GBP/NZD Forecast: Uptrend Still Intact Despite Short-term Setback

- Written by: Gary Howes

- GBPNZD in short-term pullback from highs

- Signals confirm broader uptrend remains intact

- UK data set to dominate price action this week

Image © Adobe Stock

The British Pound has fallen 2.30% from its 2023 highs against the New Zealand Dollar thanks to a recent cooling in Bank of England interest rate hike expectations and improved sentiment towards China that has aided the Kiwi unit.

UK data will dominate this week with Tuesday's rise in unemployment and Wednesday's weaker-than-expected GDP report knocking a further quarter of a per cent off the value of the Pound.

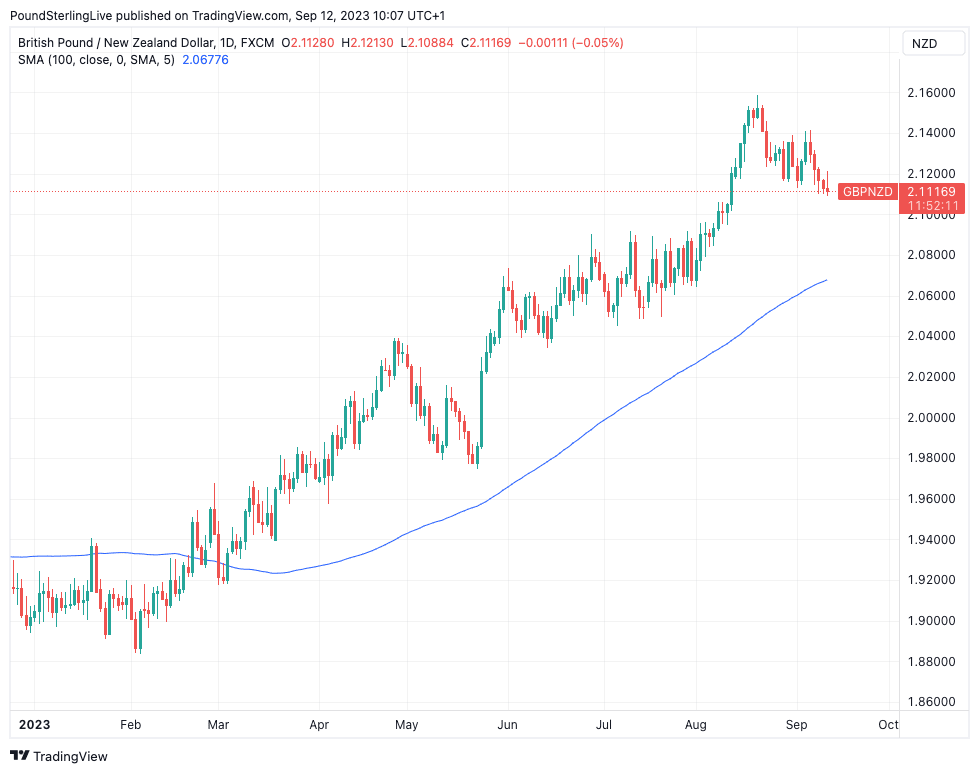

The Pound to New Zealand Dollar exchange rate (GBPNZD) peaked at 2.1585 on August 22 before retracing to current levels near 2.1110 and the immediate technical outlook is consistent with weakness likely to extend over the coming hours and days.

However, those watching this pair should be nimble given that the broader 2023 uptrend in GBPNZD remains intact and only a move below the 100-day moving average would see us call an end of the uptrend.

Above: GBPNZD is still cruising above a key momentum level that is a useful marker for gauging the prospects of future developments.

Watching the 100 DMA offers a useful technical gauge of multi-week directions and trends that allows us to ignore the constant background noise of the foreign exchange market that can often prove quite confusing.

For those interested in such developments, read our latest coverage of the Pound-Canadian Dollar exchange rate which is currently testing for a break of the 100 DMA, suggesting GBPCAD could be about to exit its 2023 uptrend.

The GBPNZD uptrend, however, still appears to be intact as Pound Sterling cools from a recent surge through early August and for now, it appears the market is consolidating this outperformance.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The move higher in GBPNZD also comes as the New Zealand Dollar is underpinned by a broader rebound in the commodity currency complex which has been boosted by improved sentiment on China.

The New Zealand Dollar joined commodities, stocks and risk-sensitive currencies by going higher at the start of a new week amidst a retreat in the Dollar and some positive data out of China.

Data showed China's inflation returned to positive territory in August, while the country's new bank loans jumped by more than expected last month, reflecting signs of economic stabilisation of the major commodity consumer.

Pound Sterling has meanwhile come under pressure of late as markets anticipate an end to the Bank of England's interest rate hiking cycle which has resulted in a lowering in UK bond yields.

The lower yields in turn lower the attractiveness of UK bonds - a significant investment asset - for international investors, lowering the demand for Sterling to finance such investments.

Data out Tuesday showed UK wages rose at record rates in July, which keeps alive the prospect of a Bank of England interest rate hike to 5.0% on September 21, giving the Pound a clear rates advantage over most rival developed market currencies.

However, the odds of a November hike to 5.75% remain relatively limited given the ONS jobs report for September showed an increase in unemployment in July, official confirmation of a deterioration in labour market dynamics seen in more timely surveys of the economy.

The trend is consistent with an easing in the labour market, something that has appeared to deny the Pound the outperformance of recent months and helps explain the recent turn lower in GBPNZD.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes