GBP/NZD Rate Week Ahead Forecast: RBNZ is Front and Centre

- Written by: Gary Howes

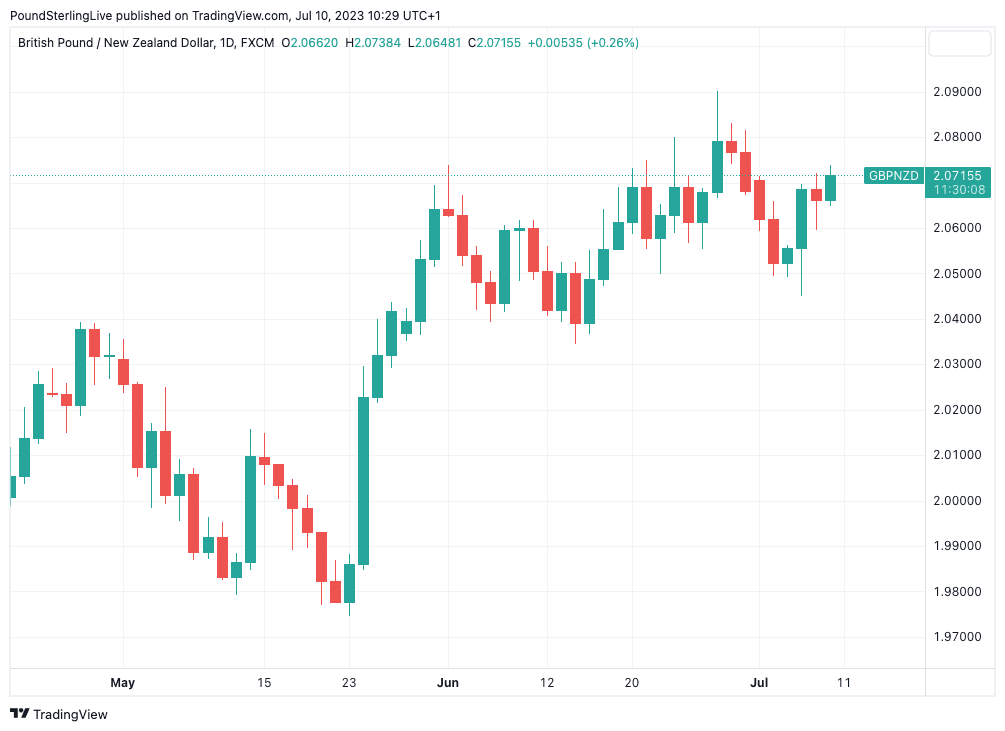

- GBPNZD in a technical uptrend

- 2023 highs can be retested and broken

- But UK jobs report on Tuesday is a risk

- Could allow GBPNZD short-term pullback to extend

- RBNZ on Wednesday forms NZ highlight

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate (GBPNZD) is subject to an intact technical uptrend that suggests the coming weeks would likely yield higher levels, but the Reserve Bank of New Zealand decision and UK jobs report on Tuesday form two key event risks in the short-term.

The strong technical uptrend in GBPNZD culminated in the pair peaking at 2.0900 on June 28, but the new highs gave way to a period of consolidation that takes the market to 2.0700 at the time of writing at the start of the new week.

A number of technical momentum studies remain in positive territory and any weakness is likely to be temporary as a result.

That said, the current phase of consolidation could extend and potentially result in a probe lower by GBPNZD should the RBNZ strike a more hawkish-than-expected tone on Wednesday.

The RBNZ will keep interest rates unchanged following the signal sent in May that it has likely completed the hiking cycle, meaning it will be the guidance coming from the central bank that will be of the most significance to currency markets.

Currency strategists at Commonwealth Bank of Australia say the New Zealand Dollar "can remain heavy this week as the RBNZ signals that they remain comfortable with the current stance of monetary policy."

