Pound-to-New Zealand Dollar Rate Forecast for the Week Ahead

GBP/NZD has been recovering ever since the post Brexit lows, and whilst there is no sign of it ending the very near picture is too clouded to offer a clear forecast in the short term.

The Pound-to-New Zealand Dollar exchange rate is in an established medium-term uptrend which is reinforced by the fact that it is trading well above a trendline drawn from the October 2017 lows.

Therefore the exchange rate is expected to continue rising in its uptrend over coming weeks given the lack of overwhelming evidence to suggest a reversal lower:

Note however that the broader uptrend can be characterised by bouts of weakness in the Pound, that can last a couple of weeks.

That is why the daily chart - i.e. the shorter-term - is much less clear at this particularl point in time. In short, the market is showing some hesitancy.

The oscillating up and down moves of January provides us with no clear trend either up or down to hitch onto, and so whilst the broader trend may be up there are no clear signals either way in the short-term.

But what we can say is that weakness should be limited and ultimately those who are looking for a stronger Pound against the New Zealand Dollar will get their way, but some patience is required for now.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

Data and Events for the New Zealand Dollar

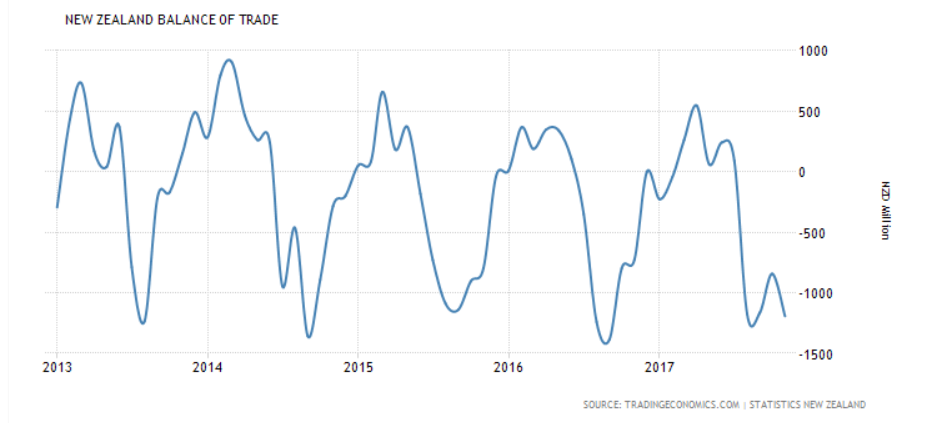

The main release for the New Zealand Dollar in the coming week is the balance of trade data out on Monday evening at 21.45 GMT which is expected to reveal a -125 million trade deficit in December.

Judging from the chart below the trade balance is a heavily cyclical phenomenon and given it is close to or at cycle lows, what we can say is that it will probably register a deficit rather than a surplus.

(Image courtesy of tradingeconomics.com)

Indeed, consensus are forecasting a reading of $-125M for December, which takes the annualised trade deficit to $-3.420M. A better number on either could provide a mild upside reaction in the NZD.

However, there is unlikely to be a heavy impact on the currency unless the actual result deviates markedly from the forecast.

A surplus is positive for the Kiwi and it signifies a greater selling of NZD exports than buying of foreign imports.

Exports require foreign buyers to exchange their currencies into Kiwis to buy them whilst vice versa for imports, thus the trade balance indicates Kiwi demand.

Data and Events to Watch for the Pound

The main data release in the week ahead for the Pound is survey data for Manufacturing and Construction in January, in the form of Markit IHS's purchasing manager indices (PMIs).

These are normally a reliable forward indicator of activity and trends within the broader economy and economists use them to predict growth. Markets will be looking for confirmation that the better-than-forecast economic momentum enjoyed by the UK economy in the final quarter of 2017, confirmed in last week's GDP data, has extended into the new year.

Manufacturing PMI is out at 9.30 GMT on Thursday, February 1 and is expected to rise to 56.5 from 56.3 previously.

Global investment bank TD Securities say economists are being too optimistic about Manufacturing and the index will fall to 55.9 instead of rising to 56.5; an outcome that would certainly weigh on the Pound we believe.

"We’re looking for a modest pullback in the manufacturing PMI after last month’s larger nearly 2pt decline, with the index falling from 56.3 to 55.9 in January. We expect to see some of the weakness in the flash Eurozone print reflected in the UK outcome," said TD Securities in a briefing to clients ahead of the new week.

Construction PMI is out at the same time on the following day and is forecast to fall to 52.0 from 52.2 in December. Note that the sector is in recession, according to official GDP data, so some recovery will be keenly anticipated. However, construction is a small component of the UK economy and the impact on Sterling will likely be small if any. Nevertheless, clues on longer-term prospects for the economy will be key to overall sentiment.

One further event of interest to Pound-watchers in the week ahead is Bank of England (BOE) governor Mark Carney's testimony to the Lord's Economic Affairs Committee at which he will have the opportunity to comment on the state of the economy and monetary policy before the 'black-out' period prior to the next official BoE rate meeting.

Markets are keen to ascertain whether or not the BOE will raise interest rates in 2018, in a follow up to 2017's rate rise. Markets are anticipating this is the case, but a bullish assessment by Carney could certainly be the catalyst to a higher Sterling in the coming week we believe.

Carney's appearance in Davos last week was striking in that he hinted that he is taking a more optimistic stance on the UK economy, seeing growth picking up sharply towards the end of the year as the UK "consciously recouples" with the accelerating global economy.

He will certainly be queried on this, and the answers will be closely followed by currency traders.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.