New Zealand Dollar 'Lower for Longer' as NZ Inflation Drops in Q2

It's not only Pound Sterling that has been stamped on by an inflation-shaped boot this week.

The New Zealand Dollar turned sharply lower against a number of its main competitors following the release of lower-than-forecast inflation data for June.

Markets had been expecting seasonality to cause a pull-back in rising New Zealand inflation on Monday when data for Q2 was release, but not as much as actually happened.

The 1.7% print was below market expectations of 1.9% and much lower than the previous 2.2%.

Global investment bank TD Securities were one of the few who predicted such a decline, which we mentioned in our week-ahead analysis, which will have prepared some savvy readers for the subsequent price action.

The fall in inflation immediately takes the pressure of the Reserve Bank of New Zealand (RBNZ) to consider raising interest rates which in turn feeds into a lower forecast profile for the New Zealand Dollar.

The RBNZ’s current stance can be summed up as neutral-dovish and by the phrase “lower for longer” used by the Bank itself to describe forward guidance.

The graph of historical quarterly inflation results below shows how difficult it was getting for the RBNZ to maintain its "lower for longer" stance amidst steeply rising inflation pressures.

Yet the hairpin bend created by the most recent data point will allow them to remain non-committal for longer, most probably.

RBNZ don’t want to raise rates if possible as it will strengthen the Kiwi Dollar and impact negatively on exports.

RBNZ is also concerned about how such a rise would impact on the highly indebted populace who would see a rise in their repayments hit disposable income.

Get up to 5% more foreign exchange by using a specialist provider. Get closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

The fall in the NZD is in line with Morgan Stanley’s expectations who argued rising inflation was not due to the economy but from rising prices of imports.

This informed thier bearish view for NZD/USD which they see eventually falling to 0.64 in 12 months time from 0.7357 currently.

“But we still expect the NZD to fall through this year, reaching USD0.67 at year-end. It is hard to disagree with the central bank’s argument that the bounce in inflation to above 2.0% is tradables-driven and unlikely to persist,” they said in a recent note.

US Dollar Weakness as Healthcare Bill Flops

The second part of the V-shape described by recent price action was due to the US Dollar weakening after another failed attempt to pass Trump’s new healthcare bill reduced chances of a juicy tax cut increasing fiscal stimulus and pushing up inflation, growth and interest rates.

It appears the proposed bill did not go down well with some of the Republican parties own Senators as it proposed to remove the rights to healthcare of swathes of the population included in Obamacare.

Dairy Prices

The market failed to react to the other major release for the New Zealand Dollar – Global Dairy Trade prices which are fixed at auction very fortnight.

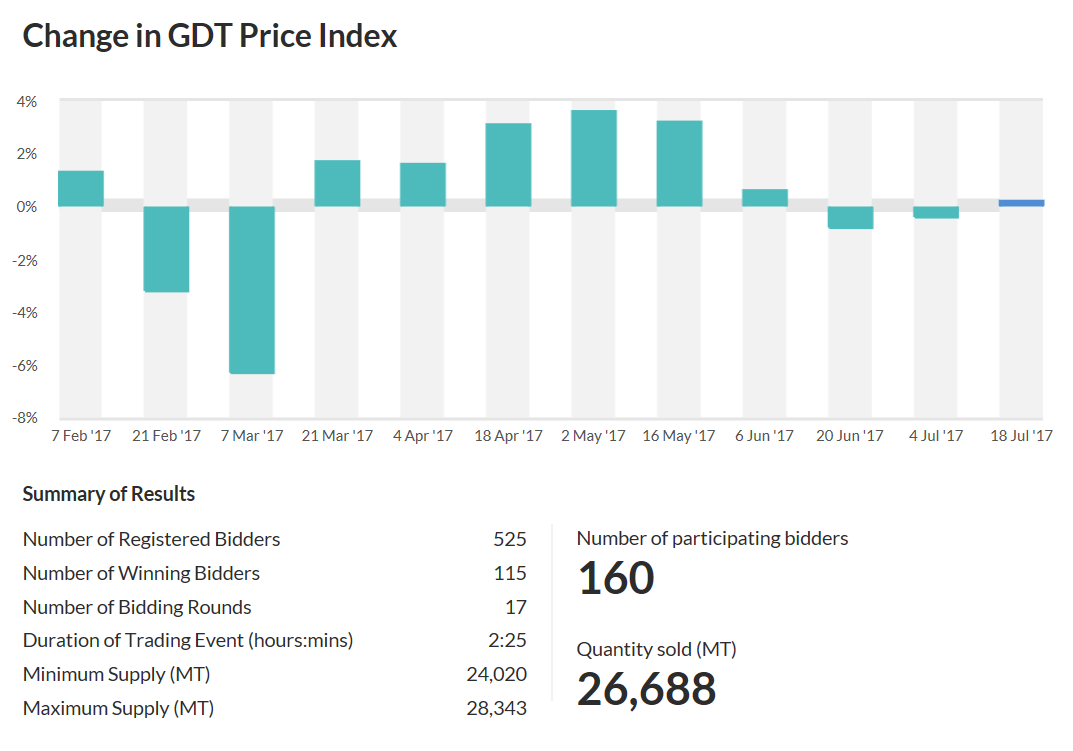

The Global Dairy Trade price index rose by only 0.2% based on average prices achieved at auction on Tuesday July 18.

The average price paid at the auction was $3,387 for a basket of dairy items, including Whole Milk Powder, Cheddar, Butter, Lactose, Anhydrous Milk Fat, Skim Milk Powder and Rennet Casein (a kind of plastic made from milk).

Neither the NZD/USD nor the NZD/GBP changed much after the release.

The former traded at the same level as prior to the release 0.7361 (current 0.7368) give or take a pip, and NZD/GBP traded at 0.5656 after the event, again, showing little overall change.