New Zealand Dollar Unravels post-RBNZ

- Written by: Gary Howes

Image © Adobe Stock

The New Zealand Dollar has unwound the gains following the Reserve Bank of New Zealand's surprise 50 basis point interest rate hike, with analysts saying the markets are concerned about the country's growth outlook.

The NZD spiked in response to the decision, as markets were prepared for a more conservative 25bp hike, but it has since retreated.

"The bounce has proven short-lived, perhaps as the relative yield support became overtaken by deteriorating global risk appetite," says Daragh Maher, Head of Research for the Americas at HSBC.

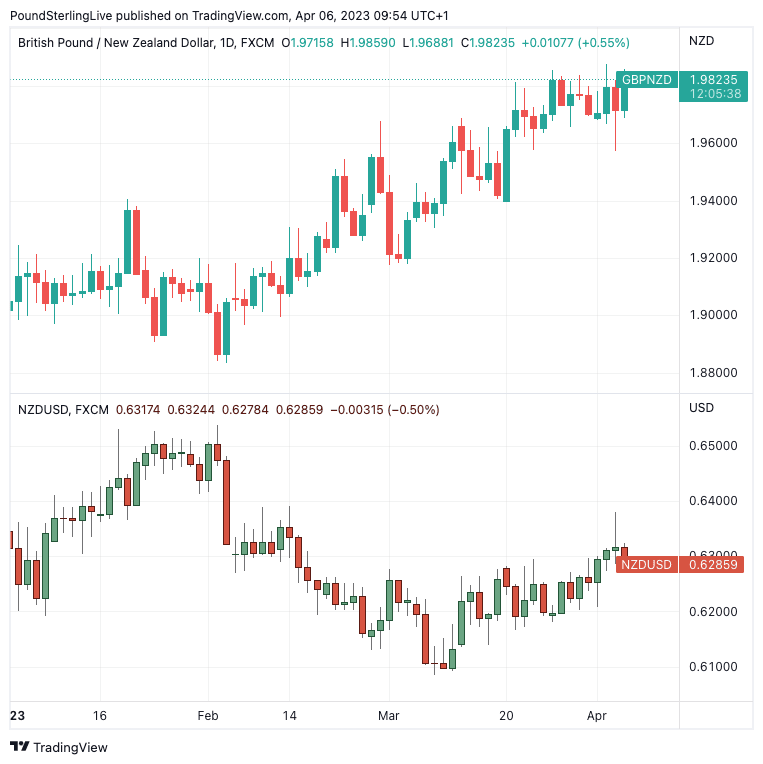

The Pound to New Zealand Dollar exchange rate went as low as 1.9590 in the wake of the decision before repricing back to 1.9827 at the time of writing.

GBP/NZD is therefore higher than where it was ahead of the RBNZ; the same can be said for a host of other NZD exchange rates.

"The price action mostly suggests that hawkish surprises are only welcome if they do not raise recession fears," says Maher.

The New Zealand Dollar to U.S. Dollar exchange rate rose to a high of 0.6380 before paring the advance to 0.6284 at the time of writing.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The rise in New Zealand interest rates will add further headwinds to economic growth over the coming weeks and months, which might not necessarily be a supportive outcome for the Kiwi Dollar.

The UK offers a recent example of how deteriorating growth sentiment can pip rising interest rate yields as a focus for investors.

The Pound plummeted in September and October 2022 despite surging UK bond yields as the market signalled it was not comfortable with the UK's fiscal outlook following the ill-received mini-budget of Liz Truss.

But the budget was overturned, yields came lower and UK economic growth has since beaten expectations, providing a more supportive cocktail for the Pound.

Above: GBP/NZD (top) and NZD/USD at daily intervals. (Consider setting a free FX rate alert here to better time your payment requirements.)

These dynamics could now be relevant to the New Zealand Dollar outlook.

"The NZD faces headwinds as the RBNZ continues to tighten conditions in the face of a weakening economy," says Maher.

New Zealand reported a -0.6% GDP reading for the final quarter of 2022 which is the largest negative GDP shock of the past decade.

Maher notes too that the country's current account deficit reached the widest level in history in the final quarter, "magnifying the risk of an underfunded deficit."

"The price action mostly suggests that hawkish surprises are only welcome if they do not raise recession fears," adds Maher.

However, the RBNZ might not be too concerned about the impact of rising rates on financial conditions in the country, saying the cost of lending had in fact fallen since February and therefore a strong move was required to keep conditions necessarily tight.

Specifically, the RBNZ said "wholesale interest rates have fallen significantly since the February statement, and this could put downward pressure on lending rates. As a result, a 50 basis point increase in the OCR was seen as helping to maintain the current lending rates faced by businesses and households."

The RBNZ's February projections showed economists at the central bank believed the OCR would need to go as high as 5.5%, and there was little in Wednesday's guidance to suggest this was still not the case.

Therefore a further 25bp of tightening looks to be on the cards, signalling a clear end-point to the hiking cycle is looming.

So while the surprise of a 50bp move offered the NZ Dollar some support, investors now have a clear view of the summit, potentially limiting the NZD's upside potential from here.

This adds another potential explanation as to why the currency has reversed from its initial highs.

"We think the key risk for NZD is whether the RBNZ continues to suggest a stance it could increase the rate from 5.5% in May," says analyst Naveen Nair at Citi, suggesting the RBNZ might have to concede it has reached a peak in the cycle ahead of May.

Such communications would potentially weigh on the NZ Dollar, in Citi's view.

"We think NZD/USD may struggle to move higher with resistance at 0.6390 (February 2023 highs), unless we see a strong print at the April 20 Q1 CPI (local) which supports the case for a higher terminal rate," says Nair.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes