U.S. Dollar Fades as U.S. and China Talks Progress and Federal Reserve Looms

- Written by: James Skinner

Image © Adobe Images

- USD softens on trade talks progress ahead of Fed decision.

- U.S.-China said to be firming up 'phase one' deal this week.

- Possible announcement, press conference to come Friday.

- Speculation boosts sentiment ahead of anticipated Fed cut.

- Fed to cut rates but words on outlook matter most to USD.

- More Brexit progress, technicals can lift GBPUSD this week.

The Dollar softened at the start of the new week amid claims of further progress in the U.S.-China trade talks and ahead of a widely anticipated interest rate cut from the Federal Reserve (Fed) on Wednesday, although some analysts say the greenback should rise in the days ahead.

China's Ministry of Commerce confirmed Saturday that U.S. and Chinese negotiators have reached what sounds like the 'phase one' deal described by President Donald Trump on October 11, encouraging speculation that a formal pact could be announced and potentially signed within days. The statement eases what had been mounting concerns over whether the agreement said to have been struck earlier in the month would ever see the light of day.

"We are looking probably to be ahead of schedule to sign a very big portion of the China deal. And we’ll call it “phase one,” but it’s a very big portion. That would take [care] of the farmers. It would take care of some of the other things. It’ll also take care of a lot of the banking needs," says President Trump, addressing reporters from Joint Base Andrews in Prince George's County, Maryland, before the departure of Air Force One on Monday.

President Trump said on Friday, 11 October that he and China's Vice Premier Liu He had reached a 'phase one' deal to avert an increase in tariffs planned for October 15 although the pact doesn't prevent new U.S. tariffs from going into effect on December 15. Trump said the current deal formalises commitments relating to China's management of its currency, intellectual property protections and provides U.S. banks access to the coveted Chinese market.

"It is hard to imagine more complacent market conditions, but these could yet extend further if we get the Friday press conference some sources suggest will happen with chief Chinese negotiator Liu He and US Treasury Secretary Mnuchin," says John Hardy, chief FX strategist at Saxo Bank. "There are strong risks that the terms of the deal could prove too narrow to merit the market’s enthusiasm and weak US data could yet spoil the party as well."

Above: Pound-to-Dollar rate shown at daily intervals, alongside Euro-to-Dollar rate (black line, left axis).

The trade war between the U.S. and China has hurt the global economy, leading central banks the world over the begin cutting their interest rates, which has further boosted the attractiveness of the now-high-yielding U.S. Dollar in recent quarters so anything that suggests and easing of tensions tends to weaken the greenback. And this Dollar strength, not to mention the Federal Reserve's rate policy, has also wounded the global economy.

Federal Open Market Committee rate setters are expected to reduce the Fed Funds rate for a third time on Wednesday, taking it down to 1.75%, in an effort to safeguard the economy from an ongoing global slowdown. The Fed has been aided in its efforts to justify rate cuts by lacklustre inflation, which has lessened the need for the rates to remain at the levels reached last year, which brought the ninth rate hike in three years in December 2018.

Third-quarter GDP data as well as non-farm payrolls figures for the month of October will also hit the market this week and expectations are downbeat going into the releases. Consensus suggests the economy grew at an annualised pace of 1.6% in the quarter, which would be its weakest since the opening quarter of 2017, and markets are looking for payrolls growth of just 90k for this month. That would be the smallest monthly jobs increase since March.

"We have a host of potential reasons for USD strength this week. Euro inflation (market expects to fall), the Fed (we expect a cut, but further easing to have a high hurdle) and US GDP on Wednesday. But also the re-starting of ECB QE, US NFP and US ISM (we expect a 2.7pp bounce!) on Friday," says Jordan Rochester, a strategist at Nomura. "The risk reward remains that EUR/USD has ended its mini uptrend and we could have a few USD positive surprises this week, the path is still a lower EUR/USD."

Above: Dollar Index shown at daily intervals.

Markets have almost fully priced Wednesday's rate cut which means investors will take their cues on the Dollar from the Fed's guidance about future changes in rates. Back in September the bank suggested it would cut rates just one more time this year to complet its 'mid-cycle adjustment' of policy but investors have consistently bet that it'll have to cut further than that in the months ahead. President Trump described the Fed as "derelict" in its duties last week in the latest of a long line of attacks on the bank.

The Federal Reserve is derelict in its duties if it doesn’t lower the Rate and even, ideally, stimulate. Take a look around the World at our competitors. Germany and others are actually GETTING PAID to borrow money. Fed was way too fast to raise, and way too slow to cut!

— Donald J. Trump (@realDonaldTrump) October 24, 2019

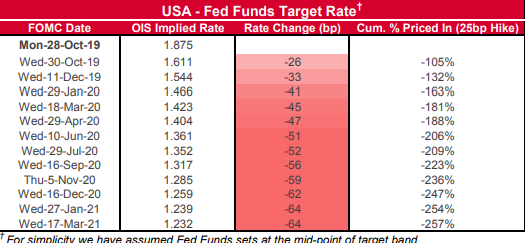

Pricing in the overnight-index-swap market implied on Monday a heavy probability of the Fed following up with another rate cut in December, and also suggested the prospect of a further two cuts once into 2020. Markets will be looking on Wednesday for the bank to confirm those bets aren't misplaced although there's a chance the Fed might neglect to do so, which is why some anticipate a turn higher by the Dollar later this week.

"US rate market participants still expect the Fed to follow through and cut rates by a further 25 basis points this week although it is now seen as more likely to be the last rate cut delivered this year," says Fritz Louw, a currency analyst at MUFG. "We expect the Fed to leave rates on hold in December and resume rate cuts next year. Our US rates strategist John Herrmann expects the US economy to slow further next year."

Above: Westpac graph showing overnight-index-swap market expectations for Federal Reserve rate cuts.

The U.S. economy has begun to slow this year, with the trade war and resulting global economic slowdown coming back like a boomerang to bite the American manufacturing sector, with output from the nation's factories falling sharply in recent months. Fears are that the downturn in the factory sector will spillover into other parts of the economy, ultimately leading to a recession. Census Bureau data revealed Monday that imports of consumer goods fell by an annualised 5% in September.

The Federal Reserve Bank of New York said Friday that its 'nowcast' is pointing to U.S. GDP growth of just 0.9% annualised for the final quarter, down from an anticipated 1.9% for the third quarter. GDP growth was 2% in the second quarter, down from 3.1% during the opening months of the year. U.S. growth actually picked up in the first quarter for the first time in five years, but the weakness in the manufacturing sector has since undermined the economy.

"We have only neutralized downside risks with the latest [EUR/USD] rally. To establish a more determined turn in the chart, we need a move well clear of 1.1200 and eventually even 1.1400 needed to suggest the lows are in. To the downside, the bulls’ hopes will begin to wane if the price action dips back below 1.1000," says Saxo's Hardy. "AUDUSD has yet to clear the 0.6900 area hurdle, much less the bigger level up into 0.6950-0.7000."

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement