GBP/NZD Rate Forecast: Uptrend Looks to Break 2020's Ceiling

- Written by: Gary Howes

- GBPNZD remains in a strong uptrend

- Short- and medium-term favour gains

- Empty calendar leaves central bank divergence in focus

Image © Adobe Stock

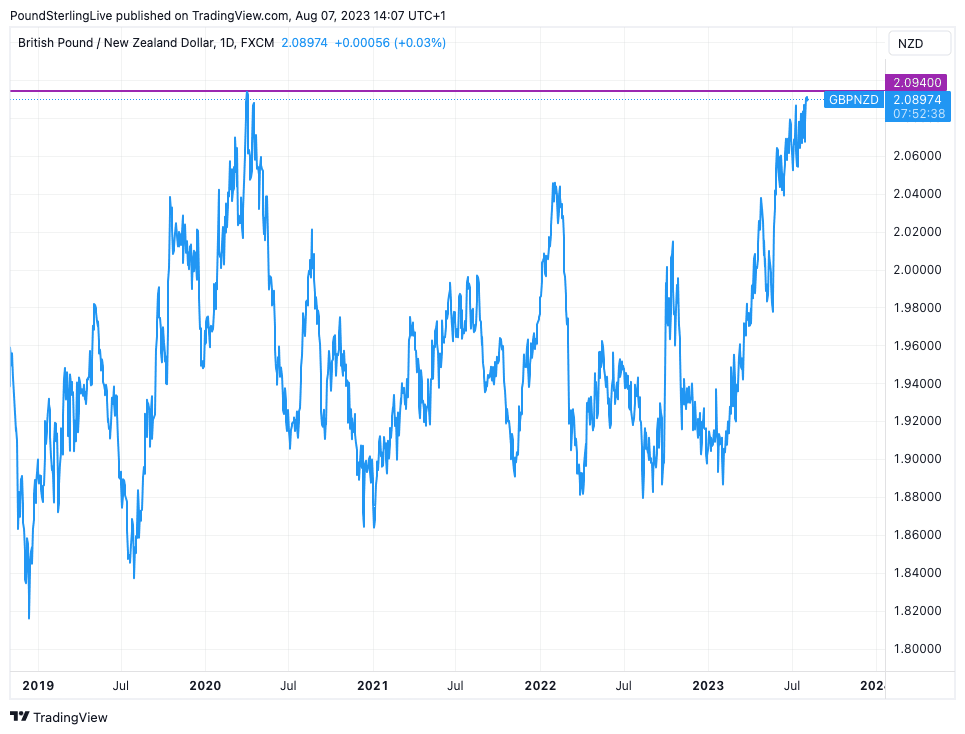

The British Pound remains in a strong uptrend against the New Zealand Dollar and charts show a key area of resistance that extends way back to 2020 is now in play, a level that should ultimately give way owing to interest rate differentials continuing to favour the Pound.

Last week brought new highs for the Pound to New Zealand Dollar exchange rate (GBPNZD) and the charts suggest the odds are in favour of new 2023 highs being printed over the coming days.

The Pound will find the Bank of England in its corner as market pricing shows investors expect at least one more rate hike in the current cycle that will put the base rates of the UK and New Zealand on par.

The initial market reaction to the Bank's August decision to hike 25 basis points was to sell the Pound as the downshift from June's 50bp hike suggested a dovish turn was underway at the Bank and that perhaps only one further hike remains in the cycle.

But, crucially, the Bank's guidance and forecasts signalled it was now pivoting to a 'higher for longer' stance, even if the peak in rates was now at hand.

This message effectively allows the Bank to push back against market expectations for rate cuts in 2023, a development that matters for foreign exchange markets that are likely to penalise the currencies of central banks that lead the cutting cycle.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The Bank of England's stance contrasts with that of the Reserve Bank of New Zealand (RBNZ) which has already ended its hiking cycle and is tipped to cut rates ahead of its peers.

