GBP/NZD Week Ahead Forecast: Better Supported

- Written by: Gary Howes

- GBPNZD looks comfortably supported

- Upside can extend short-term

- Watch UK jobs and wage data for disappointment

- NZ elections, quarterly inflation data key NZD risks

Image © Adobe Stock

The Pound is looking better supported against the New Zealand Dollar but whether an extension of the recent rebound can extend will depend on the tone of this week's important data events in both the UK and New Zealand.

Two weeks ago we wrote in our regular five-day forecast that the pair needed to snap a running streak and stage a recovery rebound to correct heavily oversold conditions that had built up on the charts.

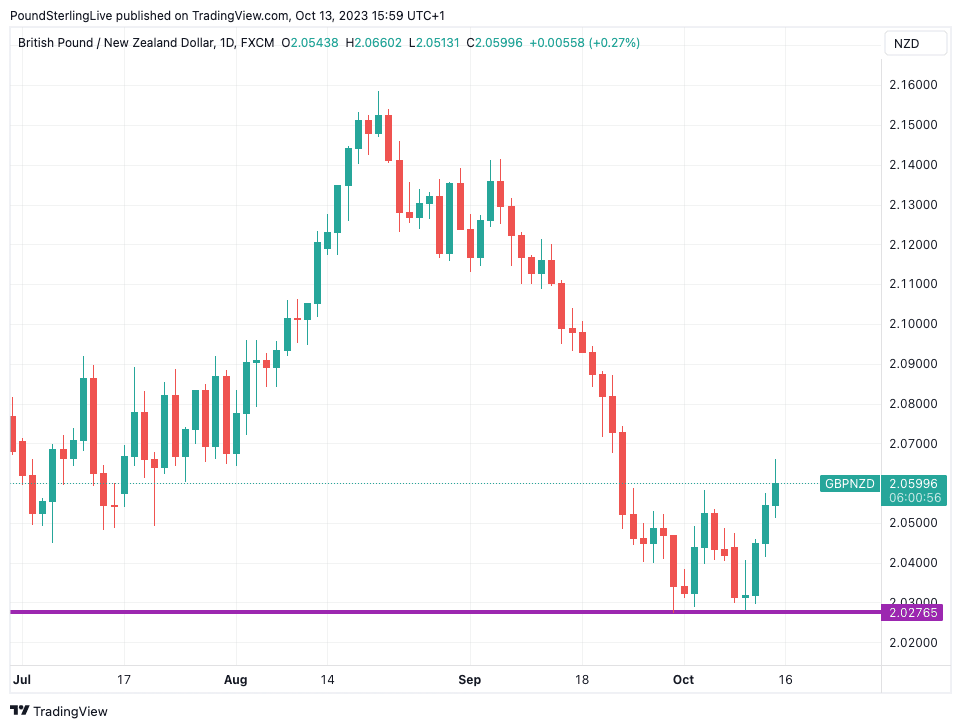

This correction has played out in style and the result is a GBPNZD exchange rate that looks increasingly comfortable above the support zone located at ~2.0270:

Above: GBPNZD at daily intervals showing the support line that can underscore the exchange rate in the near-term. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

The coming days could see events in both New Zealand and the UK provide some interest for the exchange rate, with the market's reaction to the weekend's NZ General Election providing initial interest.

The main takeaway is that any initial reactions should fade given the major parties' relative alignment on fiscal issues.

"We don’t think that the election outcome will have significant short-term macro implications as the bottom line fiscal strategies of the major parties on the centre-left and centre-right have a similar focus on returning the operating balance to surplus over the next three years," says Darren Gibbs, Senior Economist at Westpac.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The New Zealand Dollar can look forward to a busy week of data, with the highlight of the week coming early on Monday with the inflation release.

CPI inflation for the third quarter is released at 22:45 BST and forms the highlight of the week for the NZ Dollar from a data perspective.

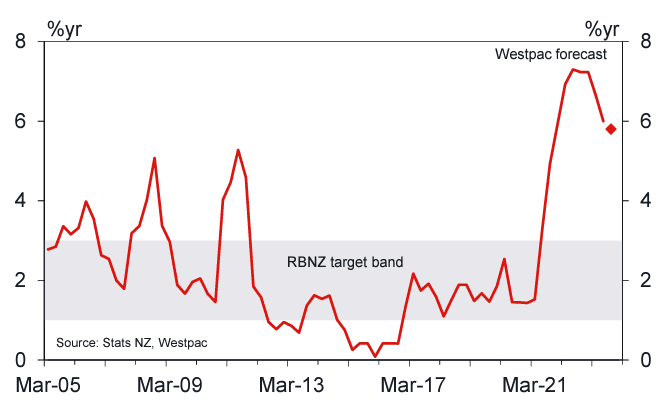

"We anticipate that the report will highlight that the inflation problem has by no means been solved, and that there are still real question marks around whether an OCR of 5.50% is sufficient to get inflation sustainably back to target in an acceptable time frame," says a preview note from ANZ Bank.

