Pound-Dollar Rate in Choppy Trading as Election Divides Opinion on Outlook

- Written by: James Skinner

© IRStone, Adobe Stock

- GBP pares gains as Westminster holdouts back election.

- December poll divides opinion in market on GBP outlook.

- Some see glimmer of certainty, others see only uncertainty.

- TD Securities tips floor under GBP/USD, sells GBP/NZD.

- RBC says Conservative campaign lead could support GBP.

- UBS says prospect of certainty over future could lift GBP.

- Westpac upgrades forecasts, eyes buoyant GBP/USD rate.

The Pound-Dollar rate was choppy Tuesday after more opposition holdouts agreed to back an early general election, setting the UK up for its third vote inside five years while dividing opinion in the market on the outlook for Sterling.

Voters will be asked to head back to the polls before Christmas, and likely between 09 and 12 December, to choose their third government since the summer of 2015. It'll be the fourth poll of signficance in as many years and one with consequences for the UK's exit from the EU as well as the economy, although Sterling has taken the development in its stride so far.

Surveys of voting intentions suggest it will be a tight race between four horses. The governing Conservative Party is expected to pitch Prime Minister Boris Johnson's Brexit proposals while the Liberal Democrats run on an anti-Brexit ticket and the newly-minted Brexit Party flogs the 'no deal' or 'clean break' Brexit it's been clambering for since the party was founded earlier in 2019. Meanwhile, the position of the official opposition Labour Party remains a point of contention.

"The market is taking this news about the election positively. I think most had assumed that since this raises the chance of a no deal (or more drawn out uncertainty) through hung parliament that this would be negative GBP, but I guess there is also a right tail in play here that a resolution is possible and plausible now by Christmas and that seems to be outweighing the price action," says Peter Wilson, an FX hedge fund salesperson at UBS.

Above: Pound-to-Dollar rate shown at hourly intervals.

The Pound was up a fraction against the Dollar in noon trading while the British currency was lower 'risk' rivals such as the Canadian, Australian and New Zealand commodity Dollars. It was also lower against the safe-haven Yen but higher relative to European currencies including the Euro.

Currencies don't normally take kindly to snap elections, especially those where significant policy changes are on the table, like with the current one. However, the December ballot offers markets not only the prospect of certainty over the UK's future economic regime, but also a fleeting shot at seeing the Brexit endevour scrapped altogether - for a period of time at least.

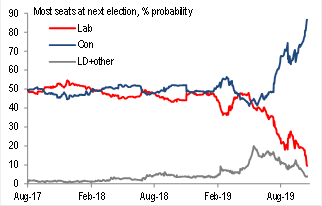

"GBP trades on a simple rule that the Conservatives are good and Labour bad...Markets appear to think the election outcome is a foregone conclusion. As the second panel shows, the implied probability of Labour being the largest party after the election has today plunged to just 10," says Adam Cole, chief FX strategist at RBC Capital Markets. "We’d be more cautious; as the 2017 experience shows, when the Conservatives’ poll lead fell from 18% points to just 2% points, prospects can change dramatically."

Above: RBC Capital Markets graph showing odds-implied probability of majority for major parties.

Liberal Democrats and the Scottish National Party said Monday they might support Prime Minister Boris Johnson's next attempt at forcing parliament into an early election, with the House of Commons vote expected to take place early on Tuesday evening. Since Johnson opted to circumvent the Fixed Term Parliaments Act that requires a two thirds majority to trigger an early poll, and secured support for a vote from other parties, Labour has said it'll back a one line bill seeking a simply majority for an election.

This makes a return to the ballot box a certainty for voters where Brexit policies will be key determinants of the outcome, but not the only determinants. And given how polarised politics have become, there's uncertainty about the reliability of polls ahead of the ballot, especially after the upset of 2017 that saw the electorate lumber itself with a hung parliament to the surprise of pollsters. That parliament has proven itself to be the most divisive and fractious in living memory for many a commentator.

"It does appear sterling is about to turn a page in its longstanding Brexit saga," says Ned Rumpeltin, European head of FX strategy at TD Securities. "We fully expect more than our share of political twists and turns. UK elections have been very greasy poles in recent years. At the outset, however, investors are likely to assume Johnson will return as PM - with or without a working majority. This presents a somewhat nuanced backdrop for sterling."

Above: Pound-to-Dollar rate shown at daily intervals.

Rumpeltin says the Pound should trade with a "pretty firm" floor under it because the prospect of a punishing 'no deal' Brexit will have been all but voided for the next couple of years if Prime Minister Boris Johnson returns to Downing Street. He also says the Pound-to-Dollar rate shouldn't sustain any fall below the 1.2705 level, but acknowledges the currency may also lack the impetus for meaningful gains. He's also tipped the Pound-to-Kiwi rate as a sell.

With Sterling up more than 10% against the Kiwi over the last three months and the New Zealand Dollar down against most rivals over that timeframe, the Pound-to-New-Zealand-Dollar rate is thought of at TD Securities as being overstretched. TD sold the exchange rate at 2.0222 on Monday and is targeting a move down to the 1.9545 level over the coming weeks.

"[GBP/USD] Cable's floor may also have a ceiling," Rumpeltin writes, in a note to clients. "Reaching a trade agreement will present its own set of major challenges. With the transition period set to expire at the end of 2020, time is not on the UK's side. This, we think, should help to cap rallies until more clarity emerges on the political front. Here, we think cable may struggle to hold above 1.3185 in the absence of fresh catalysts."

Above: Pound-to-Dollar rate shown at weekly intervals.

Election talk comes after the EU27 agreed to the UK's request for an Article 50 extension until January 31, 2020 or the date when Johnson's Brexit proposal is ratified by both the UK and European Union parliaments, whichever is sooner. The Monday revelation marks the third delay to Brexit and is a breach of Johnson's 'do or die' pledge to get the UK out of the EU on October 31.

The Prime Minister was forced into requesting an extension of the Article 50 window by the 'Benn Act' passed through parliament by the opposition, with the aid of an apparently partisan Speaker of the House of Commons and rebels within the governing Conservative Party. Commentators argue the Prime Minister will likely be forgiven by voters for the Article 50 delay given the behaviour of the Commons' Speaker and some of the tribes within parliament.

"Considerable doubt over this plan and an early election remains at time of writing but the key positive for markets is the sharp reduction in the risk of a no-deal or “hard” Brexit. This is a more benign outlook than we had been expecting, so we have revised our sterling forecasts sharply higher, with a new baseline view of GBP/USD tracking the low 1.30s well into 2020," says Sean Callow, a strategist at Westpac.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement