Pound / New Zealand Dollar Recovery at Risk from RBNZ Policy Surprise

- Written by: James Skinner

- GBP/NZD could retest March low on RBNZ surprise

- RBNZ among most hawkish of major central banks

- Risk of outsized rate rise elevated with NZ inflation

- May fuel NZD/USD recovery & weigh on GBP/NZD

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate has capitalised on recent turbulence in global bond markets but would likely be at risk of unravelling back toward late March lows around 1.87 if the Reserve Bank of New Zealand (RBNZ) surprises an already hawkish market on Wednesday.

New Zealand’s Dollar had Sterling and many other major currencies under pressure on Tuesday as government bond markets stabilised around the world and as stock markets descended lower amid allegations of Russian chemical weapons usage in Ukraine.

This is after the Kiwi featured as the biggest faller within the G10 contingent of major currencies last week when a rout in the government bond market lifted U.S. bond yields sharply, disadvantaging many currencies relative to the U.S. Dollar as a result.

The resulting Kiwi declines lifted the Pound to New Zealand Dollar exchange rate from 15-month lows near 1.87 late last week to almost 1.91 ahead of this Wednesday’s RBNZ policy decision, which is a potential risk to the recent rebound in GBP/NZD.

“Our ASB colleagues expect the RBNZ will raise the cash rate by 25bp to 1.25%. We expect the RBNZ to maintain a clear tightening bias. The RBNZ’s decision between a 25bp and a 50bp hike will be a close call” says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

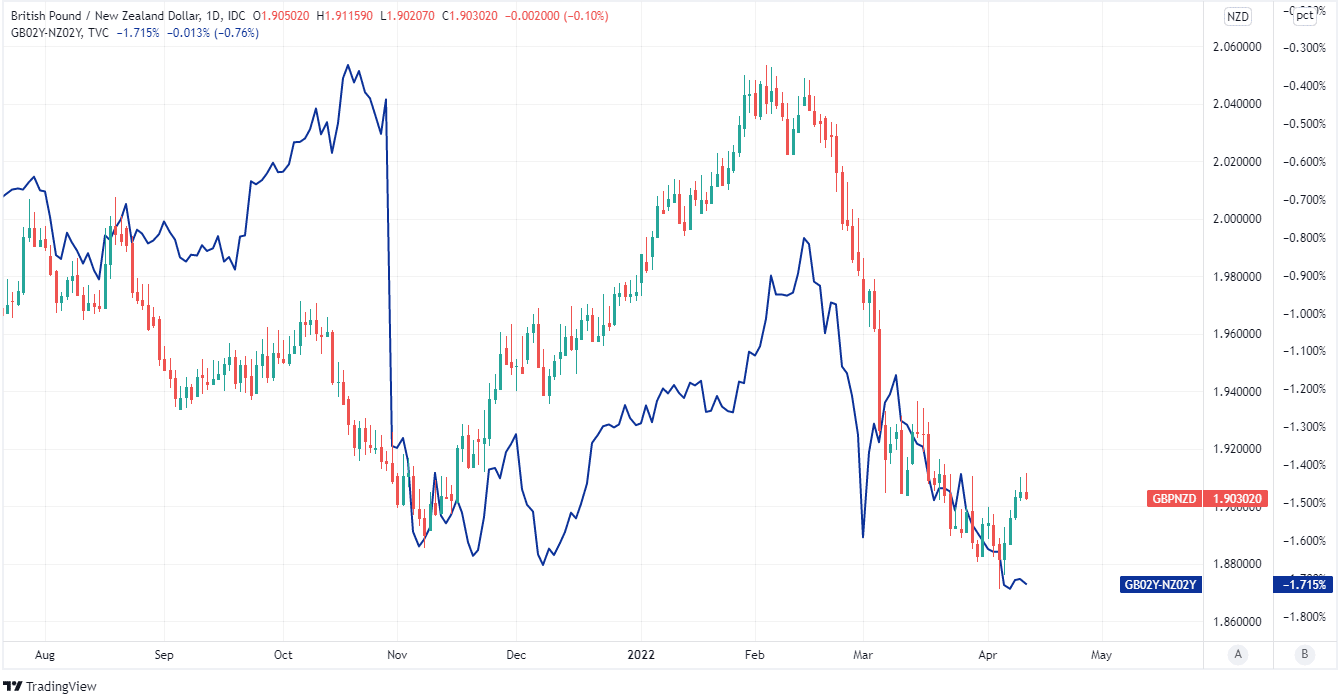

Above: Pound to New Zealand Dollar exchange rate shown at daily intervals with spread - or gap - between 02-year UK and NZ government bond yields. Click image for closer inspection.

