New Zealand Dollar: August Rate Cut Odds Increase

- Written by: Gary Howes

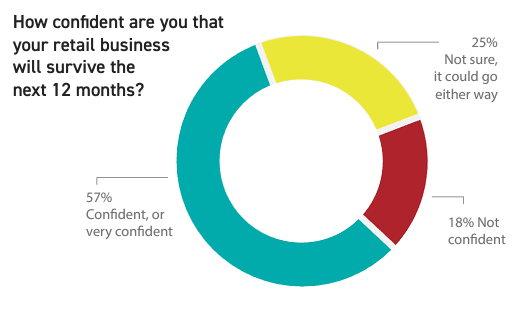

A new survey shows a staggering 43% of New Zealand's retailers are unsure they will survive the next 12 months.

The New Zealand Dollar can stay under pressure if the odds for an August interest rate cut at the Reserve Bank of New Zealand (RBNZ) continue to rise.

Markets are raising expectations for a 25bp rate cut in August, now seeing around a 70% chance, compared to 47% at the start of the week.

"NZD remains heavy and was the worst performer amidst G-10 currencies. NZD is trading around 0.5890 and is sitting near a 2-month low. Increased expectations for near-term rate cuts by the RBNZ continue to weigh on NZD," says Kim Mundy, an analyst at ASB.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The New Zealand economy is straining under the weight of higher interest rates, while at the same time Chinese demand for New Zealand exports continues to disappoint.

"We're sticking with our non-consensus view that the RBNZ will start cutting rates at its next meeting in August," says Abhijit Surya, Australia and New Zealand Economist at Capital Economics.

The latest New Zealand Retail Radar report shows a continued deterioration in the Kiwi consumer. It reports slow retail sales and uncertainty "are continuing to dog the retail sector, with low consumer confidence and rising costs impacting customers’ willingness to open their wallets."

"Things are going from bad to worse for the domestic retail industry," says Surya. "That pessimism is a matter of significant concern because nearly one in every ten workers in New Zealand is employed in retail trade."

43% of respondents to the survey said they are unsure whether they will survive the next 12 months, a substantial jump from 32% in the previous quarter.

The RBNZ might judge that continuing to hold the base rate at 5.5% for too long risks tipping the economy into a damaging recession that triggers significant job losses.

The New Zealand Dollar has come under pressure as the odds for earlier rate rises increase, but as we have reported, a significant degree of weakness has the surge in the Yen to thank.

The Japanese Yen has risen, forcing global investors to reverse the 'carry trade', which saw investors borrow money in Japan and invest it in places like New Zealand, where interest rates are significantly higher.

The yen stabilised on Friday, and selling of New Zealand exchange rates eased, confirming that this is a powerful force in global FX right now.

If the Yen gives back some of its recent gains in the coming days, the New Zealand Dollar can also recover.

However, strength will be limited if markets think the RBNZ will cut rates at its upcoming meeting.