New Zealand Dollar Forecast: Recovery "Further Out"

The New Zealand Dollar is likely to retain a passive tone in the foreseeable future before steadily recovering according to analyst Honglin Jiang of investment bank Credit Suisse.

The call comes as the currency finds itself as one of the worst-performing members of the group-of-ten currency bloc.

The underperformance comes despite New Zealand having a relatively high base interest rate compared to most of the G10 at 1.75%.

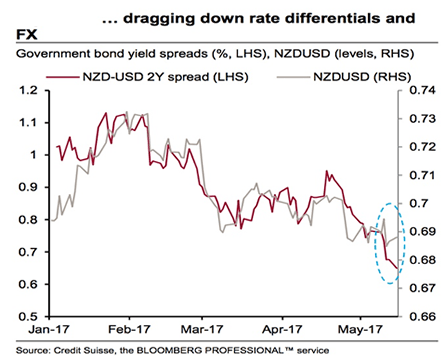

Interest rates are the main mover of currencies and higher rates attract more credit flows which in turn increases demand for the currency and lifts its value.

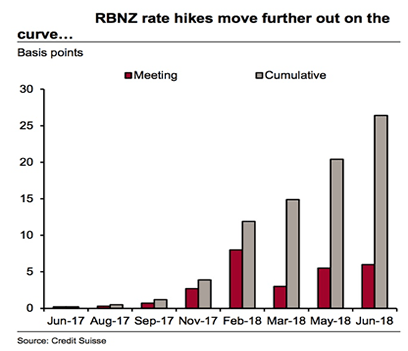

But, New Zealand rates are likely to remain static at the same level until September 2019, according to Jiang.

This is even later than the current thinking on interest rates in the UK which, despite Brexit risk, are expected to be raised by the Bank of England (BOE) in Q4 of 2018.

This would seem to indicate a propensity for weakness in NZD against the majors – since the Euro is expected to start benefiting from higher rates sooner than the UK and the US is contemplating raising interest rates this June.

Another driver for the NZD going forward will be politics, with the general election on September 23 expected to return a government with a pro-spend agenda, possibly even the New Zealand Labour party.

And this could be positive for NZD longer-term it is suggested.

But although the increased spending associated with a looser fiscal policy normally supports currencies, in the case of the Kiwi, the effect is expected to lag:

“The effect is likely to be felt more in the longer term rather than the short term, as economic effects apply with a lag, election uncertainty needs to be overcome, and the RBNZ reworks their modelled effects on monetary policy. As such, a relatively loose fiscal policy should help the NZD achieve our longer-term bullish view (vs. the AUD),” says Jiang.

The third major influence of the Kiwi according to Jiang is migration.

Although migration is normally associated with increased growth and therefore a stronger currency, and although it has boosted growth in the New Zealand construction sector over recent years, it is now, according to research by the RBNZ much less of a stimulus to inflation than it was previously.

Part of the reason is the way net migration is calculated, which is by taking away those leaving from those arriving.

In recent years, the number has been more positive not necessarily because more immigrants are arriving but because less New Zealanders are leaving.

But it is the influx of new immigrants which generates growth as their manifold needs on arrival must be met, which is not the case if people simply remain.

“The RBNZ has noted in detail how the migration surge in the current cycle has been far less inflationary than in the past, and has been partly driven by fewer kiwis choosing to leave New Zealand’s shores,” said Jiang.

Credit Suisse reiterate their neutral short-term forecast for AUDNZD of 1.0850 in 3m, and bearish long-term forecast of 1.0400 in 12m.

The EUR/NZD is forecast to be at 1.658 in three months and 1.664 in 12 months.

The NZD/USD is forecast at 0.664 in 3 months and 0.673 in 12 months.