New Zealand Dollar Jumps Against Pound and Dollar, More Strenght Forecast

The Pound to New Zealand Dollar exchange rate has defied our forecasts made at the start of the week for expectations of further upside.

It has in fact broke lower through the bottom of the long-standing consolidation pattern that formed over recent weeks.

Momentum, as measured by MACD, has turned bearish after moving below its zero-line which advocates for further losses.

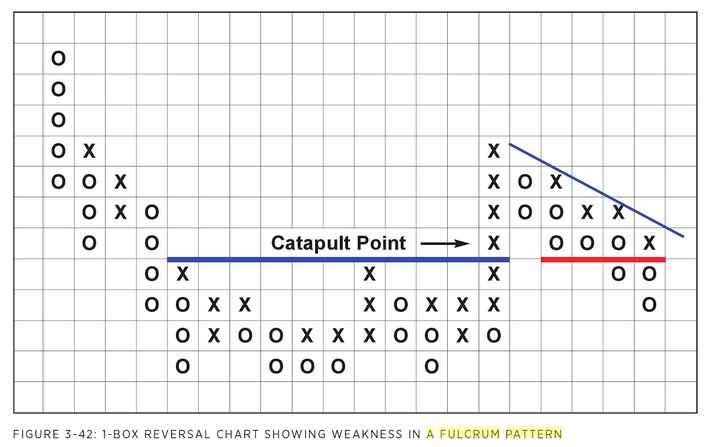

The consolidation pattern on GBP/NZD looks very much like what is known as a ‘fulcrum’ in technical terms and predicts further downside for the pair.

The fulcrum is a pattern from the branch of technical analysis called Point and Figure charting, which uses a different style of price chart composed of noughts and crosses, however, it is sometimes also recognisable in normal candlestick charts.

After a breakdown from a fulcrum top, continued strength in the follow-through after the initial breakout is required or else there is a risk that it could fail.

“The price must continue to show strength otherwise the breakout from the fulcrum can be false and a complete reversal is possible,” writes Point and Figure expert Brian Du Plessis, in his book A Definitive Guide to Point and Figure.

If the pair does not follow through after the initial breakout and begins to consolidate then that is a sign it may have been false and the fulcrum becomes a continuation pattern rather than a reversal.

If the consolidation after the initial breakout is composed of a series of rising lows this is a stronger sign the breakout was false and the market will rotate, go higher and break to new highs above the fulcrum eventually.

The chart below from Du Plessis’s book shows a fulcrum bottom failure, with the sloping consolidation after the initial breakout.

We consider the breakout true until proven otherwise and therefore expect more downside.

A move below the breakout lows at 1.7230 would be expected to target the next round number level at 1.7100.

New Zealand Dollar Boosted by Trump Press Conference

The big foreign exchange event over the course of the past 24 hours has been the capitulation in the US Dollar following Donald Trump’s much-anticipated news conference held mid-week.

Trump gave no firm details on economic policy which was required to keep the Dollar train steaming ahead.

“After his free-ranging comments the USD has fallen. Most of its peers have traded higher,” says Kymberly Martin at BNZ in Aukland. “As the USD has subsequently fallen, the AUD and NZD have pushed higher.”

The NZD/USD and AUD/USD have gained; from mid-week lows near 0.6960 the NZD/USD now trades at 0.7080.

“This is aligned to the 200-day moving average. The AUD/USD has also broken higher to now trade around 0.7460. Its 200-day moving average is now in sight, at 0.7501,” says Martin who says both the NZD/USD and AUD/USD will likely remain at the whim of global market sentiment and direction of the USD.

Meanwhile, we would expect the New Zealand Dollar to remain supported over coming months by expectations for the Reserve Bank of New Zealand (RBNZ) to raise interest rates in 2017 and 2018.

Market pricing suggests the RBNZ’s basic rate will be rising toward 2.75% in two years’ time. i.e. the RBNZ will have delivered 100bps of rate hikes.

These will likely be delivered in 2x 50bp hikes.

“However, the starting point of the hiking cycle will remain open for debate. The market currently has a first hike priced by November this year. The RBNZ’s meeting on 9 February will provide it with an opportunity to influence this pricing if it feels necessary,” says Martin.

We would expect the real NZD strength to come when the date for the first hike crystallises.