New Zealand Dollar: RBNZ to Hike Twice More Says TD Securities

- Written by: Gary Howes

Above: File image of RBNZ Governor Adrian Orr at a press conference. Image courtesy of RBNZ.

TD Securities is the latest bank to say the Reserve Bank of New Zealand (RBNZ) will raise interest rates again, which can further underpin recent New Zealand Dollar resilience.

In a research note that conveys a shift in its RBNZ and RBA policy calls, TD Securities says "we now forecast hikes at next week's meeting and in May".

This makes TD Securities the second major bank to warn the next move at the central bank would be a hike, following ANZ's warning issued following the release of strong fourth-quarter employment figures.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

It also makes for a remarkable shift in assumptions regarding New Zealand's interest rate outlook, given it was only a few months ago that the consensus expected the RBNZ to have delivered a first rate cut by mid-year.

But "we already had doubts on the RBNZ beginning its easing cycle from Aug'24," says Prashant Newnaha, Senior Asia-Pacific Rates Strategist at TD Securities. "However, throwing a real spanner in the works was yesterday's Q1 Household Inflation expectations release."

"Historically, the market does not focus on this release, but the outcomes were too difficult to ignore this time round," he adds.

He cites the following findings in the RBNZ's report as signalling more rate hikes will be needed to put a lid on domestic inflationary pressures:

One-year inflation expectations were stuck at 5% for 3 straight quarters now

Two-year expectations shifted higher to 3.2% from 3% in Q4'23 and

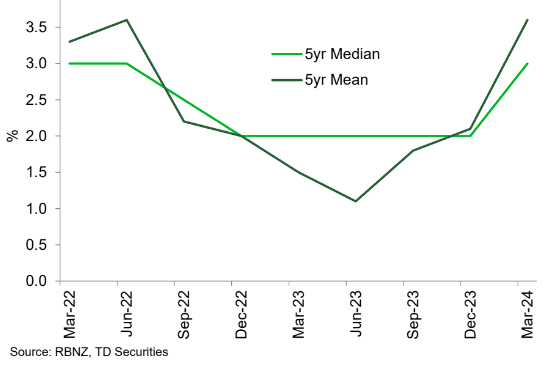

Five-year inflation expectations jumped 1% point from 2% in Q4'23 to 3%.

Above: 5-year mean and median household inflation expectations are at 3% or higher now: TD Securities.

TD Securities says these findings cannot be ignored as the RBNZ itself sees them as highly credible:

"Using univariate ARMA(p,q) models and single equation Phillips curve models, we show that 1-year RBNZ survey household inflation expectations add the most value to forecasting headline inflation."

The RBNZ will, therefore, be concerned by these latest inflation expectations results.

"The big jump in 5yr inflation expectations will certainly raise eyebrows at the RBNZ. It raised ours. If the Bank's inflation target is credible, then 5yr household inflation expectations should be anchored," explains Newnaha. "They should not jump up sharply."

TD Securities says the trend in expectations is clearly at or above the top end of the Bank's 1-3% inflation band.

"We now expect the Bank to hike 25bps at next week's meeting. And given that 1yr inflation expectations remain stuck at 5% and 5yr inflation expectations jumped, there is no reason for the RBNZ to hike just once, but signal it intends to deliver a follow-up hike," says Newhana.

This would leave the RBNZ's OCR at 6.0%, making it easily the highest central bank interest rate in the G10.

For the New Zealand Dollar, this implies significant support via the interest rate carry channel, whereby capital is assumed to flow to areas where interest rates offer better returns.

But, were RBNZ rate hikes to worsen New Zealand's economic outlook (the country has already fallen into technical recession), a clear-cut positive for NZD from higher interest rates cannot be guaranteed.

Instead, the prospect of stagflation (low growth, high inflation), could keep a lid on the currency's appreciation potential.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes