New Zealand Dollar Pumped and Dumped in Wake of RBNZ's Push to 3.0% OCR

- Written by: Gary Howes

Above: File image of RBNZ Governor Adrian Orr at a press conference. Image courtesy of RBNZ.

The Reserve Bank of New Zealand (RBNZ) raised interest rates again and signalled it would raise them to levels higher than they had previously been expecting, but the market's verdict of the August policy update and guidance resulted in a New Zealand Dollar sell-off.

On paper the RBNZ did everything it could have done to provide a result supportive of NZD bulls: it said the economy was in good shape, inflationary pressures were broad based and it would keep on hiking.

Indeed, the initial reaction by the market agreed: short-term New Zealand bond yields rose as the RBNZ indicated they will need to raise rates higher than they had previously expected, with two more 50 basis point hikes now likely over the remainder of 2022 and a potentially smaller hike in early 2023.

"The NZD reacted positively," says foreign exchange strategist David Croy and ANZ, "as one might expect given the renewed focus on short end rates in FX markets."

The Pound to New Zealand Dollar fell by two thirds of a percent in the 15 minutes following the decision, with the New Zealand Dollar also rising against the U.S. Dollar by three quarters of a percent.

But these were the highs for the Kiwi which subsequently retreated:

Above: GBP/NZD (top) and NZD/USD (bottom) at 15 minute intervals. Set your FX rate alert here.

The decline in the Kiwi dollar might suggest that everything the RBNZ did was fully anticipated by the market, allowing investors to rapidly switch their gaze away from domestic drivers to global events.

We note sentiment is soft in midweek trade with equity markets in the red with commodity prices softer.

The Australian Dollar is also retreating; in fact it is the biggest loser of the day, even underperforming the New Zealand Dollar.

This suggests an antipodean flavour to the underperformance.

"Global themes remain all-powerful, and if the Fed maintains its hawkish rhetoric, that could eclipse the RBNZ’s policy stance," says ANZ's Croy.

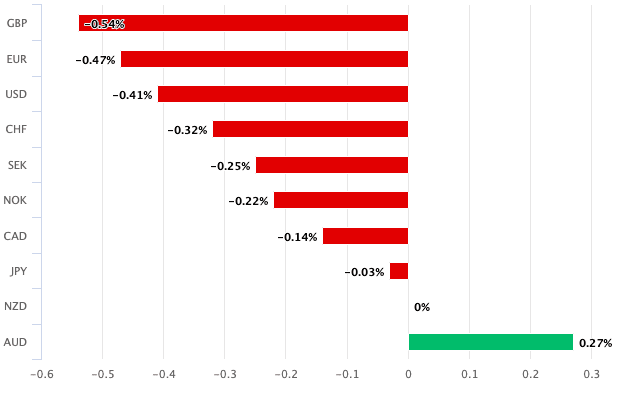

Above: NZD relative performance by mid-morning London time showed the market discounted the RBNZ's decision.

The GBP/NZD exchange rate is now quoted at 1.9173, taking bank account rates for NZD payments to around 1.8632 and quotes from independent money transfer specialists around 1.9111.

Going forward the NZD should nevertheless benefit from some degree of interest rate support as the RBNZ now comments one of the richest basic interest rates in the developed world.

The RBNZ said the economy remains supported by robust employment, continued fiscal support, an elevated terms of trade, and sound household balance sheets in aggregate.

But production is constrained by acute labour shortages, heightened by seasonal and COVID-19 related illnesses.

This leaves spending and investment outstripping supply capacity at a time of heightened wage pressures, which spells for elevated inflation.

"Committee members agreed that monetary conditions needed to continue to tighten until they are confident there is sufficient restraint on spending to bring inflation back within its 1-3 percent per annum target range," said the RBNZ in a statement.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The Bank's Monetary Policy Committee increased the Official Cash Rate (OCR) to 3 percent from 2.5 percent.

The MPC also discussed the possibility that neutral interest rate - the level at which rates are neither stimulatory or restrictive - may be higher.

This suggests the RBNZ sees itself as being able to target a higher interest rate.

Ahead of the meeting, HSBC economists said a rise to 3.0% means New Zealand policy rate will be above the RBNZ's estimate of 'neutral', as such they said it may be time for guidance to turn less hawkish as the economy starts to feel the effects of earlier tightening.

"The risks appear skewed to the downside in terms of forward guidance relative to what the market has priced in," said HSBC FX strategist Dominic Bunning in a preview.

But, in the event, the RBNZ raised its estimate of neutral, which is therefore a supportive development from a New Zealand Dollar perspective.

The MPC discussed whether more rapid increases, greater than 50bp, could improve the credibility of the inflation target and reduce the risk of a significant increase in inflation expectations.

However, they agreed that maintaining the recent pace of tightening remains the best means by which to meet their Remit.

The RBNZ’s updated OCR forecast reaches a peak of 4.1% by mid-2023, versus the May MPS forecast of a peak of 3.95%. As before, cuts are pencilled in for 2024

"The 15bp upward revision to the OCR peak is the bare minimum the RBNZ could have chosen in light of the very large upward revision to their non-tradable and wage inflation forecasts, in our view," says Sharon Zollner, Chief Economist at ANZ.

Above: Forecasts for the RBNZ's OCR, image courtesy of ANZ.

This suggests two more 50bp hikes in 2022 and another smaller hike is possible in the new year, ahead of a pause.

Although the RBNZ decision is the week's most important domestic event for the New Zealand Dollar, going forward global sentiment will likely remain in the driver's seat.