Pound / New Zealand Dollar Advance Could Extend to 2.0400

- Written by: James Skinner

- GBP/NZD set to hold above 2.00

- Could reach 2.04 in days ahead

- Further rise possible multi-week

- As NZD/USD extends correction

- Westpac eyeing slip below 0.66

Image © Adobe Stock

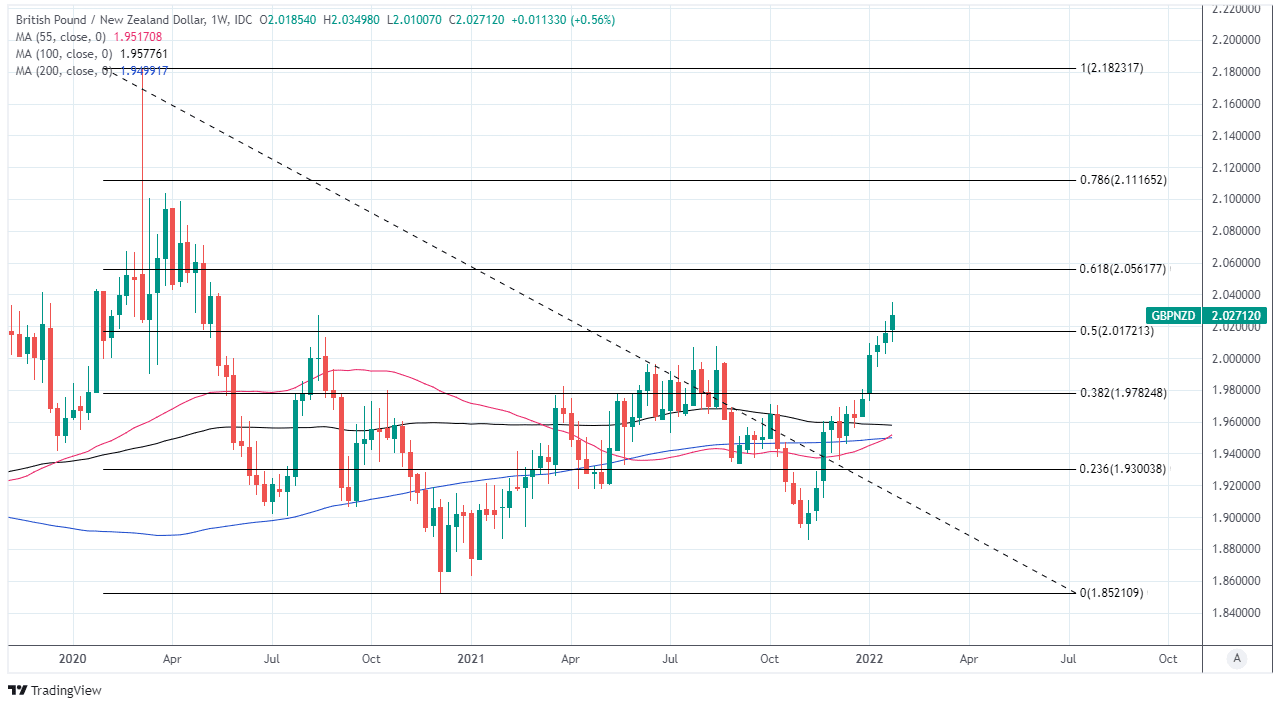

The Pound to New Zealand Dollar rate reached its highest since May 2020 this week but could now be likely to hold above the 2.00 level and may even probe above 2.04 over the coming days in response to an ongoing breakdown in NZD/USD, which slipped below 0.66 on Thursday.

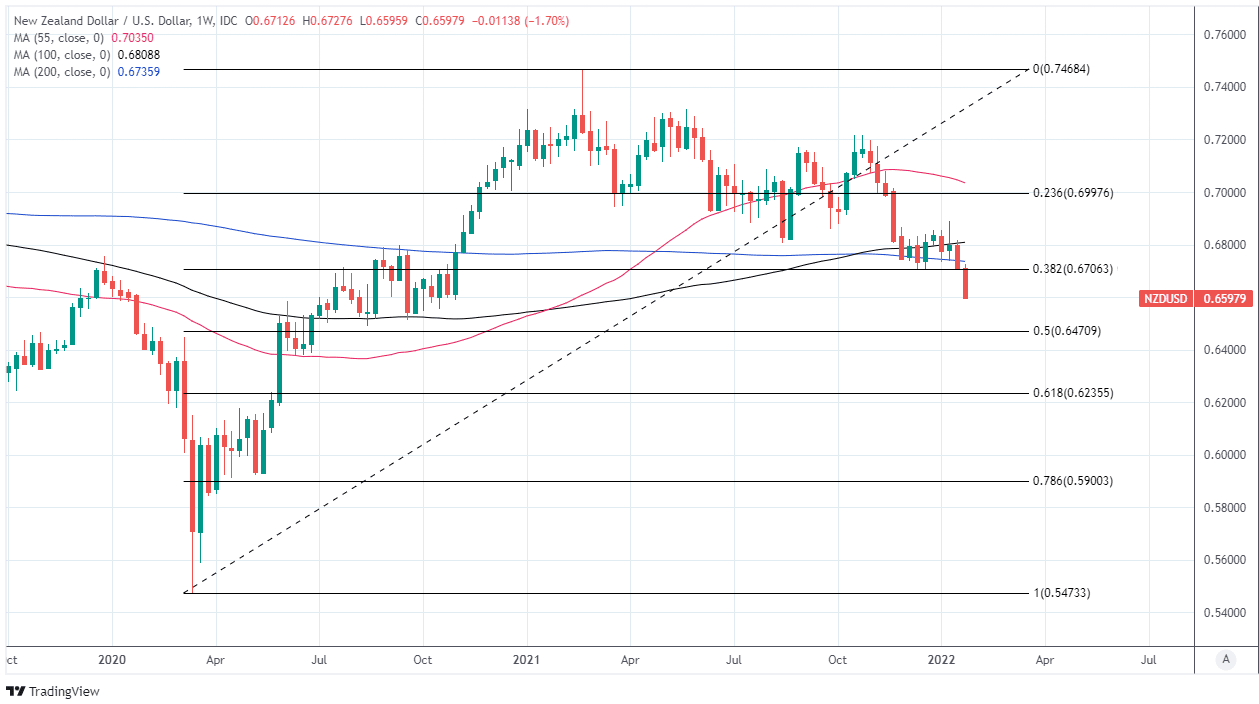

New Zealand’s Dollar extended a more-than year-long corrective decline against the U.S. Dollar after breaking beneath an important level of technical support around 0.6706 on the charts earlier in the week, which put a fresh gust of wind into the sails of GBP/NZD on Thursday.

GBP/NZD reached highs of 2.0350 on Thursday as NZD/USD extended its run of losses with a tentative break below 0.66 in another bearish technical development that leaves the Kiwi at risk of further declines.

This is something of a victory for strategists at Westpac who’d advocated earlier this week that clients bet on a prompt decline to 0.66 by NZD/USD.

“The main driver has been the stronger USD, which got a further boost from today’s hawkish FOMC. Today’s NZ CPI data was also strong, but within market expectations, resulting in nil reaction,” says Imre Speizer, head of NZ strategy at Westpac.

Above: NZD/USD shown at weekly intervals with Fibonacci retracements of 2020 recovery indicating possible areas of support for the Kiwi.

- GBP/NZD reference rates at publication:

Spot: 2.0308 - High street bank rates (indicative band): 1.9597-1.9739

- Payment specialist rates (indicative band): 2.0125-2.0206

- Find out about specialist rates, here

- Set up an exchange rate alert, here

“Multi-month, we remain bearish, targeting sub-0.6600. Our house view is that the US dollar will outperform most currencies over the next few months as Fed rate hikes outpace market pricing,“ Speizer and colleagues warned.

The Kiwi was quick to retreat from the path of an oncoming U.S. Dollar on Thursday as the market responded to Chairman Jerome Powell’s Wednesday suggestion that the Federal Reserve (Fed) could lift its interest rate in March and follow up that move with additional increases that come faster than in the bank’s previous monetary policy tightening cycle.

With economy and labour market far stronger than in 2015 and at the beginning of the prior cycle of interest rate rises, the Fed appears to be coming around to the view that it can afford to move faster than before to rein in U.S. inflation.

Inflation rose to seven percent in December and is expected to remain far above the Fed’s target for much of this year and next.

“While NZ’s economic data pulse should remain positive, the Fed-driven USD will dominate. NZ-US yield spreads have declined recently, with the RBNZ fully priced but the Fed arguably underpriced,” Westpac’s Speizer says.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The U.S. Dollar’s advance and its impact on NZD/USD has had an uplifting influence on GBP/NZD, which tends to closely reflect the relative performances of NZD/USD and its Sterling equivalent, GBP/USD.

“Although trading is proving choppy in the short term, the established downtrend is intact. GBP is shrugging off PM Johnson’s political difficulties for the moment and the BoE will raise the bank rate 25bps next week,” says David Croy, a strategist at ANZ, referring to NZD/GBP.

The Pound often proves to be more resilient to strength in the U.S. Dollar, which is one prospective explanation for GBP/NZD’s buoyancy on Thursday, although Sterling has also benefited recently from a favourable evolution of interest rate policy at the Bank of England (BoE).

With UK inflation rising to 5.4% in December and other data showing the labour market recovery from its coronavirus-related disruption continuing, financial markets have bet there’s a high probability of a second interest rate rise being announced in February.

Above: GBP/NZD shown at weekly intervals with Fibonacci retracements of 2020 decline indicating possible areas of technical resistance for Sterling.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“GBP/USD may be vulnerable to another flush to 1.3400 but easing of restrictions and a potential BoE hike could trigger a lift to 1.3625 if not a retest of 1.3750,” says Tim Riddell, a London-based macro strategist at Westpac.

The Kiwi Dollar’s declines and a resilient performance from GBP/USD have enabled the Pound to New Zealand Dollar exchange rate to build further on its new year breakout above the 2.00 level, and could potentially see it rise as far as 2.04 over the coming weeks.

Should the decline in NZD/USD extend to 0.65 or below over the coming weeks, near to its next major level of support on the charts, the Pound to New Zealand Dollar rate could remain buoyant even if in the interim the GBP/USD pair comes under further pressure.

However, GBP/NZD would likely rise to 2.09 or a touch more if Westpac’s Riddell is right in thinking that GBP/USD could recover back up toward 1.36 over the course of February in response to the BoE’s next policy decision and differences in the level of coronavirus-related restrictions in effect in the UK and New Zealand.

The last remaining restrictions were removed in the UK on Thursday while in New Zealand the government recently extended to 24 days the isolation time required of individuals exposed to those who’ve tested positive for the virus.