New Zealand Dollar in Focus as Reserve Bank Expected to Change Statement

The RBNZ (Reserve Bank of New Zealand) is expected to drop its call to keep the interest rates at a record low 1.75% until late 2019, according to Credit Agricole (CA).

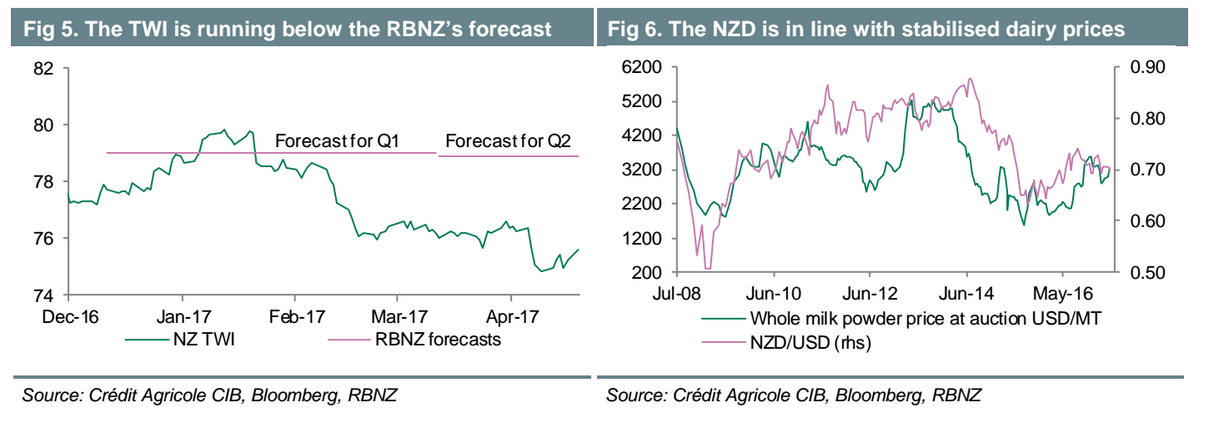

A spike in inflation in Q1 has heightened expectations the Bank might soften its stance on holding rates down for so long.

“Crédit Agricole CIB expects the RBNZ to bring forward its forecast first rate hike a full 12 months to late 2018 and to signal more strongly that the next move in rates is likely higher rather than lower,” said CA’s David Forrester.

The central bank is meeting on Wednesday (22.00 GMT) to set its interest rate – or Official Cash Rate (abrv OCR).

Fear of strengthening the Kiwi (NZ Dollar) unduly, however, amidst an uncertain outlook for exports will make RBNZ reluctant to talk up the possibility of raising interest rates.

Nevertheless, they may drop the phrase alluding a cap lasting till 2019.

Moribund wages are a further reason for the RBNZ to be cautious of raising interest rates as higher loan repayments would weigh overly on household budgets and could precipitate a slowdown.

CA’s Michael Forrester also points out that far from being too high, inflation is now at a goldilocks level judged by the standards of the RBNZ’s target of between 1-3% for inflation (it is currently in the middle of the band at 2.2%).

The New Zealand economy is doing very well currently and the “RBNZ is getting everything it wants,” says Forrester.

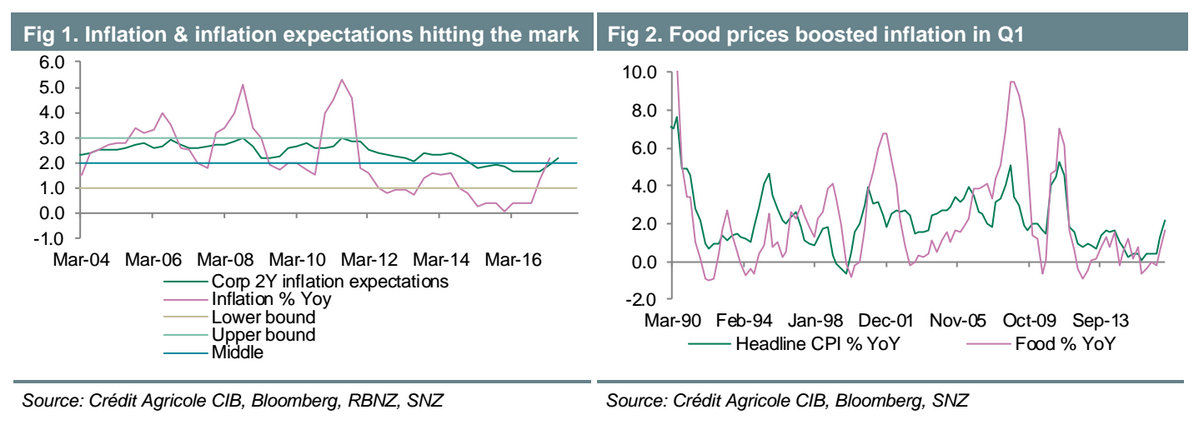

“Economic growth continues to be the envy of the G10, even if it is expected to slow to just below 3% in Q117 from 3.5% in Q416,” remarked the analyst.

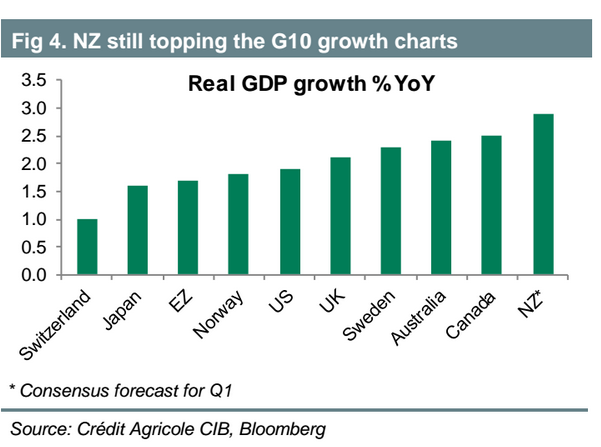

Compared to other commodities the prices of Dairy Goods, New Zealand’s largest export, are “stabilising”.

“Even the currency is being well-behaved,” said Forrester, with the New Zealand Tarde Weighted Index versus a basket of major partners running 4% lower than the RBNZ had forecast in February.

This could embolden the central bank to adopt a more hawkish tone in future rate meetings.

Forrester, however, concedes the RBNZ will try to do all it can to shield the exchange rate from going any higher, although whether that includes leaving the forecast unchanged is debatable.

He also suggests the NZD may not see as much upside as expected if the RBNZ bring forward their forecasts as the market tends to pay little head to them, although we at Pound Sterling Live, see a strong possibility of a reaction from NZD to a change in forecasts.