New Zealand Dollar's Turning Point is Coming

- Written by: Sam Coventry

Governor Orr might signal a turning point in August. File image © Pound Sterling Live, Still Courtesy of RBNZ.

The New Zealand Dollar is approaching a turning point and will reverse recent gains say analysts who think the Reserve Bank of New Zealand (RBNZ) will cut interest rates aggressively.

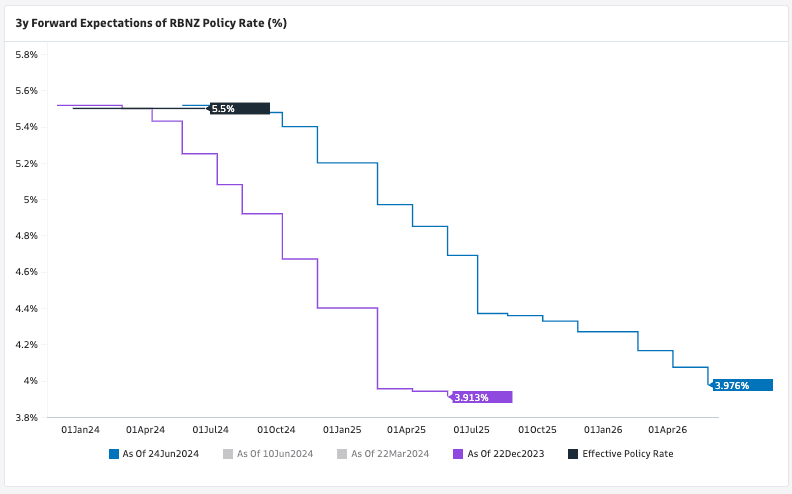

According to market pricing, the RBNZ is not expected to cut interest rates for the first time until close to the end of 2024 due to still-high inflation levels, and even then, the rate cutting cycle is expected to be shallow.

This ensures the NZ Dollar benefits from the highest policy rate in the G10 at 5.5%, as international investors can borrow at lower interest rates and park that capital into New Zealand to scalp a superior interest rate. (This is called the 'carry' trade).

However, analysts at two major investment banks warn market expectations on the RBNZ rate cutting cycle are wrong.

"We think eventually the NZD will lose its lustre. Carry built upon weak fundamentals may not be sustainable and eventual dovish pivots by the RBNZ may see rate cut pricing being aggressively added back," says a new currency research note from HSBC.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

HSBC thinks high interest rates can support a currency if they are high for a good reason, i.e. to cool strong economic growth. New Zealand was in recession for the second half of 2023 and only just exited it in the first quarter of 2024.

Surveys show consumers and businesses continue to labour under the weight of elevated interest rates while GDP per capita continues to decline.

Above: Since December, the market has pared expectations for the start and pace of RBNZ rate cuts. Image: Goldman Sachs.

Economists say the RBNZ will cut interest rates as far and as soon as necessary when inflation allows.

"The Reserve Bank of New Zealand (RBNZ) is expected to make a more explicit dovish turn at its August meeting, but only cut for the first time in November," says Dominic Schnider, a strategist at UBS.

"New Zealand’s economy has been flatlining for over a year and inflation is finally cooling. So, we believe a relatively aggressive cutting cycle will start in November and continue through 2025," he adds.

UBS strategy initiated a sell on NZD against the CHF, reasoning that the RBNZ will be entering a notable interest rate cutting cycle while the Swiss National Bank is already nearing the end of its rate cutting cycle.