New Zealand Dollar Can Rise on a 'Hawkish' RBNZ say Analysts, but Strength to be Fleeting says Major Investment Bank

- Written by: Gary Howes

- NZD in focus midweek when RBNZ expected to raise rates again

- Scope for rise in expectations for a further rate hike, could boost NZD

- But JP Morgan is bearish on NZD, says economic headwinds building

Image © Adobe Stock

The New Zealand Dollar is set to take the limelight midweek when the Reserve Bank of New Zealand (RBNZ) is expected to raise interest rates by a further 25 basis points as it continues its fight against elevated domestic inflation levels.

The hike is fully priced by markets and is therefore unlikely to shift the dial on the New Zealand Dollar's prospects, instead the currency market reaction will likely depend on expectations for future hikes.

"We expect the RBNZ to lift the cash rate by another 25bps to 5% on 5 April. That said, this has been more or less fully priced into expectations, so the decision itself is unlikely to cause too much friction on the day," says Thomas Flury, Strategist, UBS Switzerland AG.

Money markets show investors are not yet fully priced for an additional 25 basis hike beyond April, meaning there is scope for rate expectations to rise again following the meeting.

This would typically be associated with a strengthening in the New Zealand Dollar.

"A hawkish RBNZ can support NZD," says Kristina Clifton, Senior Economist and Senior Currency Strategist at Commonwealth Bank of Australia.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The RBNZ meeting comes at a time of mixed performance for the New Zealand Dollar which has experienced falls against the Pound, Yen, Euro and Franc over the past month while it has risen against the Australian and U.S. Dollars.

The Pound to New Zealand Dollar exchange rate (GBP/NZD) is now 3.60% higher for 2023 at 1.9167 with the pair trending higher since early February. The pair rose 1.65% in February and a further 1.90% in March.

"This week is all about the RBNZ for the Kiwi," says David Croy, a strategist at ANZ. "While they’re likely to acknowledge risks around financial instability, NZ is remote from all that, and we think the inflation risks relating to the cyclone recovery in an already capacity-constrained economy are a bigger story. That could help the NZD this week."

The RBNZ projected the cash rate to reach a peak of 5.5% this year in its February forecasts but global developments centred around the banking sector have meant interest rate expectations across the world have come down during March, including in New Zealand.

"We expect the RBNZ will acknowledge recent downside developments, including the volatility in the global banking system. Even so, they will continue to emphasise the strength in inflation pressures and leave the door open for further hikes," says Satish Ranchhod, Senior Economist at Westpac.

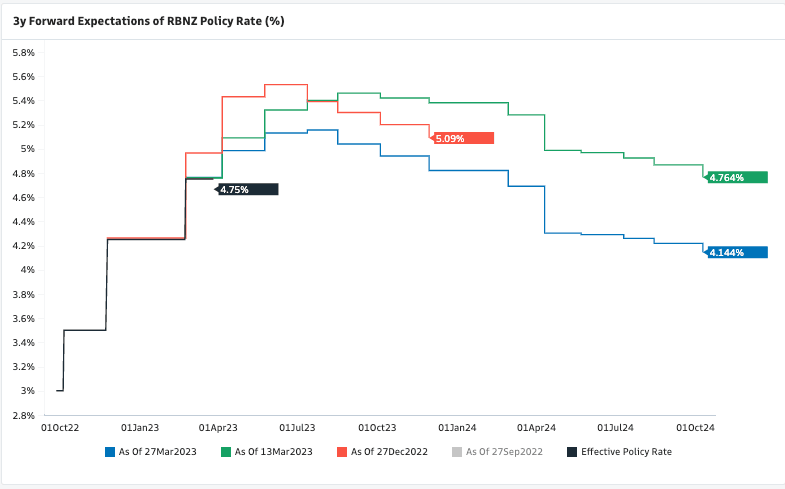

Above: The market has pared back expectations for the peak in the RBNZ's OCR, while pricing in more cuts further out. Image courtesy of Goldman Sachs.

Westpac expects both economic activity and the labour market will weaken materially over the year ahead, and those conditions will see inflation easing back.

"But until the RBNZ gets clear confirmation that the economy is slowing, it will continue to emphasise the potential for further rate hikes," says Ranchod.

Therefore it might be too soon to expect the RBNZ to condone the market's expectations for rate cuts later in the year, potentially supporting the Kiwi.

"We believe that the RBNZ will give an explicit nod to the fact that the tightening cycle is probably not complete," says Stephen Toplis, Head of Research at BNZ.

Analysis from Kiwi lender BNZ argues the RBNZ sent a subtle 'hawkish' signal last week when a key figure warned there was more work to be done on interest rates in order to bring inflation back towards the 2.0% target.

RBNZ’s Chief Economist, Paul Conway, last week "sent a clear message that the Reserve Bank still thinks it has work to do, and that recent banking sector ructions will not dissuade it from its intended course of action," says Toplis.

Conway delivered a speech entitled The Path Back to Low Inflation in New Zealand, argued recent global and domestic events should not preclude further rate hikes at the central bank.

"This is important because markets have markedly lowered their expectations of where the New Zealand cash rate might peak," says Toplis.

However, JP Morgan's economists say the RBNZ is set to deliver a final 25bp hike at the April meeting as the Bank seeks to avoid overtightening.

"We retain our short-NZD bias on relatively weak domestic fundamentals that should prompt the RBNZ to imminently pause, and perhaps eventually start cutting rates faster than many of its G10 peers," says James Nelligan, a strategist at JP Morgan.

JP Morgan sees underlying risks in the housing sector as more residents roll off fixed-rate mortgages in the coming months, exposing them to the new higher interest rate regime for the first time.

"Following a sizable miss in the 4Q GDP print last week and further deterioration in the trade balance this week, NZD now screens as one of the weakest global currencies across our systematic growth and BoP models," says Nelligan.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes