New Zealand Dollar Bid as China says to Support Economy & Markets

- Written by: Gary Howes

- China remains key to NZD outlook

- Authorities commit more support to economy

- As Covid concerns rise

- Ukraine peace hopes support GBP/NZD

Above: File image. IMF Managing Director Kristalina Georgieva, Liu He, China's Vice Premier. Credit: IMF. Source: Flickr. License: Creative Commons.

The New Zealand Dollar was bid on news Chinese authorities are to expand support for the economy, however concerns over rising Covid cases in the country and an easing in tensions regarding Ukraine are two notable headwinds to navigate.

Vice Premier Liu He, Chair of the Financial Stability and Development Committee, committed to keep the equity market stable and to take measures in the first quarter to boost the economy.

"That is a clear indication of imminent policy support," says Derek Halpenny, Head of Research for Global Markets at MUFG. "Unfolding developments in China should not be ignored".

Liu encouraged long-term institutional investors to increase their shareholdings, while promising to closely communicate with the Hong Kong regulator to maintain stability in the city's financial market.

The New Zealand Dollar and its Australian cousin are highly correlated to the fortunes of China, owing to their strong trade links to the world's second-largest economy and we reported yesterday of declines in the antipodeans as Chinese and Hong Kong markets slumped.

Any slowdown in China is anticipated by foreign exchange analysts to correlate with underperformance in the two antipodean currencies going forward.

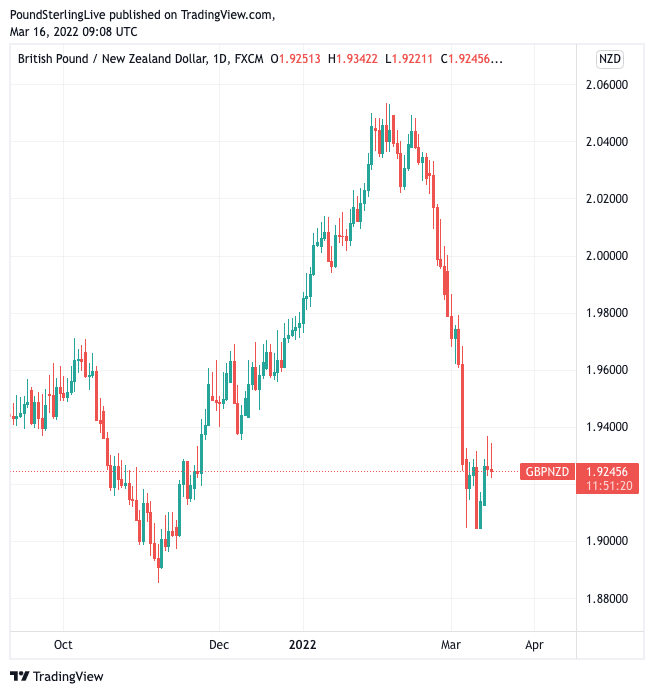

The New Zealand Dollar rose by 0.40% against the U.S. Dollar in the wake of the comments, taking NZD/USD to 0.6787. The currency recorded an advance of a third of a percent against Sterling, with the Pound to New Zealand Dollar exchange rate now quoting at 1.9242.

Above: GBP/NZD at daily intervals.

- GBP/NZD reference rates at publication:

Spot: 1.9245 - High street bank rates (indicative band): 1.8570-1.8706

- Payment specialist rates (indicative band): 1.9072-1.9110

- Find out about specialist rates, here

- Set up an exchange rate alert, here

Chinese markets were hammered on Tuesday March 15, but in a sign of the fretful nature of these markets, the Hang Seng went 8% higher on Wednesday while the Shanghai Composite was higher over 3.0%.

Concerns for the Chinese economy have this week risen amidst signs the Omicron variant of Covid is spreading through a country that has resolutely pursued a 'zero covid' approach to the pandemic.

Chinese authorities have shown little inclination to depart with the policy, meaning strict lockdowns and quarantine measures are likely to be expanded, posing threats to Chinese and global growth.

The New Zealand Dollar is a pro-cyclical currency that benefits when the global economy is growing, but it is vulnerable when the opposite is the case.

"The increased scale of lockdowns in order to contain the spread of Covid and concerns over the potential for China to be hit with secondary sanctions due to a perception of implicit support for Russia has left the financial markets fragile and seen downgrades to the economic outlook," says Halpenny.

Manufacturers in China are warning of shipment delays for products ranging from circuit boards to touchscreen components after controls were introduced to try to halt an Omicron variant.

For a world economy already struggling with surging inflation - a hangover from when Covid first struck - this is resolutely bad news.

The two major technology exporting centres of Shenzhen and Dongguan are of particular concern to economists as they have both imposed restrictions in light of rising Covid cases.

"Back at the scrambling days when the pandemic first hit in 2020, China’s lockdowns resulted in the first wave of supply chain snarls which impacted economies across the globe, including the rest of Asia. Fast forward to this week, and the renewed lockdowns as the country adheres firmly to its Zero Covid policy threatens to resurrect such an old ghost once again," says Wellian Wiranto, Economist, at OCBC Bank.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Wiranto says the two major cities of Shenzhen and Dongguan in the southern Guangdong province generate the most concerns from the trade flow perspective as Shenzhen alone contributes 10.9% of China’s total exports, while the whole province supplies more than a quarter of the country’s outbound trade in 2021.

"While there may be hope yet that the lockdowns had been imposed quickly enough such that they are needed only for a short period for these areas and limit the need to impose restrictions on more regions, Omicron’s higher transmissibility has inadvertently made things more challenging to contain," says Wiranto.

Another key headwind to the New Zealand Dollar would be the breakout of peace in Ukraine, an outcome that could be nearing.

The stances presented by the Ukrainian and Russian delegation at ongoing bilateral talks "have become more realistic," Ukrainian President Volodymyr Zelensky said in his most recent assessment of ongoing negotiations.

The talks continue today.

Above: File Image. NATO Secretary General Jens Stoltenberg meets with the President of Ukraine, Volodymyr Zelensky. Source: NATO. Access: Flickr. Licensing: Creative Commons. This week Zelensky said Ukraine would no longer seek to join NATO.

"The meetings are continuing and, as I have been told, the stances presented at the negotiations have become more realistic," Zelensky said in a video released on Telegram.

"It will take time to reconcile decisions with the interests of Ukraine. This is difficult but important," he added.

The New Zealand and Australian Dollars were the two standout beneficiaries in the initial stages of the Ukraine conflict as markets panicked about the repercussions the conflict posed to global commodity supplies.

Surging commodity prices in turn bolstered New Zealand's terms of trade prospects, which is invariably supportive of the NZ Dollar.

But with markets now factoring in a potential ceasefire and resolution to the conflict the New Zealand Dollar stands to lose a previously supportive narrative.

Should the conflict escalate however, the NZ Dollar could extend its recent trend of advance.