New Zealand Dollar "Boosted By Strong Migration Data"

- Written by: Gary Howes

Image © Adobe Stock

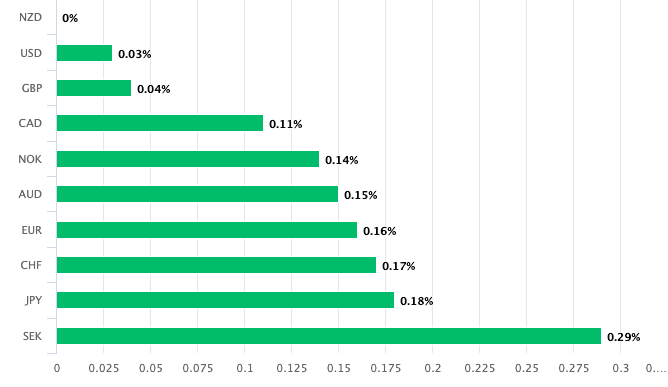

The New Zealand Dollar is the best-performing G10 currency on the day, with one analyst saying the outperformance is being driven by the country's latest immigration figures.

New Zealand reported an annual net migration gain of 133,800 to January after 257,200 migrant arrivals and 123,300 migrant departures. This is "the highest on record for an annual period," says Statistics New Zealand.

"NZD... was boosted by strong migration data," says David Forrester, Senior FX Strategist at Crédit Agricole in a daily currency briefing.

The Pound to New Zealand Dollar was quoted lower at 2.0775, the Euro to New Zealand Dollar was down 0.20% at 1.7744 and the New Zealand to U.S. Dollar exchange rate was higher at 0.6159.

Above: The New Zealand Dollar is the top-performing G10 currency on March 14.

New Zealand's elevated immigration figures point to the importation of additional demand into the economy, which can keep rates of inflation above the Reserve Bank of New Zealand's 2.0% target for an extended period.

New Zealand inflation has proven slow to fall and is why investors reckon the RBNZ will be one of the last major central banks to cut interest rates. In an FX world focussed on the timing and quantum of rate cuts, this can support the NZ Dollar.

"More people means more labour, easing wages. More people also means more demand, fuelling prices," says Jarrod Keer, Chief Economist at Kiwibank, pointing to the double-edged implications for New Zealand's inflation outlook posed by strong immigration.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

New Zealand recorded a record 130k net gain of permanent and long-term migration in 2023. Today, Statistics New Zealand revised the net inflow up by more than 13K people over the last year, setting a new peak of 141,400 last November.

"Most of that revision occurred in November and December, with further upward revisions for February and March last year – presumably international students who have now been correctly identified as long-term stayers," says Michael Gordon, Senior Economist at Westpac NZ.

Gordon notes the pace of net inflows does appear to have slowed from last year’s peak, though it remains high compared to history.

He adds that there is a great deal of uncertainty surrounding how the accumulated inflow of migrants will affect the economy. "The effects can be mixed – alleviating supply-side constraints in some areas, while adding to pressures in other areas such as the demands on the housing stock".

Meanwhile, the RBNZ's Chief Economist, Paul Conway, told a Kiwibank event that the RBNZ’s job in its fight against inflation is not over. He said although inflation is falling, it is still high.