The U.S. Dollar is on the Defensive as Economic and Political Concerns Weigh

- Written by: James Skinner

Image © Adobe Images

- USD softens further after inflation and spending data disappoint.

- Data reduces impediments to further Federal Reserve rate cuts.

- Comes as Washington weighs on USD with impeachment threat.

- Trump administration on the defensive as 'Ukrainegate' rolls on.

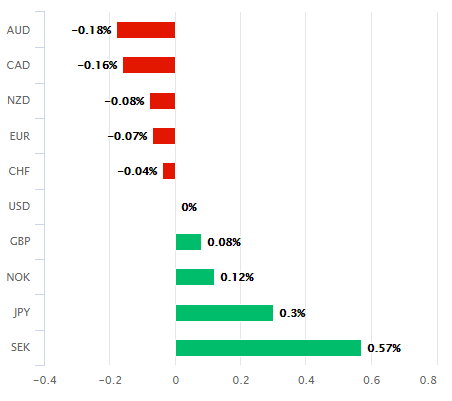

The Dollar softened in noon trading Friday, enabling other currencies to extend their lead over the greenback and offering a lifeline to the Brexit-stricken Pound, after economic data gave the Federal Reserve (Fed) one less reason to pause before cutting interest rates again.

Personal spending rose just 0.1% last month, according to the Bureau for Economic Analysis, down from the 0.6% increase seen previously and when markets had looked for a 0.3% gain. This underwhelming increase in spending came after personal incomes rose 0.4% during the same month, in line with market expectations.

"US consumers have been a bastion of strength for the economy this year, and while they continued to get solid support from income gains in August, they chose to be more cautious than expected in spending that money," says Avery Shenfeld, chief economist at CIBC Capital Markets. "The result could see Q3 consumption forecasts revised down."

The core personal consumption expenditures price index, which is the measure of inflation most closely watched by the Federal Reserve, also surprised on the downside for August. The two disappointments were enough to offset in the eyes of the market, a strong set of 'capital goods orders' figures that bode well for business investment in the third quarter.

Above: Dollar performance Vs major rivals on Friday. Source: Pound Sterling Live.

Core PCE prices were up 0.1% in August, taking the annual rate from 1.7% to 1.8%, but markets had been looking for a 0.2% gain to lift the index to 1.9%. The headline PCE index remained steady at 1.4% in August, although the core figure garners more market attention because it excludes energy, food, tobacco and alcohol items so is thought to provide a better reflection of domestically generated inflation pressures.

"The core PCE deflator rose 0.14%, less than implied by the CPI, with most of the downside due to an inexplicable and unsustainable 0.3% decline in the hospital services component. Assuming a modest September rebound in the overall core deflator, the quarterly increase will be 2.3%, a pace last exceeded in Q1 2012, and the y/y rate remains on course to hit 2.0% in January. The Fed’s forecast for Q4 2020, just 1.9%, is too low," says Ian Shepherdson, chief economist at Pantheon Macroeconomics.

Friday's data could mean the Federal Reserve is less challenged when it comes to justifying any further interest rate cuts that might yet be announced before the year is out. It's already cut rates twice, leaving the Fed Funds rate at 2%, in an effort to protect the economy and its 2% inflation target from a mounting global economic slowdown that could ultimately lead to slower U.S. growth and weaker price pressures further down the line.

Changes in rates are normally only made in response to movements in inflation, which is sensitive to growth, but impact currencies because of the push and pull influence they have over capital flows. Those flows tend to move in the direction of the most advantageous or improving returns, with a threat of lower rates normally seeing investors driven out of and deterred away from a currency.

Markets are betting the Fed will cut rates at least three more times before the end of next year and anything that appears to vindicate such wagers, like Friday's data, would rarely be welcomed by the Dollar although some analysts say most of the price action seen on Friday is the result of politics. The Dollar was lower against the commodity currencies like the Aussie, Kiwi and Canadian Dollars, the main so-called risk currencies.

Above: GBP/USD and EUR/USD (orange line, left axis) rates shown at daily intervals.

"Political drivers remain front and center - on both sides of the Atlantic. Risk appetite rebounded in European trading after a more downbeat session in Asia overnight. The USD is heading into the weekend on a mixed footing with trading ranges muted. Within this, we note that EURUSD dipped to a new low," says Ned Rumpeltin, European head of FX strategy at TD Securities.

President Donald Trump and his administration are on the defensive after a whistleblower alleged he's attempted to use his office in order to strongarm Ukraine into actions that could have an impact on the 2020 U.S. election campaign. House of Representatives Speaker Nancy Pelosi, who's also a senior leader in the opposition Democratic Party, announced an impeachment inquiry earlier this week amid a clamour from opposition politicians.

Trump is alleged to have pressured Ukrainian President Volodymry Zelensky into investigating Joe Biden, a 2020 Democrat presidential candidate, and a member of his family. He is said to have withheld military aid to Ukraine in an effort to force an investigation that would risk tainting his rival ahead of an election year. Since Tuesday, when the impeachment inquiry was announced, it's been further alleged the administration attempted to "lock down" and hide details of the call that took place.

"GBPUSD's move lower has provided support due to "dovish" MPC commentary, but we have to imagine that the rest of the FX space (vis-a-vis the USD) is pausing given the new twist in US politics - which has dramatically (in our opinion) increased the odds of formal Trump impeachment proceedings. This in turn has weighed on the USD," says Stephen Gallo, European head of FX strategy at BMO Capital Markets.

Above: Dollar Index at daily intervals, annotated for recent events including trade developments.

America's Dollar and stock markets have done nicely out of the Trump presidency so anything that suggests a premature or unexpected end was always likely to ruffle feathers in the market, although some analysts say the adverse impact of such a thing would be less now than in the earlier stages of the incumbent's tenure. This might also explain why the Dollar was lower against the commodity currencies Friday, but higher against others.

Many of those commodity Dollars have been badly wounded by the ongoing trade scrap between the U.S. and China, which has led to slower growth in the world's two largest economies and arguably hit the trade-sensitive German and Eurozone economies even harder. That slowdown is a headwind to commodity producing countries whose prospects depend very much on sentiment toward the global economy.

If Trump was to be ousted from the White House the trade war could come to an end sooner than it otherwise might. However, the rub for those commodity Dollars and anybody looking for a much weaker U.S. Dollar in the short-term, is that there are still significant obstacles to a succesful impeachment process. Opposition politicians will need a two-thirds majority in the Republican held Senate in order to successfully oust Trump via the impeachment channel, although there is an election in November 2020.

"The impeachment probe has the potential to undermine the US dollar if market participants become more fearful that Trump’s pro-growth policies could be reversed and/or rising political uncertainty begins to weigh more on the US economy. However, it is probably a more material downside risk for next year," says Lee Hardman, an analyst at MUFG.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement