New Zealand Dollar Steadying Above Major Support On Charts

- Written by: James Skinner

"ASB Economics changed its OCR call on the back of the stronger numbers. A 25bp hike in February 2023 has been added to the forecast profile, on top of the 100bps of OCR hikes expected over the rest of 2022," - ASB Bank.

Pine timber being exported from Wellington, New Zealand. Photo by James Anderson, World Resources Institute.

The New Zealand Dollar edged higher against most other major currencies in the final session of the week, partially reversing otherwise steep declines after appearing to draw a bid from the market following contact with a major level of technical support on the charts.

New Zealand's Dollar defied a stronger greenback and falling Chinese Renminbi on Friday when NZD/USD appeared to stabilise around 0.5940 on the charts, which had the effect of curbing the week's rally in GBP/NZD too.

"FX sentiment remains USD/globally driven, and the Kiwi struggled to garner any support from GDP data yesterday. Surprising as that was, given the size of the miss, what that tells you is that the market will be sensitive to next week’s Fed “75 or 100bps” rate hike decision," says David Croy, a strategist at ANZ.

Croy suggested earlier on Friday that both 0.5940 and 0.5915 are likely areas around which the main Kiwi exchange rate NZD/USD could be likely to stabilise.

Above: NZD/USD shown at weekly intervals with Fibonacci retracements of 2020 recovery indicating medium and long-term levels of technical support.

Any continued stabilisation by the Kiwi around Friday's levels would also have further potential implications for the negatively-correlated Pound to New Zealand Dollar rate, which had risen from just beneath 1.90 on Monday to highs just above 1.93 during European trading on Friday.

"Looking at the sub-index results, the pick-up was influenced by New Orders (59.2) at its highest level since July 2021, along with Production (54.6) at its highest point for 2022. Overall, it was the first time all five sub-index values were in expansion since May," says Catherine Beard, a director at BusinessNZ.

Friday's price action came at the tailend of a week in which the New Zealand Dollar has fallen against all G10 counterparts except the Norwegian Krone, although it also followed a BusinessNZ Manufacturing PMI covering the month of August, which rose to its highest level for more than a year.

"Not content with bouncing back to near normality in July (53.5), the Performance of Manufacturing Index (PMI) nudged up to 54.9 in August. It was, strictly speaking, the best result since the hefty 62.5 of July 2021, just before Delta’s lockdowns spoiled things," says Craig Ebert, a senior economist at BNZ.

Above: GBP/USD shown at weekly intervals with Fibonacci retracements of 2018 recovery indicating possible medium and long-term levels of technical support. Selected moving-averages denoted areas of possible technical resistance.

The stronger manufacturing PMI followed barely a day after the release of second-quarter GDP data, which surprised strongly on the upside of financial market expectations.

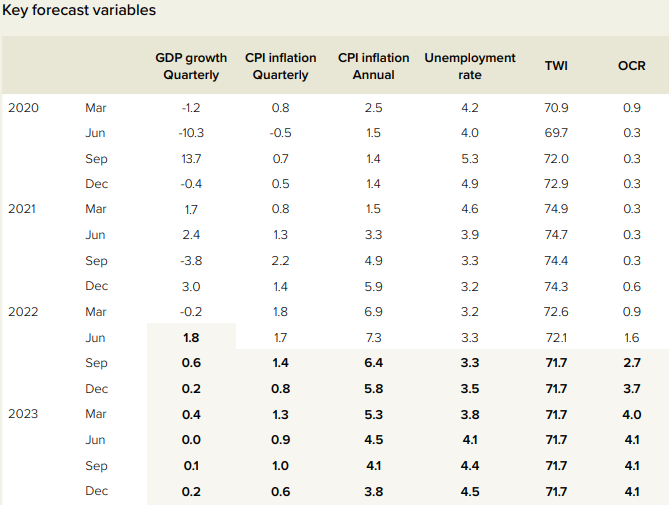

"This meant the economy easily avoided a technical recession over the first half of 2022 (recall the -0.2% GDP contraction in Q1), albeit 2023 is likely to be the real test," says Mike Jones, a senior economist at ASB Bank.

"ASB Economics changed its OCR call on the back of the stronger numbers. A 25bp hike in February 2023 has been added to the forecast profile, on top of the 100bps of OCR hikes expected over the rest of 2022," Jones and colleagues said on Friday.

New Zealand's economy grew at a quarter-on-quarter pace of 1.7% during the three months to the end of June, more than reversing the opening quarter's -0.2% reading, when the economist consensus had favoured only a once percent expansion.

This was the result of a strong performance from services industries offsetting declines from goods producing manufacturers, although the quarterly outcome was still not quite the 1.8% that was assumed within the August forecast variables of the Reserve Bank of New Zealand.

Source: Reserve Bank of New Zealand August Monetary Policy Statement.

Source: Reserve Bank of New Zealand August Monetary Policy Statement.