New Zealand Dollar Due a Rebound say Analysts

- Written by: James Skinner and Gary Howes

- NZD oversold says Crédit Agricole

- Also says GBP overbought

- NZD/USD trend key to GBP/NZD outlook

- NZ jobs data, RBNZ policy in focus

Image © Adobe Stock

The Pound to New Zealand Dollar's rally higher might be over say analysts, noting the New Zealand currency is now screening as oversold and is prone to a rapid rebound if global risk sentiment stabilises.

Pound Sterling entered the new week quoted near 2.05 and at its highest level against the New Zealand Dollar since May 2020 only for the Kiwi currency to call a halt to a three month rally that has lifted GBP/NZD from 1.88 since late October.

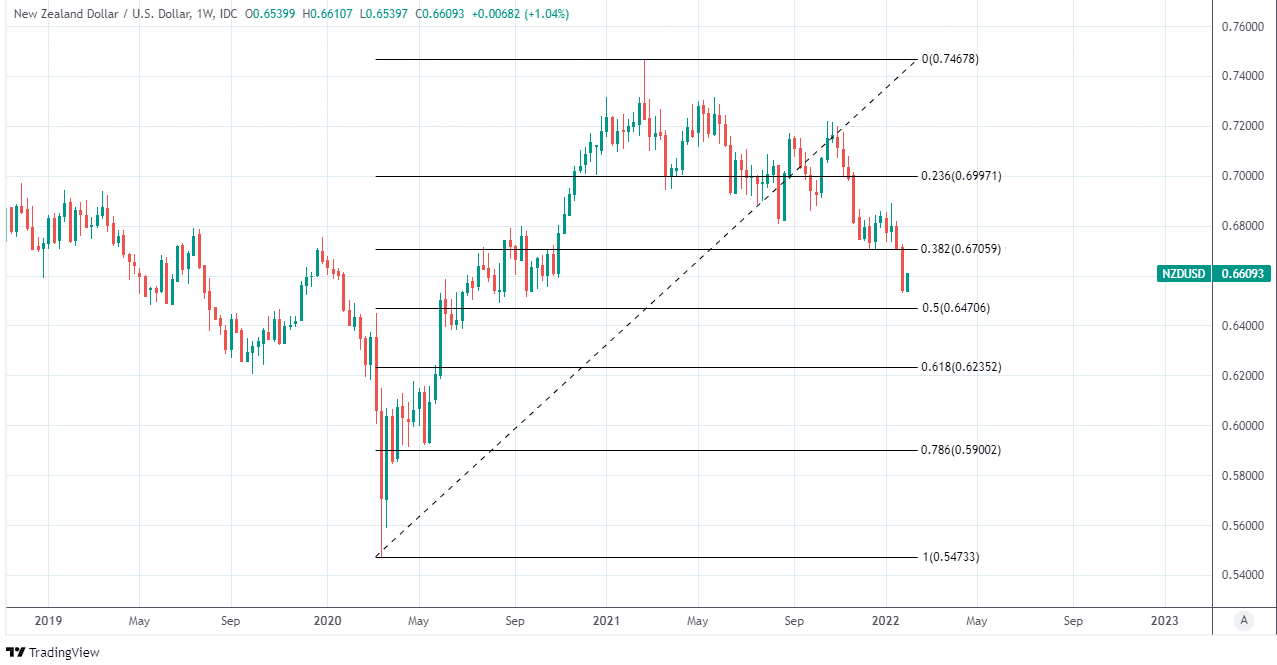

GBP/NZD has stalled just as the main Kiwi exchange rate NZD/USD rises off its lowest since September 2020 in a tentative rebound which, if continued, would likely force GBP/NZD into at least a short period of consolidation.

“The G10 FX PIX 2.0 model signals that the NZD is oversold and the GBP is overbought. Subsequently, we have entered a long position in NZD/USD with a target (+3%) and a stop-loss of (-1.5%) and a short position in GBP/USD with a target (+3%) and a stop-loss of (-1.5%),” says Valentin Marinov, head of G10 FX strategy at Credit Agricole CIB.

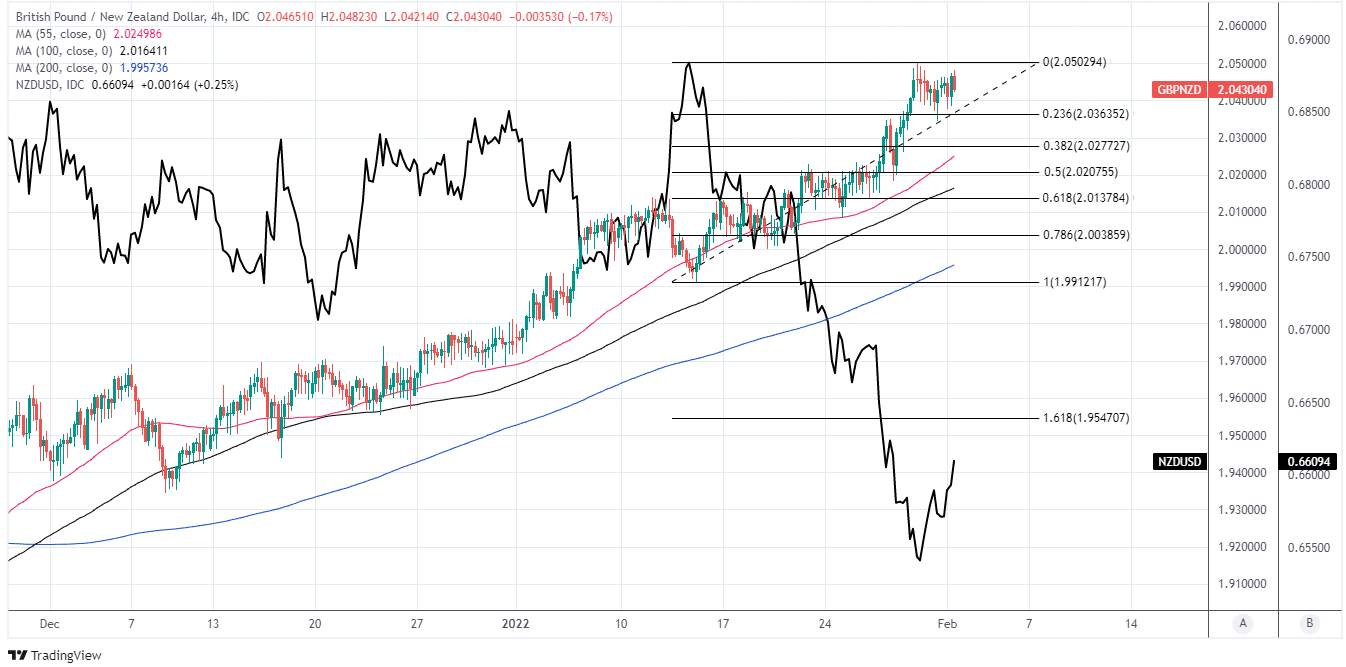

Above: GBP/NZD at 4-hour intervals with Fibonacci retracements of mid-January’s extended move higher indicating possible areas of technical support for Sterling. Shown along with NZD/USD.

- GBP/NZD reference rates at publication:

Spot: 2.0387 - High street bank rates (indicative band): 1.9673-1.9816

- Payment specialist rates (indicative band): 2.0204-2.0285

- Find out about specialist rates, here

- Set up an exchange rate alert, here

While the New Zealand Dollar rose against the U.S. Dollar and Sterling early in the new week, it remained the worst performing major currency for 2022 as well as for the three months leading up to the beginning of February.

This underperformance has coincided with a further extension of the U.S. Dollar’s six-month rally as well as a period of persistent weakness in global stock markets, each of which is ordinarily enough to see investors giving the Kiwi a wide berth.

“NZD has been hit very hard from the adverse risk environment and U.S. dollar strength, but is one of those currencies that could look at a faster recovery thanks to strong fundamentals,” says Francesco Pesole, a strategist at ING.

GBP/NZD tends to closely reflect the relative performance of the main Sterling exchange rate GBP/USD and its Kiwi equivalent NZD/USD so will be sensitive to whether or not this week’s rebound by the latter continues.

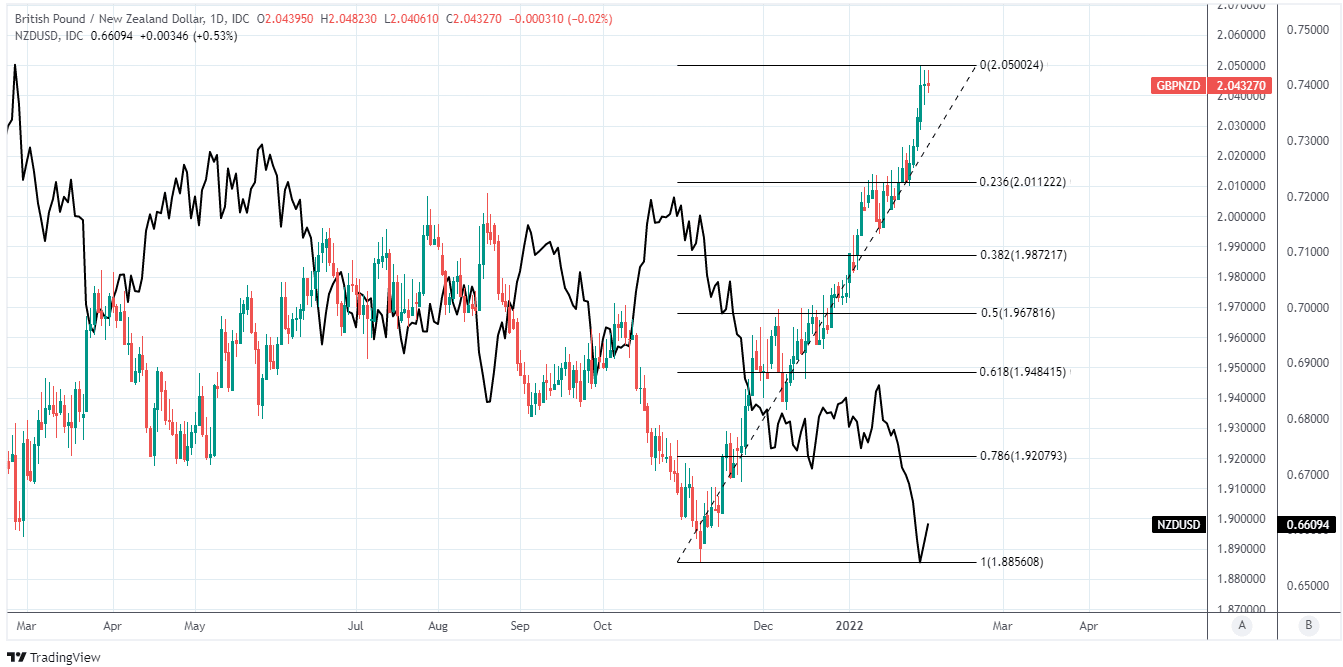

Above: GBP/NZD at daily intervals with Fibonacci retracements of late October rally indicating other possible areas of technical support for Sterling. Shown along with NZD/USD.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Wednesday’s release of final quarter employment data from Statistics New Zealand could have a say on whether it does, although any GBP/NZD declines would be likely to peter out around 2.0280 unless NZD/USD can decisively recover above the 0.67 handle that was lost last week.

“Both AUD and NZD are getting down to key technical support levels and one might be brave enough to argue that they are due for some consolidation after tumbling 2½-2¾% for the week and sitting on year-to-date losses of about 4%,” says Jason Wong, a strategist at BNZ.

Consensus among economists suggests that employment rose by 0.4% in New Zealand during the final quarter and that this likely pushed the unemployment rate down to a new post-financial-crisis low of 3.3% by year-end.

“Yesterday’s 0.2% m/m rise in NZ filled jobs data for December is in line with our expectation that a 0.7% q/q lift in employment will be enough to push the unemployment rate lower to 3% in Q4,” says Miles Workman, a senior economist at ANZ.

Above: NZD/USD shown at weekly intervals with Fibonacci retracements of 2020 recovery indicating possible areas of technical support for the Kiwi. Shown along with GBP/NZD.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“With the risk that Omicron cases explode over coming months, sending worker absenteeism higher and possibly dragging on labour force participation, it would appear that even negative near-term economic risks are skewed towards a tighter (more inflationary) labour market,” Workman also said.

The above kinds of outcomes are exactly the things that could continue cultivating growth in Kiwi worker’s wage packets, and could potentially lead financial markets to anticipate a further or more prolonged pickup in Kiwi inflation during the months ahead.

This could mean there’s a risk of Wednesday’s employment data prompting speculation on a possible faster pace of monetary policy normalisation from the Reserve Bank of New Zealand (RBNZ) later this year, which would act as a headwind for the Pound to New Zealand Dollar rate.

The RBNZ began lifting its cash rate in October and has since suggested the benchmark could rise from 0.75% to more than 2% before the curtain closes on 2022, although financial markets have so far assumed the bank would be likely to lift rates only in increments of 0.25%.

Any speculation about an accelerated pace of interest rate rises would be almost certain to revive market appetite for the Kiwi Dollar and to weigh further on GBP/NZD in the days and weeks ahead.