantee offers you competitive rates and maximises your currency transfer. They offer great rates, tailored transfers, and market insight to help you choose the best times for you to trade. Speaking to a currency specialist helps you to capitalise on positive market shifts and make the most of your money. Find out more here.

* Advertisement