Above: Pound to New Zealand Dollar exchange rate shown at daily intervals with spread - or gap - between 02-year UK and NZ government bond yields. Click image for closer inspection.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

Economists widely expect the RBNZ to lift its cash rate by 0.25% on Wednesday, taking the benchmark for borrowing costs up to 1.25%, but pricing in certain financial markets implies a chance of a larger move and the RBNZ itself also warned in February that larger steps are possible going forward.

“Expectations of the RBNZ meeting on 13 April are running high, with an 80% chance of a 50bp hike priced in. That is the highest probability ever priced in for a +50bp move,” says Imre Speizer, head of NZ strategy at Westpac.

“Such hawkish expectations reflect offshore, rather than local, developments. Indeed, the net sum of local economic developments since the February meeting probably warrants a slight shift lower in the OCR track (housing is not as strong as forecast, and the NZD is higher),” Speizer also said Monday.

The RBNZ lifted its cash rate by 0.25% for a third time since long before the coronavirus crisis last month as part of an effort to withdraw monetary stimulus from the economy in order to ensure inflation returns to the two percent target over the coming years.

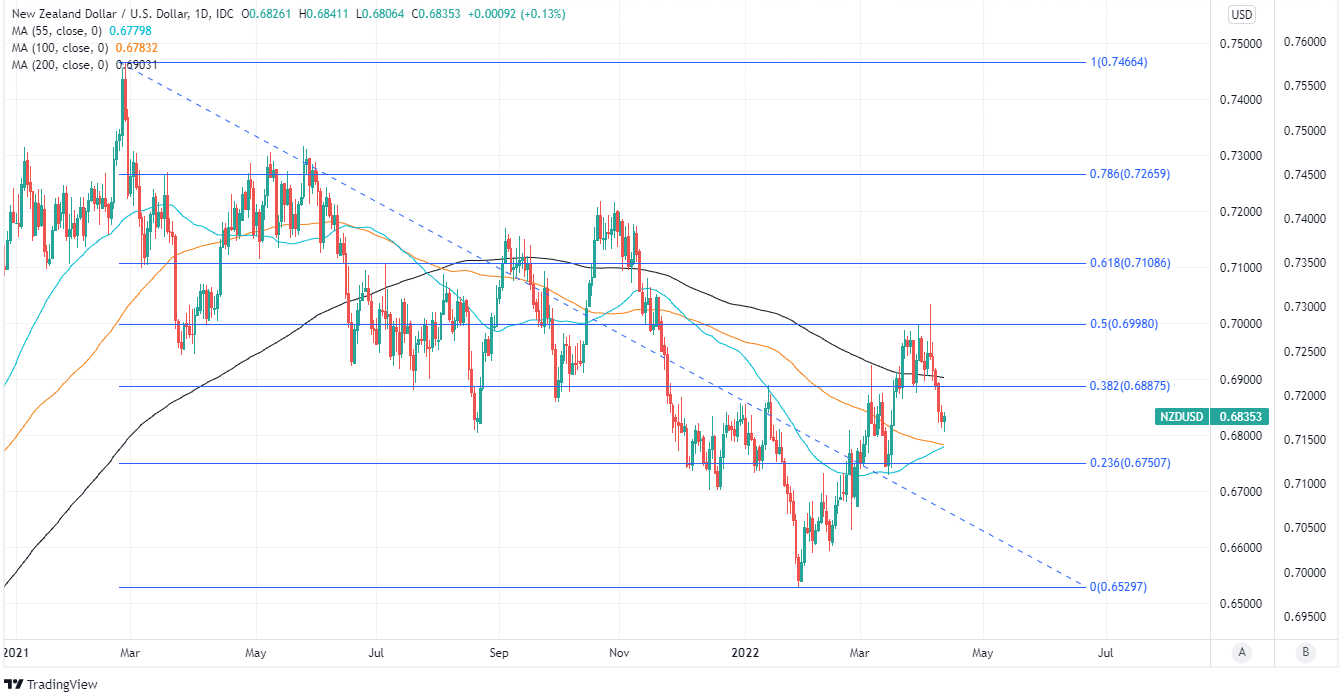

Above: NZD/USD shown at daily intervals with selected moving averages and Fibonacci retracements of 2021 downtrend indicating possible areas of medium-term technical resistance to any Kiwi Dollar recovery. Click image for closer inspection.

Above: NZD/USD shown at daily intervals with selected moving averages and Fibonacci retracements of 2021 downtrend indicating possible areas of medium-term technical resistance to any Kiwi Dollar recovery. Click image for closer inspection.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

But the RBNZ also lifted to more than 3% the assumption about the level of interest rates that may be necessary if the bank is to actually rein in inflation and also “affirmed that it was willing to move the OCR in larger increments if required over coming quarters.”

This and the bank’s February decision to begin extricating itself from the New Zealand government bond market means there are still upside risks to interest rates and bond yields in New Zealand, which is supportive of the Kiwi Dollar and a possible ongoing headwind for GBP/NZD.

