New Zealand Dollar Bats Away News of Recession

- Written by: Gary Howes

Image © Adobe Stock

Official data confirms the New Zealand economy entered recession at the turn of the year but the New Zealand Dollar remains well supported in the short term thanks to positive global investor sentiment.

Data showed a 0.1% contraction in the first quarter of 2023, which adds to the downwardly revised -0.7% reading for the final quarter of 2022.

This means the economy endured two consecutive quarterly declines, thus meeting the definition of a technical recession.

"Underlying momentum is softer and possibly Cyclone Gabrielle impacts were more negative in Q1 than our previous understanding," says Miles Workman, Senior Economist at ANZ.

From a currency market perspective, the GDP reading was in line with analyst expectations and therefore offered little by way of FX-moving surprise factors.

Therefore, the impact on the New Zealand Dollar is limited as this is backwards-looking data and incoming economic surveys confirm an economy that remains relatively robust.

"With the unemployment rate still near a record low, non-tradables inflation at a record high, and the current account deficit still well outside the bounds of ‘sustainable’, it’s hard to diagnose this ‘technical recession’ as anything but part of the necessary adjustment towards putting the economy back on a sustainable path," says Workman.

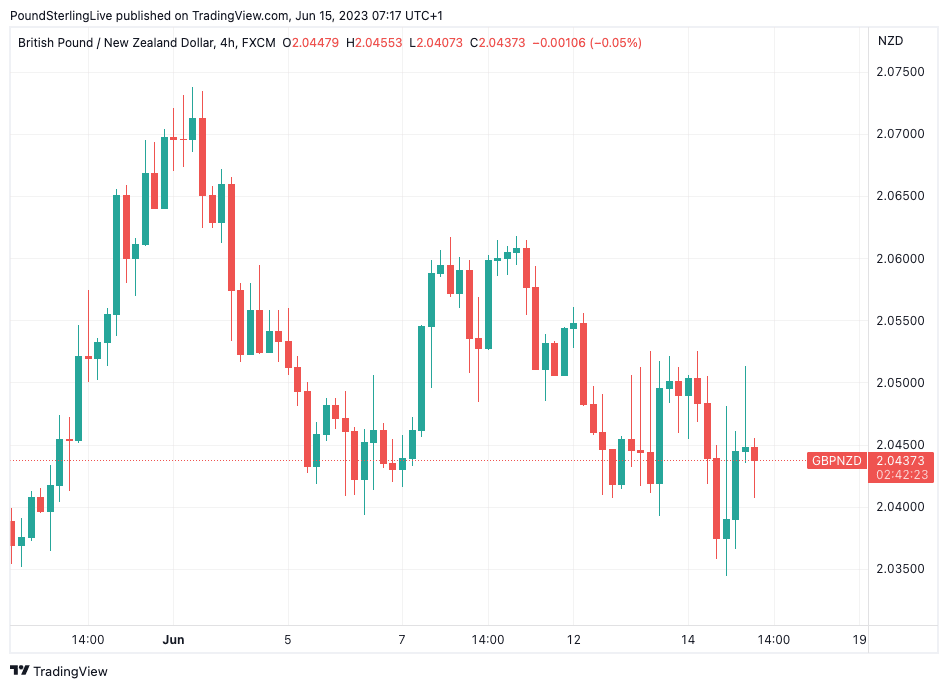

Above: GBPNZD has fallen in June as the Kiwi Dollar has been better bid this month.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

Also of particular relevance to the NZ Dollar is global investor sentiment is currently in a buoyant phase.

Global equity markets are in a bull run as investors bet the Federal Reserve is approaching the end of its rate hiking cycle, creating the background conditions traditionally supportive of the New Zealand Dollar.

Indeed, the Pound to New Zealand Dollar exchange rate has fallen one per cent in June as a run of five consecutive monthly gains is put on hold.

The New Zealand-U.S. Dollar exchange rate is meanwhile up nearly 3% in June.

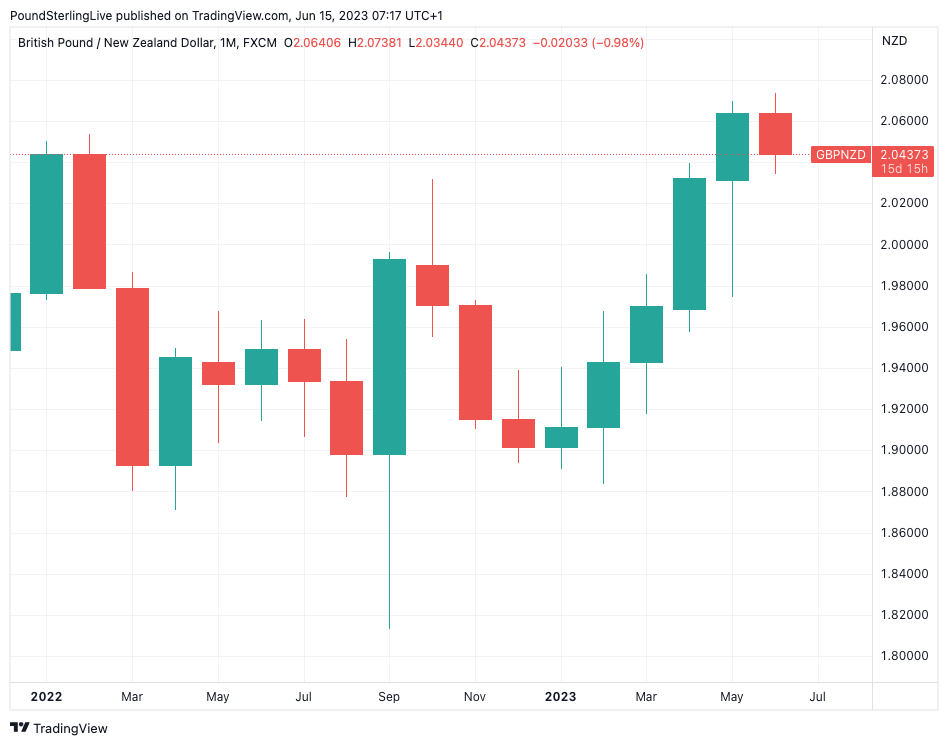

But the broader trend has been one of decline for the Kiwi in 2023 which has left it towards the bottom of the G10 pile for this year.

Above: GBPNZD medium-term view shows NZD has been depreciating for some months against the GBP.

Of note, the Reserve Bank of New Zealand has suggested it has ended its interest rate hiking cycle in a development that could leave the Kiwi lacking support via the interest rate channel. To be sure, New Zealand will command one of the highest base interest rates, but market bets for a cut to that rate could act as a drag on the currency.

Furthermore, China's economic rebound has proven sluggish, something that is particularly relevant to the two antipodean currencies that rely on China as their main export market.

Some economists say it might be only towards the end of the year that China's economy begins to pick up speed.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes