Pound / New Zealand Dollar Rate May Have Bottomed Out

- Written by: James Skinner

- GBP/NZD's sell-off may be over but upside limited

- Could struggle to extend rebound much past 1.93

- Fed could burden NZD/USD, supporting GBP/NZD

- NZ GDP & BoE both downside risks for GBP/NZD

The Pound to New Zealand Dollar exchange rate appeared to draw a line under its recent heavy sell-off early in the new week although upside for Sterling could be limited over the coming days due to a strong Kiwi economy and possibly-cautious Bank of England (BoE) policy statement.

Sterling rose briefly above the round number of 1.93 against the Kiwi on Tuesday and it could remain buoyant into the mid-week session if some strategists are right to expect the antipodean currency to soften in response to Wednesday’s Federal Reserve (Fed) interest rate decision.

“Ukraine-fuelled risk aversion, plus the looming FOMC meeting (17th), can boost the USD further near term. Post-FOMC, we see scope for slippage towards the 0.6600-0.6700 area,” says Imre Speizer, head of NZ strategy at Westpac, in reference to NZD/USD.

“But multi-month, we are bullish, targeting 0.6900+ by year end. The RBNZ clearly has more work to do to claw back inflation expectations, and NZ commodity prices should remain supportive,” Speizer and colleagues wrote in a briefing to clients on Tuesday.

Wednesday is widely expected to see the Fed take its first major step to withdraw the monetary stimulus provided to the U.S. and global economies since the onset of the pandemic, by lifting its interest rate, and there’s a chance that its guidance about future policy will lift the U.S. Dollar.

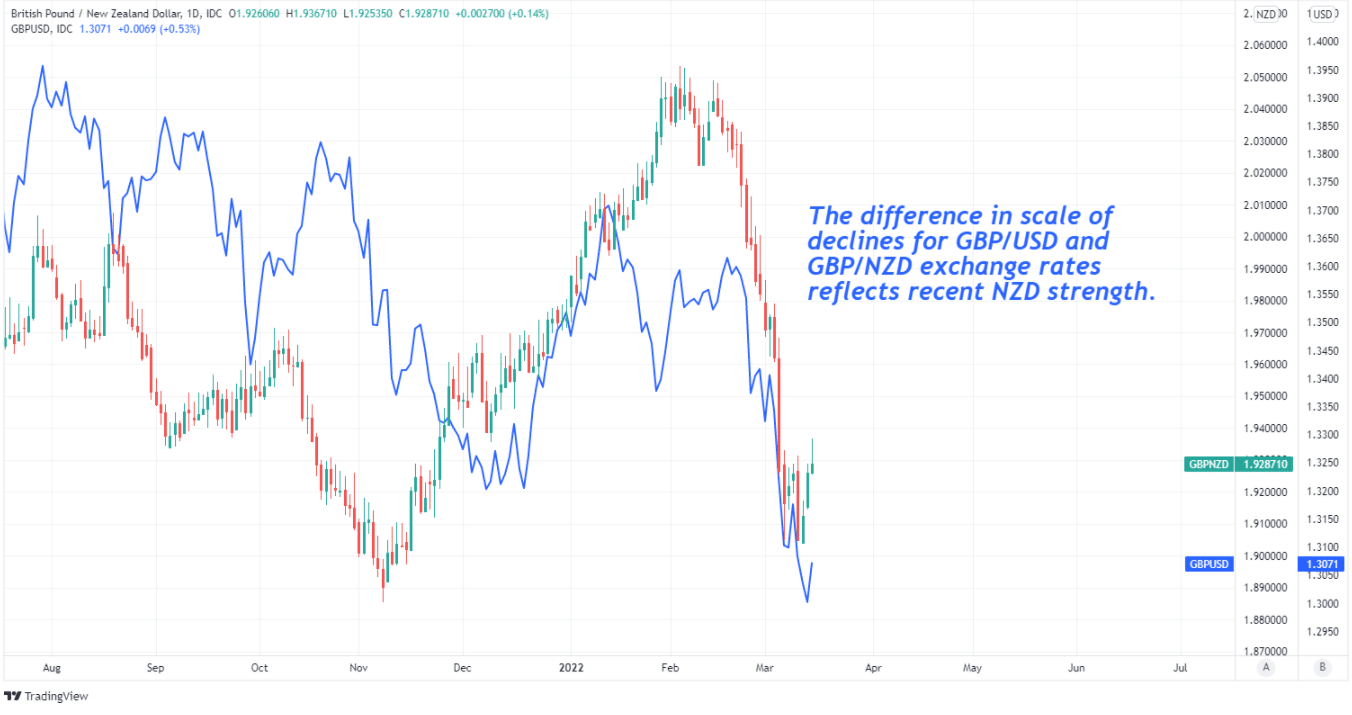

Above: Pound to New Zealand Dollar rate shown at daily intervals alongside GBP/USD.

- GBP/NZD reference rates at publication:

