New Zealand Dollar Steams into "Winter of Discontent"

- Written by: Sam Coventry

Image © Adobe Images

The New Zealand Dollar is proving to be one of the top-performing major currencies in the short-term, but this outperformance masks fears of a "winter of discontent" for New Zealand's economy.

The New Zealand Dollar is the second-best performing G10 currency when screened over one week and is the third-best performer over the past month, topping the leaderboard alongside its Scandinavian 'high beta' peers NOK and SEK.

NZD's outperformance has no clear triggers; instead, stable expectations for interest rates to stay elevated in New Zealand for a protracted period, while other countries are expected to cut rates sooner, appears to be the fundamental driver.

This allows investors to buy NZ-based financial assets due to their superior interest rates, in what is known as the 'carry trade'. Analysts agree the carry trade remains the most important driver in global FX at this time, and the RBNZ's base rate of 5.50% makes the NZD the obvious winner.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

But, the gains come amidst clear signs that the New Zealand economy is struggling and raises questions about how long the Reserve Bank of New Zealand can hold the overnight rate at such restrictive levels.

Sharon Zollner, Chief Economist at ANZ, says the country faces a "winter of discontent".

In a note giving a snapshot of the state of New Zealand's economy, Zollner says business sentiment and reported activity has generally weakened in the past month.

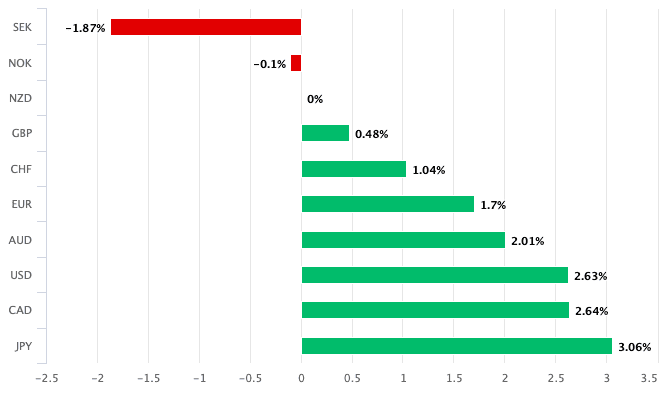

Above: NZD performance during the past month. Track NZD with your own custom rate alerts. Set Up Here

"Hospitality is increasingly feeling the chill of lower discretionary spending, and the retail sector also remains under immense pressure," she says. "Manufacturing is a mixed bag."

ANZ's economists say anecdotal reports from the housing market are mostly weak "but with a few anecdotes of green shoots here and there".

Nevertheless, the construction pipeline is emptying out rapidly.

"Firms are finding it much easier to find staff (as long as housing is available in their region) but more firms are letting staff go or leaving vacancies empty, rather than hiring," says Zollner.

Such findings are evidence that the RBNZ's restrictive interest rate stance is creating the economic slack that is consistent with lower inflation. It might also warrant interest rate cuts.

"Investment plans are often gathering dust awaiting either a more certain economic environment or lower interest rates.

Business failures are rising amongst firms that have been struggling for some time but are finally hitting the wall. However, there are still numerous customers with robust balance sheets who are seeking opportunities," says Zollner.

New Zealand GDP fell 0.1% in the fourth quarter of 2023, with GDP per capita falling 0.7%.