GBP/NZD Week Ahead Forecast: Stalled Uptrend to Be Tested by NZ and UK Inflation Releases

- Written by: Gary Howes

- GBPNZD uptrend remains intact medium-term

- But consolidation seen likely near-term

- NZD and UK data due for release this week

Image © Adobe Stock

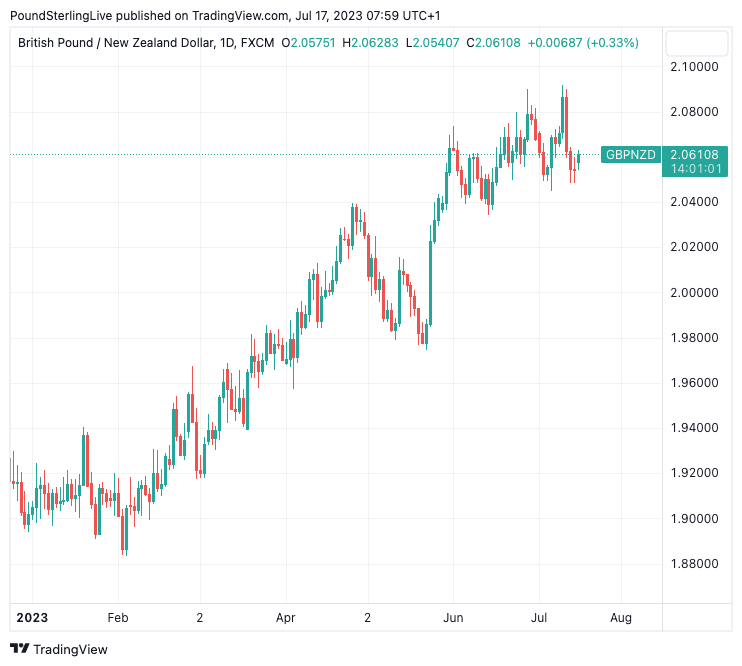

The Pound to New Zealand Dollar exchange rate (GBPNZD) has been subject to a strong technical uptrend in 2023 and there is little evidence to suggest now is the time to bet on a meaningful reversal.

However, this week sees key inflation releases in both New Zealand and the UK and surprises here could stir some volatility into the exchange rate.

The data comes in the context of a sharp decline in GBPNZD last week (-0.60%), which forms the third consecutive weekly decline for the pair and suggests upside momentum is yielding to a period of consolidation.

That said, it is worth noting that new year-to-date highs were struck both last week (9.0918) and the week prior (2.0902), confirming pockets of opportunity can emerge for NZD buyers.

The recent pullback indicates a zone of support lies towards 2.0450 (the July low) and any short-term weakness might therefore fade here. However, an undershoot in this week's UK inflation data could prompt this level to break, exposing the June low at 2.034.

Above: GBPNZD uptrend is still intact, however, near-term expectations for further consolidation are increasingly preferred.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

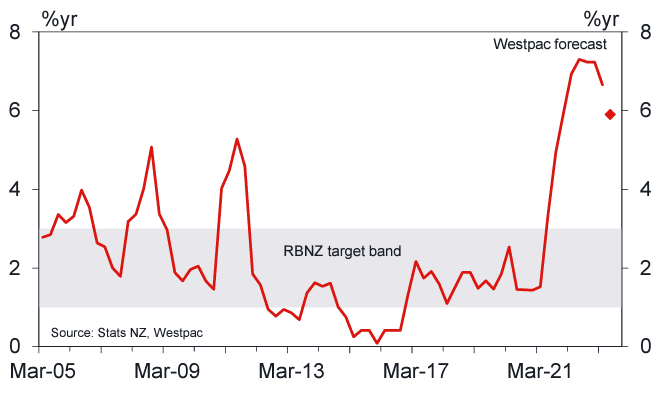

The New Zealand calendar is dominated by the release of inflation data for the second quarter on Tuesday (23:45 BST), where analysts are looking for a 5.9% year-on-year figure to be announced and a 0.9% quarter-on-quarter figure.

This would mark a slowdown in New Zealand's inflation rate from the first quarter's 6.7% and 1.2% readings, respectively, and underpin the Reserve Bank of New Zealand's decision to pause its rate hiking cycle.

Should inflation beat expectations the market might bet the RBNZ will have to reconsider its stance, potentially boosting the NZ Dollar.

But an undershoot would bring forward the prospect of interest rate cuts at the central bank, underscoring the NZ Dollar's 2023 run of depreciation against the Pound.

Above: NZ inflation and Westpac forecast. Image courtesy of Westpac.

The Pound's reaction to the Wednesday UK inflation release forms the key fundamental input into British Pound price action this week.

Analysts say an undershoot in inflation could result in broad-based Pound Sterling weakness as investors would be prompted to lower expectations for the scale of upcoming Bank of England rate hikes.

CPI is forecast to have risen 8.2% year-on-year in June, down from 8.7% previously, with core inflation expected to have fallen to 6.8% from 7.1%.

The core inflation release could arguably be the more important figure to watch given it is given greater consideration at the Bank of England.

However, there is also the possibility that falling inflation boosts UK real bond yields (nominal yields minus inflation), which some analysts say is a supportive development for the Pound.

Furthermore, an undershoot in inflation would boost the UK's economic prospects as the end of the 'cost of living crisis' comes into sight and businesses can anticipate a future of settled interest rates.

This narrative is given credibility by the Pound's lacklustre response to last month's above-consensus data release.

Therefore, the Pound's reaction to the inflation data release is difficult to predict, but this week's release will, at the very least, provide GBPNZD watchers with some heightened volatility.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes