New Zealand Dollar Week Ahead Forecast: RBNZ to Keep Kiwi Supported but Shanghai Lockdown Poses Downside Risks

- Written by: Gary Howes

- 50bps RBNZ hike to support NZD

- But global risk sentiment deteriorates

- As Shanghai lockdown enters another week

- Could thwart NZD strength

Above: The Port of Shanghai is the largest seaport in the world.

It's a soft start to the new week for the New Zealand Dollar as stock markets reflect dour global investor sentiment, but analysts at antipodean lender ANZ expect the currency to be supported near-term by a Reserve Bank of New Zealand interest rate hike.

The RBNZ will raise rates on Wednesday, but for the New Zealand Dollar the size of the hike and guidance on further action will in part determine where the currency trades come Friday.

"This week is all about the RBNZ; we expect a 50bp hike and a firm tone; that’ll likely support NZD," says analyst Brian Martin at ANZ.

Money market pricing shows investors are currently anticipating nearly 230 points of hikes from the RBNZ in 2022 which is more than any other G10 central bank and should keep the currency supported, at least if they are delivered.

"Markets are sure we'll get a hike, but expectations remain split on whether we’ll see 25 or 50bps. We expect the latter on the grounds that if ever there was a need to act swiftly and firmly to head off rising inflation expectations, now is that time, despite growth risks," says Martin.

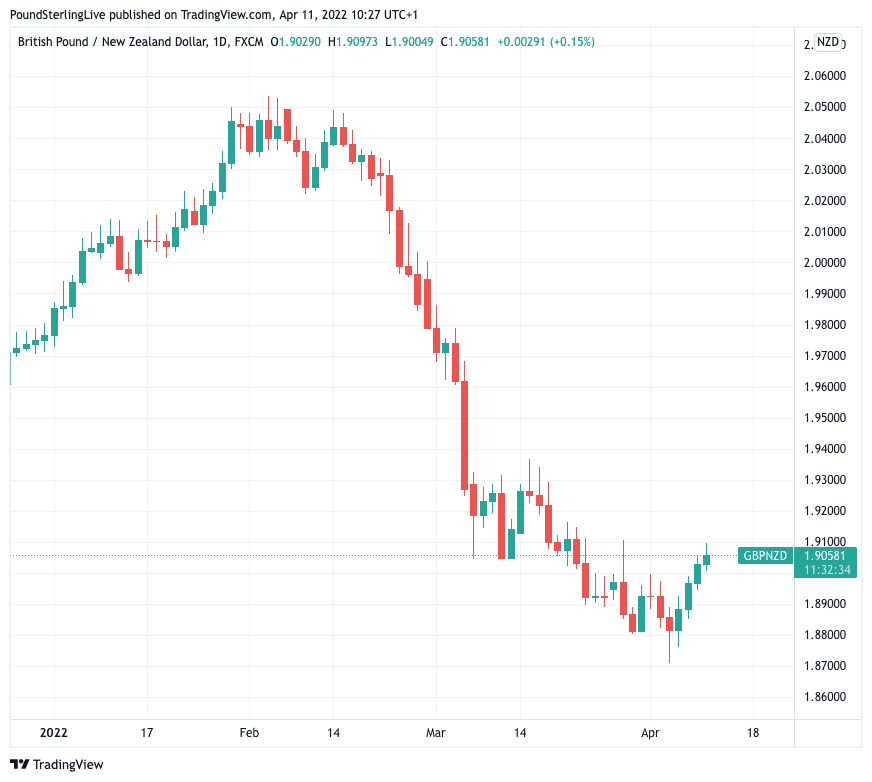

Above: GBP/NZD at daily intervals.

The ANZ analyst says currency markets will "reward" a larger hike with a rally on the view that it’d cement the RBNZ’s inflation fighting credentials and lessen inflation risks down the track.

"But with 43bps priced in, the bigger reaction would come on a 25bp hike (in which case, the NZD would likely spike lower)," says Martin.

ANZ's currency strategists see NZD/USD resistance at 0.6715/0.6830 and support is seen located at 0.7105, 0.7225 and then 0.7316 further out.

Regarding the Pound to New Zealand Dollar exchange rate, ANZ sees short-term gains but notes the pair is still subdued on a one-year view. "What happens this week likely largely depends on the RBNZ."

Resistance for GBP/NZD is seen located at 1.9475 and then 1.9940 further out, but near-term support to any weakness would be seen at 1.8640 and then 1.85. (Set your exchange rate alert here).

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

ANZ's analysis of the EUR/NZD shows resistance to any advances at 1.6260 and 1.6806 but support is located at 1.5528/1.5244 and 1.5094.

Although the RBNZ event forms the focus of the week for the New Zealand Dollar, global risk sentiment will probably be the more important driver.

Investor focus will increasingly turn to Shanghai where a strict lockdown is set to enter another week, posing significant headwinds to global trade and economic growth.

The New Zealand Dollar is a pro-cyclical 'commodity currency' that tends to outperform when global growth is strong and sentiment positive.

This rule was not observed when the Ukraine war spooked markets as it has driven up commodity prices and the price of agricultural products, of which New Zealand is a major exporter.

But when risk takes a hit on concerns over Chinese growth the Kiwi Dollar will take note and revert to traditional dynamics.

"While high food prices might ostensibly be good news for a net food exporter like New Zealand, they not only reflect geopolitical risks; they add to them," says Martin.

Chinese stock markets shed value at the start of the week as investors considered the rising financial and economic impact of a wave of lockdowns across China and especially in Shanghai, the centre of the country’s worst coronavirus outbreak in two years.

Disruptions to Chinese supply chains have intensified following the complete lockdown of the financial centre since April 1 and media report significant supply chain disruptions are building.

Importantly, China looks to be in no mood to end its strict zero-Covid policy, even in the face of the highly contagious Omicron variant of the disease.

"Market concerns are likely driven most prominently by the ongoing steep rise in global bond yields, but also by the risk of widening Covid lockdowns in China and geopolitical concerns as Russia may be eyeing an intensification of its aggression in eastern Ukraine," says Peter Garnry, Head of Equity Strategy at Saxo Bank.

As long as the Chinese lockdown narrative pressures markets the NZ Dollar might stay under pressure, meaning this week's RBNZ rate hike might offer only fleeting support for Kiwi bulls.

"Shanghai and a few other cities are locked down in this new wave of Covid-19. The implications include disrupted supply chains for China and the world and another hit to the Chinese economy, which was already weak. We believe the market may be under pressure in the near term until it sees more policy stimulus and easing," says Richard Tang, Equity Research Asia analyst at Julius Baer.