ANZ looks for another rate hike from the RBNZ, whereas the market does not. The NZ Dollar could gain if the inflation numbers steer the market into coming on board with ANZ's view.

The above chart shows New Zealand inflation and the forecast from Westpac Bank.

Fonterra's latest dairy auction results will be made known at 16:00 BST on Tuesday, where markets will get a sense of how New Zealand's most valuable export commodity is faring.

A decline in demand for milk products from China has been the theme of 2023 and economists say this has weighed on New Zealand's foreign exchange earnings potential, with downside implications for the currency.

A strong reading would, however, signal that a recent stabilisation and improvement is gaining some traction and could offer NZD some support. Dairy prices are forecast to lift another 4% as expectations of lower milk production this season will spur buyer activity.

New Zealand's trade dynamics are in focus Thursday at 22:45 with the release of the trade balance for September. The same themes as discussed with regard to the milk market will be at play, although these official figures are more backwards-looking than the Fonterra auction.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

Imports (~$6.8b) are expected to exceed exports (~$5.1b) as export prices remain soft, expanding the current account deficit, which is a long-term headwind to the NZ Dollar.

China has often proven the deciding factor for direction and volatility in the Australian and New Zealand Dollar in 2023 as markets attach great weight to the importance of the world's number two economy for the two antipodean economies.

"But both AUD/USD and NZD/USD suffer from the China syndrome. Investors use the exchange rates to express weak CNY views," says a weekly FX note from Crédit Agricole. "Our China strategist expects the CNY to strengthen into year-end, however, which will provide the Antipodean currencies with support."

Australia relies heavily on China as an export market for raw materials used in the industrial sector, while New Zealand relies on Chinese demand for its agriculture-orientated export economy.

Therefore, the AUD and NZD could react to Chinese GDP figures for the third quarter when released at 03:00 BST on Wednesday. The market anticipates the Chinese economy to have grown by 4.4% y/y in the third quarter, down from 6.3%, with the m/m reading expected at 1.0%, up from 0.8%.

Image © Adobe Images

China's lacklustre post-Covid performance has been a deciding factor in the New Zealand and Australian Dollar declines through much of 2023 and any signals of a pickup in activity could offer the two currencies a boost.

Chinese industrial production is also due Wednesday, with a headline of 4.3% y/y expected. Retail sales are meanwhile anticipated to have grown 4.5% y/y in September.

Big Week for the Pound

The coming week is busy for UK data releases and idiosyncratic volatility for Pound exchange rates can therefore be expected.

"The release of UK labour market, inflation and retail sales data could attract considerable attention. Given the reassessment of the BoE policy outlook by the markets in recent weeks and the aggressive unwinding of GBP-longs, the GBP could benefit from any positive data surprises," says a weekly FX analysis note from Crédit Agricole.

Tuesday sees the release of UK labour market statistics and the market will react to earnings and changes in employment levels as these offer a signpost as to where UK inflation trends could be headed over the coming months.

Average Weekly Earnings - excluding bonuses - are expected to have risen 7.8% annualised, unchanged on a month prior.

But economists at Pantheon Macroeconomics look for a fall to 5.0% annualised, representing a sizeable undershoot that would lower the odds of the Bank of England raising interest rates again, weighing on UK bond yields and the Pound.

Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics, says the labour market report will likely show that the unemployment rate has continued to exceed the Bank of England's expectations and wage growth has started to lose some pace.

Above image is courtesy of Pantheon Macroeconomics.

The market expects a 4.3% headline unemployment rate in August, unchanged from July, but above May's 4.0% and the Bank of England's Q3 forecast for 4.1%.

The Bank of England, therefore, shouldn’t hesitate to keep Bank Rate at 5.25% next month, according to Tombs.

Wednesday brings with it the all-important inflation numbers for September and the market looks for headline inflation to fall to 6.5% year-on-year from 6.7% previously, but the month-on-month reading is anticipated to have risen from 0.3% to 0.4%, largely as a result of rising fuel prices.

September's release proved a decisive moment for the Pound as the unexpectedly soft reading prompted a selloff that endured through the month. Another undershoot could trigger similar price action in October, putting the 2023 lows for GBPUSD back under pressure.

Friday will see the release of GsK consumer confidence figures and retail sales, while offering some interest these releases are unlikely to have a material impact on the market, particularly given the sizeable signals that will have been provided by the wage and inflation numbers just days earlier.

Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.