Dollar Retreats as Market Chases 'Reflation' Trade in Wake of U.S.-China Deal

- Written by: James Skinner

Image © Adobe Images

- USD retreats from all other than safe-havens in new week.

- As 'reflation' trade in fashion after China deal, UK election.

- Recovering EUR and GBP seen keeping USD index capped.

- But other currencies can also eat from USD's plate up ahead.

- CIBC tips NZD and NOK to outperform in reflationary market.

The Dollar softened against all major rivals other than safe-havens Monday as markets continued to celebrate an improved geopolitical environment which is being tipped by analysts to benefit so-called risk currencies in the weeks ahead.

‘Reflation’ of the global economy and non-Dollar currencies has been the name of the game for investors since Friday when President Donald Trump announced a “very large phase one deal” to end the trade war with China, which has already averted one volley of tariffs due to hit China’s exports on Sunday and is expected to reduce existing tariffs on both sides.

The text of the agreement is yet to be made public and the pact itself might not be signed until the early weeks of January but based upon the details made available so far, the deal is broader than many analysts had anticipated. President Trump said Friday it would cover intellectual property regulations, forced technology transfer and a range of other key U.S. concerns about Chinese trade practices including state management of the currency.

“The USD is trading a touch lower but the BBDXY is now basically just treading water. There is a firm cap on top of the Index owing to the shift in the geopolitical tone during the preceding week," says Stephen Gallo, European head of FX strategy at BMO Capital Markets.

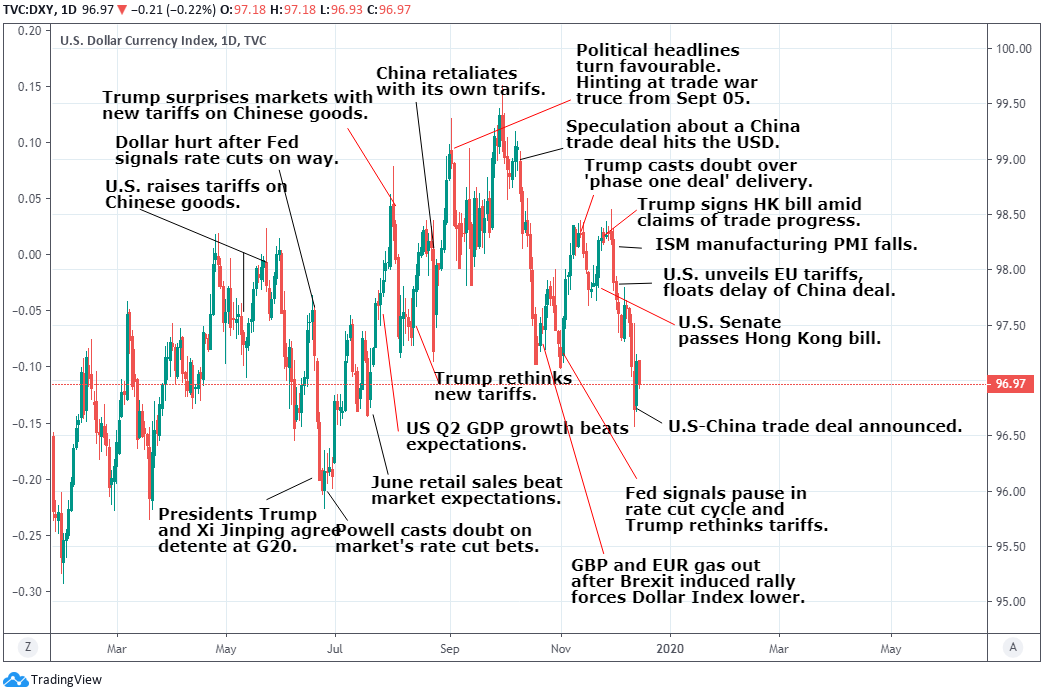

Above: Dollar Index shown at daily intervals.

