New Zealand Dollar Recovery and BoE Bets Risk Driving GBP/NZD Below 1.90

- Written by: James Skinner

- GBP/NZD under pressure from resurgent Kiwi

- Tests key support on charts into BoE decision

- With risk of losses to 1.90 or below short-term

Pine timber being exported from Wellington, New Zealand. Photo by James Anderson, World Resources Institute.

The Pound to New Zealand Dollar exchange rate appeared poised to break below a notable technical support on the charts early in the new week but would risk falling to 1.90 or below if the Kiwi's recovery continues and market bets on the Bank of England (BoE) outlook burden Sterling this Thursday.

New Zealand's Dollar was a major beneficiary on Tuesday when a second retreat and surprise on the downside of expectations for U.S. inflation appeared to enhance market confidence that at least an intermittent end of the Federal Reserve (Fed) interest rate cycle is in sight.

Tuesday's data makes it more likely that the Federal Funds interest rate will peak around 4.75% and at a level that is below the anticipated endpoint for the Reserve Bank of New Zealand (RBNZ) cash rate, which November's Monetary Policy Statement suggested would rise to 5.5% by the mid stage of next year.

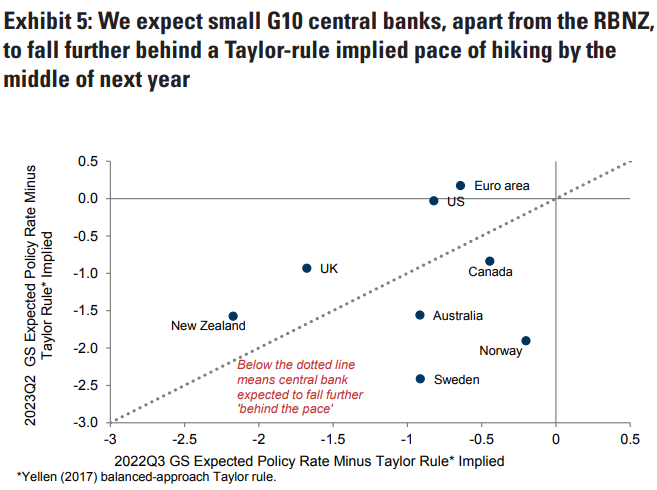

"The RBNZ is marching to a different tune as the only G10 central bank to actually be stepping up the pace of hikes," writes Michael Cahill, a G10 FX strategist at Goldman Sachs, in a research briefing on Friday.

Source: Goldman Sachs Global Investment Research. Click image for closer inspection.

Source: Goldman Sachs Global Investment Research. Click image for closer inspection.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

"In fact, we expect that the RBNZ will be the only small G10 central bank to speed up relative to what a Taylor rule would imply by the middle of next year (Exhibit 5), and the outperformance of the Kiwi Dollar reflects this," Cahill adds.

Cahill and colleagues's Taylor Rule analysis encapsulated above cites relative differences in unemployment, inflation and interest rates to suggest the RBNZ is likely to be among the most effective of G10 central banks in driving inflation back to within the one-to-three percent target band.

This is in part because the RBNZ now stands out as the most 'hawkish' G10 central bank with an interest rate policy stance that is supportive of the New Zealand Dollar and one of many headwinds currently weighing on GBP/NZD.

However, it's the UK inflation rate for November and monetary policy decision from the Bank of England that will matter most for Sterling from midweek and the risk is that these also weigh further on GBP/NZD.

Above: Pound to New Zealand Dollar rate shown at daily intervals with Fibonacci retracements of September recovery indicating possible areas of technical support for Sterling. Click image for closer inspection. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.

Above: Pound to New Zealand Dollar rate shown at daily intervals with Fibonacci retracements of September recovery indicating possible areas of technical support for Sterling. Click image for closer inspection. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.

Economists and financial markets expect a ninth increase in interest rates from the BoE on Thursday to take Bank Rate up to 3.5% while also penciling in further increases that would lift the benchmark to 4.5% or more as the U.S. interest rate cycle draws to a close during the early months of the new year.

But the BoE has sought to discourage these expectations in recent months and the risk is of it doing the same again on Thursday with possibly adverse implications for Sterling and GBP/NZD.

"The impact of Thursday’s meeting will largely hinge on the forward guidance provided. While much of the signal will rest on the voting split and what that means for another 50bp hike in February, the current market base case, the MPC minutes will also be examined for signs that officials are still uncomfortable," says Simon Harvey, head of FX analysis at Monex Europe.

"The inclusion of November’s statement that “further increases in Bank Rate may be required for a sustainable return of inflation to target, albeit to a peak lower than priced into financial markets” will be the most tell-tale sign," he adds.

Above: Pound to New Zealand Dollar rate shown at weekly intervals. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: Pound to New Zealand Dollar rate shown at weekly intervals. To optimise the timing of international payments you could consider setting a free FX rate alert here.