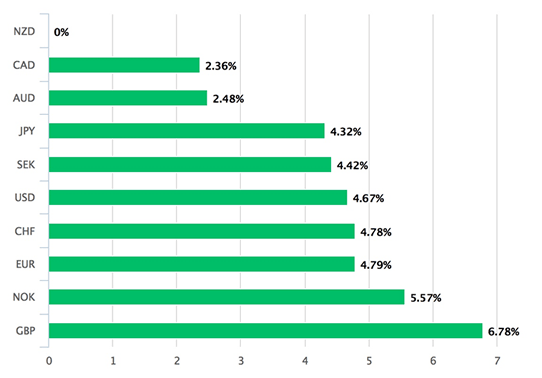

Strong Economy Underpins New Zealand Dollar as Best-Performing G10 of the Past Month

The New Zealand Dollar has been the best-performing currency amongst the world's ten largest currencies over the course of the past month-to-date as global market conditions shift back into the currency's favour.

NZD gained further support on Friday after a domestic gauge of manufacturing activity, similar to the Purchasing Manager Indices (PMI’s), revealed stronger growth than economists had been expecting, reinforcing the view that this economy continues to fire on all cylinders.

Above: NZD performance over the past month-to-date

The NZD rose by a marginal 5-6 basis points after the release, as the data helped the fall from Monday’s poor growth data.

The Performance of Manufacturing Index rose to 58.5 an 18-month high, from 56.9 in April.

Any result over 50 indicates an expanding sector.

On the previous day, the New Zealand Dollar had weakened after GDP data showed only 0.5% growth in Q1, versus the 0.7% expected.

Yearly growth fell to 2.5% from 2.7% previously.

The farming and retail sectors enjoyed the fastest growth whilst construction showed the biggest fall.

The rise in farming was due to increased milk production possibly due to a recent recovery in dairy prices, however, actual exports of dairy products were down in Q1.

Construction may have been hit by a combination of peaking house prices, 'macro-prudential' rules limiting mortgage lending and falling immigration after the government tightened immigration policy.

Given the central bank’s preoccupation with a potential house price bubble the fall in construction may not be seen by the authorities as such bad news.

Analyst David Bloom from HSBC said the NZD economy has holding up relatively well and dismissed the GDP data miss as insignificant.

“For the NZD, cyclical indicators have generally held up better and, even though GDP was lower than expected, the print was still resilient on an absolute basis,” said Bloom.

New Zealand’s soft commodities were holding up relatively well amidst the recent fall in commodities, exemplified by the drop in oil and iron ore.

“In particular, the contrast to Australia in the commodity complex continues with iron ore prices still plunging, while New Zealand’s terms of trade actually reached a 44-year high in Q1 in absolute terms,” said Bloom.

Yet the Kiwi is unlikely to appreciate much due to the Reserve Bank of New Zealand (RBNZ) which remains hostile to a stronger NZD.

“Yet the challenge for the NZD is the RBNZ’s policy stance, which remains hostile to a stronger currency. NZD/USD is more than 5% higher than after the RBNZ’s May meeting, leaving the trade weighted index around 2% stronger than the bank’s projections. With NZD/USD also facing resistance near February’s high of 0.7376, we think risks are skewed to the downside once again going into the June RBNZ meeting next week (22 June),” concluded the HSBC Stategist.