Friday’s agreement has quelled fears about another damaging blow being dealt to the global economy by more U.S. tariffs while the prospect of some existing tariffs being rolled back has gotten markets hoping the pact might prompt a small global economic rebound in the months ahead. Global growth has slowed amid the 18-month trade fight between the world’s two largest economies, with the Eurozone and Asian exporters hit particularly hard.

"The improved political backdrop and reduction in US/China trade tensions has buoyed sentiment and kept G10 currencies on their front foot vs the USD. This trend could extend further into year-end. Together with a Fed that sees some optimism on the external environment, this backdrop reinforces the recent top in the broad USD - particularly as the USD continues to look expensive vs. other major currencies," says Mark McCormick, head of FX strategy at TD Securities.

The China deal came hard on the heels of the UK election, which awarded an 80 seat parliamentary majority to Prime Minister Boris Johnson and in the process, radically reduced the odds of a ‘no deal’ Brexit in 2020. That’s also good news for the global economy, although to a lesser extent than the U.S.-China deal, because ss the world’s fifth largest economy and a net importer of goods the UK is a top export destination for some economies including those in the Eurozone.

“A hard Brexit looks less likely after last week. A global recession is still not in the cards while household debt issues in smaller G-10 economies remains contained so long as rates are low,” says Bipan Rai, head of FX strategy at CIBC Capital Markets. “So with monetary policy going nowhere, liquidity still sizeable, fiscal policy expanding, a cyclical recovery and no clear and present macro shocks looming – the macro playbook should endorse reflationary views.”

Above: Pound-to-Dollar rate shown at daily intervals.

Last week’s developments boosted to the Pound and Euro which, accounting for nearly two thirds of the Dollar index, helped force the U.S. currency benchmark to lows not seen since July. With such a hefty weighting for the two European currencies, much about the Dollar Index outlook depends on the trajectory of Euro and Sterling exchange rates in the weeks ahead.

The China deal, UK election result, and their implications for the global economy have also left analysts eyeing ‘reflation’ trades, which means they’re now biased toward buying what would once have been economic underperformance stories because the currencies attached to those economies could be the first to benefit from a global economic rebound.

"The reflation strategy is best expressed by staying long currencies that are leveraged to increased global activity and commodities. On the latter, we flagged the NZD as an outperformer well over a month ago, and we’ll allow for some consolidation before we look to buy again. The NOK should benefit as well," Rai says. "We’re expecting North American currencies to underperform as the benefits of the 2018 Trump tax cuts wane and long positions built up in the USD and the CAD are exited."

Above: NZD/USD rate shown at daily intervals.

‘Reflation’ means the Euro as well as the New Zealand and Australian Dollars are all potentially prospects for investors in the weeks ahead. All three of those currencies have deep links to China and have been hurt during the course of the trade war, although the Euro has also been weighed down by Brexit.

CIBC’s Rai is backing the New Zealand Dollar and Norwegian Krone to do well off the back of last week’s news, although others are not yet willing to let their guard down by betting on a pickup in growth outside of the U.S. Strategists at Nordea Markets said Monday they’re still sellers of the Euro-to-Dollar rate because they doubt the Eurozone and global economies can pick up enough to warrant investors dumping the high-yielding Dollar.

“Enough global improvements could warrant a stance against the dollar, as we would then move down in the dollar smile towards an area of synchronized global growth. We do not think were there yet though. Global growth may be showing some signs of picking up, but it’s far from evenly spread. Europe remains in the doldrums, and US growth expectations vs the rest of the world’s show signs of levelling off at levels NOT conducive to significant USD weakening,” says Martin Enlund, chief FX strategist at Nordea Markets. “We are still tempted to short GBP anyway, as the market has sort of forgotten that the UK outlook is probably even bleaker than the Euro zone outlook – at least short-term. The GBP bulls seem to have gotten a tad too euphoric.”

Above: Euro-to-Dollar rate shown at daily intervals.

Time to move your money? The Global Reach Best Exchange Rate Guarantee offers you competitive rates and maximises your currency transfer. Global Reach can offer great rates, tailored transfers, and market insight to help you choose the best times for you to trade. Speaking to a currency specialist helps you to capitalise on positive market shifts and make the most of your money. Find out more here.

* Advertisement