Spot: 1.9254 - High street bank rates (indicative band): 1.8580-1.8715

- Payment specialist rates (indicative band): 1.9080-1.9119

- Find out about specialist rates, here

- Set up an exchange rate alert, here

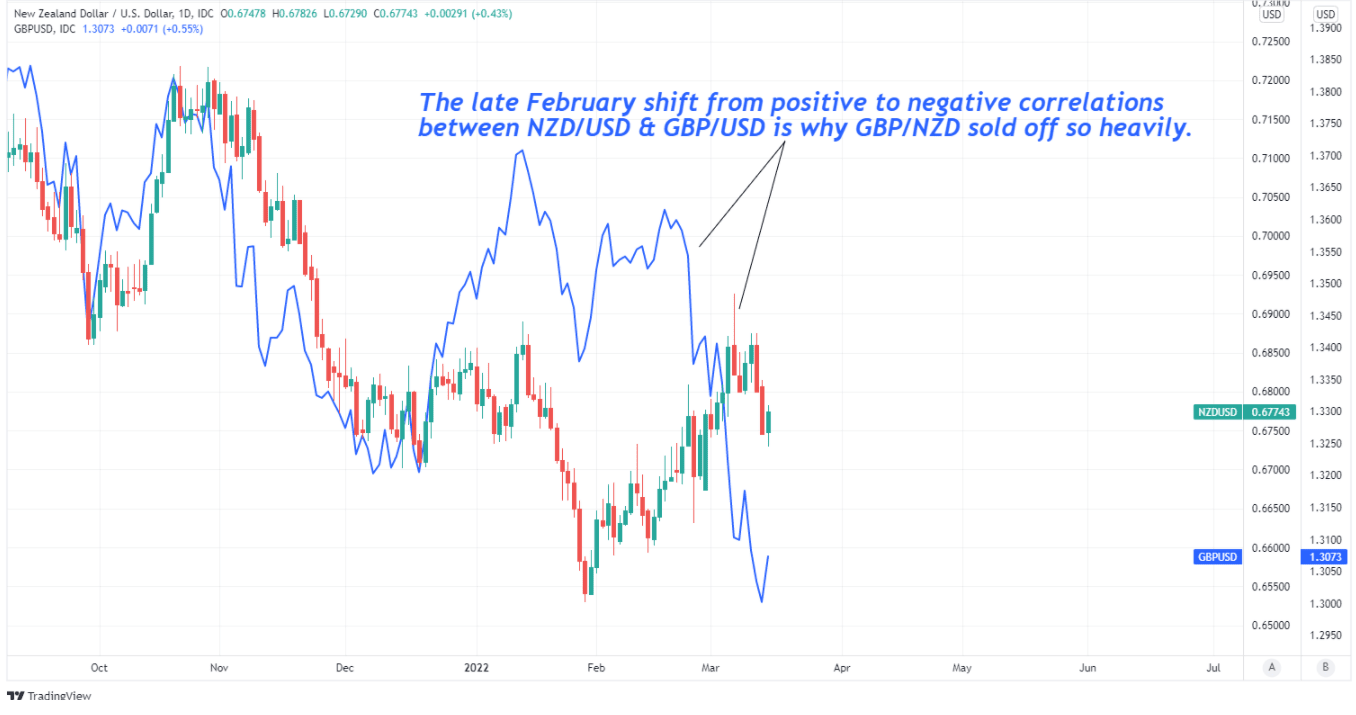

To the extent that Wednesday’s Fed decision weighs on the main Kiwi exchange rate NZD/USD it could also be likely to have a supportive impact on GBP/NZD, which closely reflects the relative performance of the Kiwi and Sterling when each is measured against the U.S. Dollar.

While the main Sterling exchange rate had stabilised early in the new week, which was itself a supportive influence on GBP/USD, the Pound also often tends to be less susceptible than the Kiwi to strength in the U.S. Dollar.

This is why the Pound to New Zealand Dollar rate could be likely to remain buoyant into the mid-week session, although the rub for Sterling and reasons for why any further GBP/NZD gains are likely to be limited include the implications of Wednesday’s Kiwi GDP figures.

“The week hasn’t gotten off to a good start for the Kiwi, and although there is some domestic data coming up this week (which should be pretty good and which we think might be more influential) global events continue to dominate sentiment,” says David Croy, a strategist at Westpac.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“Technically, the break of 0.6775 about 2hrs ago doesn’t bode well, and the sharp rise in US bond yields might keep the USD bid. Markets remain very skittish and more volatility seems likely,” Croy and colleagues said in a Tuesday morning note.

Consensus suggests Wednesday’s GDP data will show the Kiwi economy rebounding strongly in the final quarter of last year from the effects of the prior quarter’s attempts at containing the latest derivative of the coronavirus, which could potentially reinforce expectations in the market for an accelerated pace of interest rate rises at the Reserve Bank of New Zealand (RBNZ) later this year.

That would potentially place a floor under the main Kiwi exchange rate NZD/USD, if not lift it, and just hours before the Bank of England announces its own latest interest rate decision which could be a downside risk for Sterling this time out.

“If the BoE hikes this week, we would expect a material slowdown in the pace of any further hikes thereafter. This would fit with the BoE’s guidance in February that OIS markets seem to anticipate more hikes than policymakers believe are necessary to return inflation to target,” says Kallum Pickering, an economist at Berenberg.

Above: NZD/USD shown at daily intervals alongside GBP/USD.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The BoE is widely expected to lift Bank Rate for a third consecutive time in a decision that would take the benchmark back to the pre-crisis level of 0.75%.

Although this has been well priced-in by the market and there’s a chance - if not likelihood - that guidance about future policy decisions will rankle with parts of the market which have bet that a significant number of further interest rate rises will be announced later this year.

“We expect the MPC to hike rates but to also strike a more cautious outlook on the economy in view of the Ukraine crisis. Ahead of that, the GBP may continue to struggle, especially if UK real rates and yields remain deeply negative,” says Alexandre Dolci, a strategist at Credit Agricole CIB.

Even before the Russian invasion of Ukraine in late February the BoE had warned markets earlier that month “not to get too carried away” with their expectations for interest rates, although since then the market-implied level of Bank Rate for year-end has risen further from 1.8% to 2%; implying that investors think the conflict in Ukraine is likely to necessitate a steeper upward climb for interest rates.

Meanwhile, at least one member of the BoE’s Monetary Policy Committee has begged to differ with the market’s apparent interpretation, which could be an indication of the broader committee’s likely approach on Thursday.

"It's not clear at this stage if those recent developments have any effects on the outlook for inflation two and three years out," MPC member Michael Saunders reportedly said following a speech at the University of East Anglia on March 01.