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

Economists at Auckland Savings Bank (ASB) expect the RBNZ to leave interest rates on hold at 5.50% and deliver a similar message to last month.

"Now the RBNZ is in the position of feeling that the 5.5% OCR is high enough to get inflation back into the 1-3% target band in an acceptable timeframe," says Nick Tuffley, economist at ASB.

ASB notes there has been nothing in the data that has been released in the six weeks since the RBNZ's last decision to sway the central bank into a more 'hawkish' stance.

This would, therefore, likely leave the NZ Dollar with limited support, offering GBPNZD the possibility of retesting 2023 highs.

That said, recent business surveys from New Zealand reveal businesses continue to face high costs, which suggests inflationary pressures will be slow to come down.

Above: GBPNZD at daily intervals showing the strong uptrend has entered a consolidative phase.

The RBNZ would therefore likely be unwilling to strike a too-dovish tone and would be particularly keen to pushback against expectations rate cuts could come as soon as year-end.

Interestingly, the market has lifted expectations for the RBNZ to restart its rate hiking cycle of late, a development that has coincided with NZD strength in July.

Money market pricing shows just 3bp of hikes are priced for this week's meeting, but markets have now moved to price more than one more 25bp hike by early 2024.

"Both short- and long-term bond yields increased, as did expectations for RBNZ rate hikes. The NZ interest rate market moves also help to explain NZD outperformance against most of the crosses we monitor," says Kim Mundy, a strategist at ASB.

For the NZD, how the RBNZ deals with this pricing is key. Are they happy to maintain it as a ploy to ensure rate cut pricing does not come forward?

Or do they push back against these expectations to ensure domestic interest rate expectations do not rise much further, thereby enhancing the current economic slowdown?

"There is a risk of some pull-back in pricing if the RBNZ reiterates its belief that 5.5% will be the peak," says Mundy.

This would represent a NZD-negative outcome.

Ahead of the RBNZ the Pound is in focus as UK labour market data are due for release Tuesday.

The figures are likely to confirm the UK's labour market remains 'tight' as job creation continues amidst low unemployment rates, in turn ensuring wage growth remains well above the Bank of England's 2.0% inflation target.

Indeed, the data comes as markets are prepared for the Bank of England to raise interest rates a further 150 basis points in its fight against inflation, an expectation that has ensured the Pound remains well supported.

"The MPC will be under pressure to keep hiking until it sees clear evidence that wage growth is beginning to cool. If the MPC doesn't push back against these pressures forcefully enough, the risk they persist will increase," says Andrew Goodwin, Chief UK Economist at Oxford Economics.

The consensus expectation is for employment to have increased 158K in the three months to May, keeping the unemployment rate at 3.8%. The average earnings index (with bonuses) is expected to have risen 6.8% in May, up from 6.5% previously. Average earnings with bonuses included are expected to have risen 7.1% in May, down on 7.2% previously.

Should any of the figures beat expectations, UK bond yields will likely extend their relentless march higher, reflecting the market's expectation for further Bank of England rate hikes, which can support the Pound.

However, there is a risk the data undershoots given incoming labour market surveys reveal slack is finally starting to build.

According to the KPMG and the Recruitment and Employment Confederation (REC) UK Report on Jobs survey, the number of vacancies in June climbed at the slowest pace in 28 months, with a significant drop in permanent placements.

Staff availability rose for the fourth month in a row, with the supply of both temporary and full-time workers surging at the fastest pace recorded since December 2020.

Recruiters said companies became reluctant to take on new staff in June owing to the darkening UK economic outlook, particularly as the rising cost of living and competition for skilled workers have pushed up wages.

Upwards pay pressure slumped to its lowest level in 26 months, with rates of starting salary and temp wage inflation falling to more than a two-year low.

Any undershoot in UK jobs data on Tuesday could see a rapid revision lower of Bank of England rate hike expectations, which could weigh on the Pound against the New Zealand Dollar.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes