New Zealand Election Risks Pose Further Downside for NZ Dollar

Rising political uncertainty is said to be one reason the New Zealand Dollar has struggled of late, and some analysts say more downside is likely.

Neither Labour nor the National Party is expected to be able to win an outright victory, which means they will probably have to form a coalition with the third-largest party, New Zealand First.

"We expect the NZD to be most vulnerable in a scenario where NZ First is seen as part of the ruling coalition," says economist Jonathan Koh of Standard Chartered.

This poses further downside potential for the New Zealand Dollar; a currency that has absorbed a decent dose of political premium over recent weeks ensuring it is the worst performing global currency in the G10 complex over the course of the past month.

Recent data from ASB, who run a quarterly survey of importers and exporters, appears to confirm that businesses are buying and selling currency in order to hedge against election-related risks.

"Among reporting enterprises, 44.5% already had increased their hedging activities, with a further 38.5% intending to increase hedging; only 17% cited the election as not having an impact," say ASB.

New Zealand first is seen weighing on the NZ Dollar owing to their stance on immigration; a cut in immigration to the extent proposed by NZ First would probably result in two things happening - a slowdown in the economy and a rise in wages.

Whilst a rise in wages would normally be considered positive for a currency, Koh thinks investors will focus on the slow-down in the economy instead, which will be negative for the NZ Dollar, "via lower real yields on a weaker growth outlook."

"On immigration, we think markets will focus on downside risks to growth rather than upside risks to wage inflation," says Koh.

Despite already having fallen recently, Standard Chartered expects the currency to fall even further.

"Rising political risks and stronger jawboning from the Reserve Bank of New Zealand have recently weighed on the New Zealand Dollar by triggering an unwinding of stretched long NZD positions. We see potential for further downside, as polls remain tight and net positioning remains long NZD," added the analyst.

Koh's views are similar to those of ING's Viraj Patel, who pointed out the risks to the NZ Dollar in research published at the end of August.

Patel argued the NZ Dollar was in danger of falling as it had not absorbed any of the risk premia from the election, which he estimated as between 1-2%.

It seems it is arguable that the NZ Dollar may now have absorbed roughly some of the risk premium attached to the election - at least in some pairs.

GBP/NZD shows signs of having absorbed the political risk premium, after having risen from 1.7807 to 1.8250 at the start of September, which is an increase of 2.48%.

NZD/USD is currently trading at the same level as it did at the end of August, however, in the interim it fell by 1.69% suggesting some absorption of the risk mentioned by ING's Patel as well.

It would also be a mistake to think that only the New Zealand First is was a threat to the Kiwi - all three parties have policies which would be detrimental to the currency.

All three want to curb immigration but New Zealand First and the present incumbent, the New Zealand National party want to limit it the most.

The Labour party and the Nationals want to reform the Reserve Bank of New Zealand (RBNZ).

Both parties want the RBNZ to change its practice of allowing the governor to decide monetary policy on their own, rather than deciding by committee, which is the reform they are proposing.

The Labour party also want the RBNZ's mandate to include a requirement for 'full employment' to be reached, like the Federal Reserve.

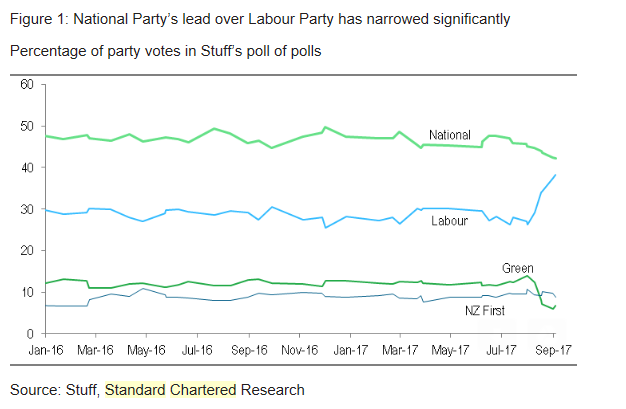

The latest election opinion poll conducted by One News Colmar Brunton over 26-30 August shows that support for Labour has risen significantly to 43% from 37% in the previous survey over 12–16 August.

In contrast, support for the National Party slipped further to 41% from 44%.

While Labour's gains in polls are having a negative reaction on NZD, according to analysts at Barclays this reaction is unjustified and therefore unlikely to last:

"The negative reaction in the NZD to the Labour Party’s lead could have been somewhat related to a populist tilt in its new fiscal plan unveiled last week."

"The Labour Party said it plans to offer free post-secondary education and boost student allowances. Although it plans to fund the expenditure partly through the imposition of a tourist tax, it has said its fiscal plans mean smaller operating surpluses and more debt over the next five years."

Barclays suggest the weakness in NZD due to Labour's policies is due to the fiscally expansive nature of the policies, which are likely to increase the country's debt burden and may be fiscally unsustainable.

However, analysts note how low New Zealand government debt is and how these plans are unlikely to increase the debt burden materially.

If anything the policies are more likely to, "support consumption and GDP growth," say Barclays.

While Barclays are more optimistic it is possible to note they have failed to mention the New Zealand First factor identified by Standard Chartered.

Perhaps this stance is justified, as junior coalition parties typically do not get to implement their headline policies in full and have to make significant compromises in order to get some grip on government levers.

Either way, what we do have is the potential for embedded uncertainty should neither Labour nor the National Party win outright, and one thing is certain - currencies hate uncertainty.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.