“The RBNZ has a big job to do to get ahead of the inflation curve. We’re forecasting that the RBNZ will lift the OCR 50bps on Wednesday and again at the May Monetary Policy Statement, before continuing in 25bp increments,” says Sharon Zollner, chief economist at ANZ.

“The inflationary labour market reinforces the need to get in front of the inflation curve –and that requires further interest rate rises over 2022 and into 2023. But how many? It depends on the labour market holding up,” Zollner and colleagues also said in a Tuesday research briefing.

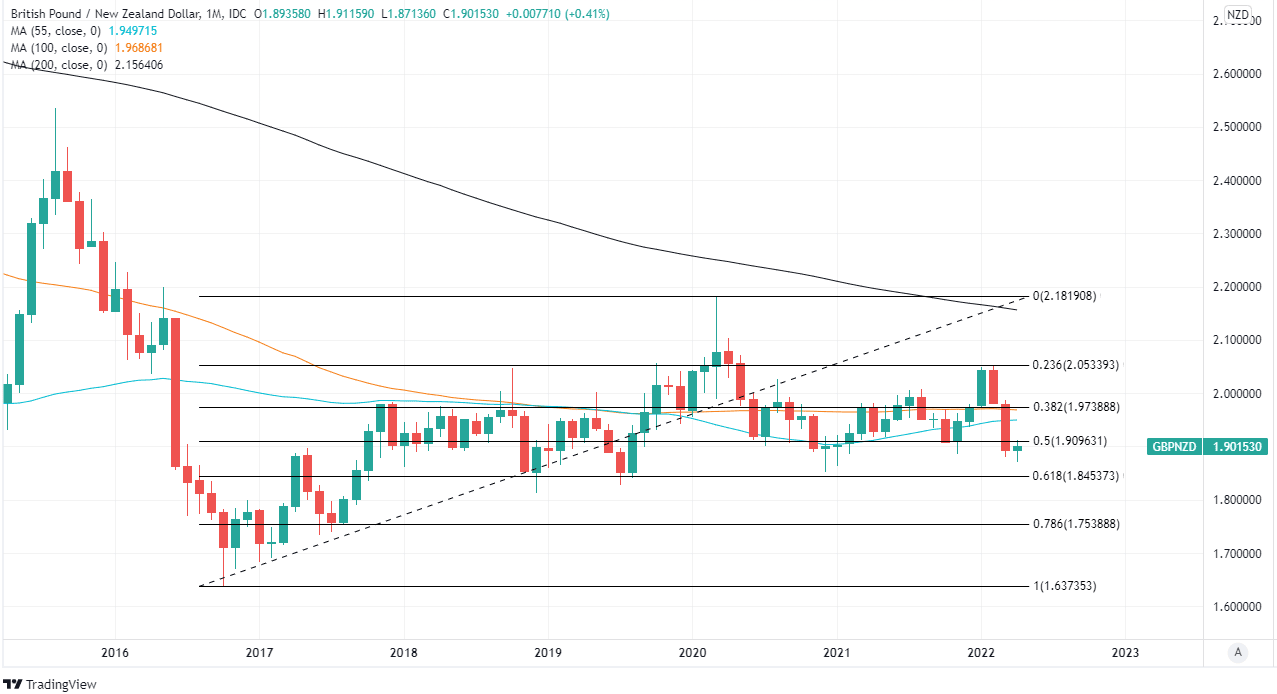

Above: Pound to New Zealand Dollar exchange rate shown at monthly intervals with Fibonacci retracements of post-referendum recovery indicating possible areas of medium-term technical support for Sterling. Click image for closer inspection.

Above: Pound to New Zealand Dollar exchange rate shown at monthly intervals with Fibonacci retracements of post-referendum recovery indicating possible areas of medium-term technical support for Sterling. Click image for closer inspection.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The risk for the Pound to New Zealand Dollar exchange rate is one of the RBNZ lifting its cash rate by a larger-than-usual increment of 0.5% on Wednesday, which would likely bolster the Kiwi against a range of currencies.

“We expect a 50bp OCR hike tomorrow. We expect this will lend the NZD support on grounds that it’ll add to RBNZ credibility and cap inflation down the track,” says David Croy, a strategist and ANZ colleague of Zollner.

To the extent that this week’s RBNZ decision helps NZD/USD to pare away last week’s losses it could also act to undermine the recent rebound in GBP/NZD and may even see it trading back down to the 1.87 handle.

This in part because the Pound to New Zealand Dollar rate tends to closely reflect the relative performances of NZD/USD and its Sterling equivalent GBP/USD.

“NZD/GBP is elevated but also drifting and showing signs of having maybe topped out but is also hostage to OCR decision,” Croy said on Tuesday.