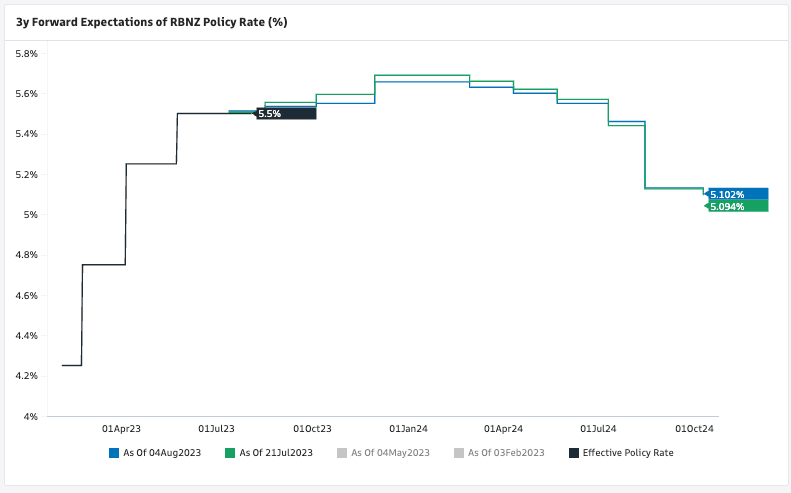

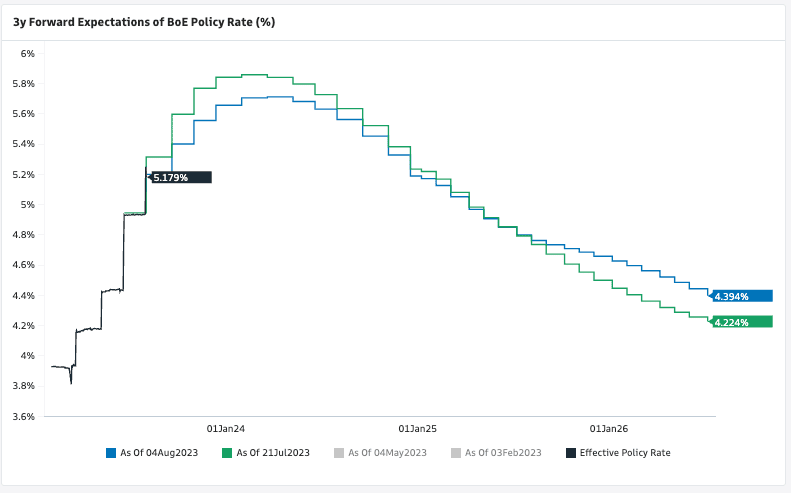

A look at market-implied expectations shows investors see more rate cuts from the RBNZ in 2024 than from the BoE:

Above: Top chart shows that by August 2024 two rate cuts of 25bp are expected to have been delivered by the RBNZ, with the Bank of England (lower chart) seeing less than one 25bp cut. Images courtesy of Goldman Sachs.

This state of affairs is related to the belief the UK's inflation levels are likely to remain 'sticky' and therefore UK rates will be required to stay higher for longer.

It suggests the all-important interest rate environment is set up in such a manner that is consistent with GBPNZD upside.

Both the UK and NZ have no major market-moving events on the calendar this week which could see the technical uptrend remaining underpinned by the relative rates story between the UK and New Zealand. "Local data this week is mostly second tier, so expect broad themes and the global vibe to drive the Kiwi ahead of next week’s RBNZ meeting, which is the next major local event," says David Croy, a strategist at ANZ.

Charts suggest immediate support emerges at 2.0940 for GBPNZD and any weakness over the coming hours might fade here.

But resistance at 2.0940 is capping gains for now, a figure that actually coincides with the 2020 highs:

Above: GBPNZD at daily intervals.

It was at this point that Sterling's uptrend against the Kiwi rolled over and gave way to a sharp fall over the coming months.

But that was during the time of the Covid outbreak and should the global backdrop remain unchallenged by major black-swan events further gains can be expected as interest rate differentials look set to favour the Pound.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes