Pound / New Zealand Dollar Rate Potentially Topping Out Near 1.97

- Written by: James Skinner

- GBP/NZD meeting resistance, struggling at 1.97

- Could be topping out with NZD/USD finding feet

- NZD/USD rebound off 0.6707 a risk to GBP/NZD

Image © Adobe Stock

The Pound to New Zealand Dollar rate has run into something of a road block near to 1.97 and may even be in the process of topping out following a six-week recovery rally, although much about the outlook depends on if the Kiwi can hold above a major but nearby level against the U.S. Dollar.

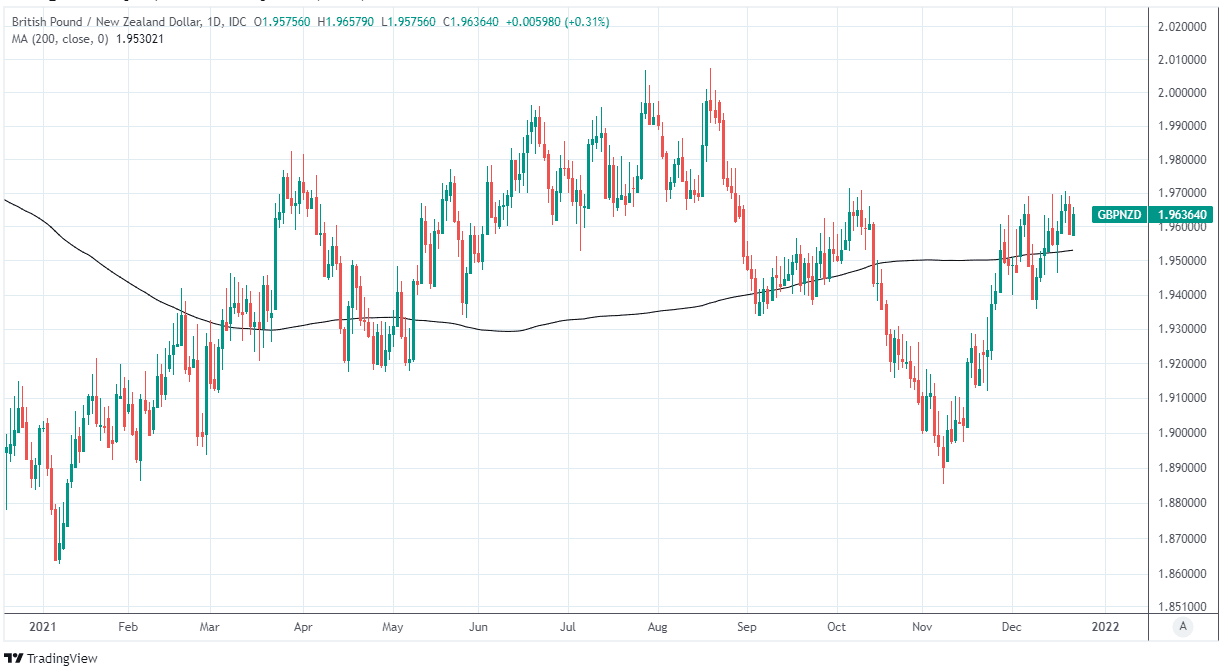

Sterling traded as low as 1.8850 against the Kiwi Dollar during the early days of November before a six-week long recovery rally saw the Pound-New Zealand Dollar rate testing but ultimately proving unable to get above the 1.97 handle five times in December.

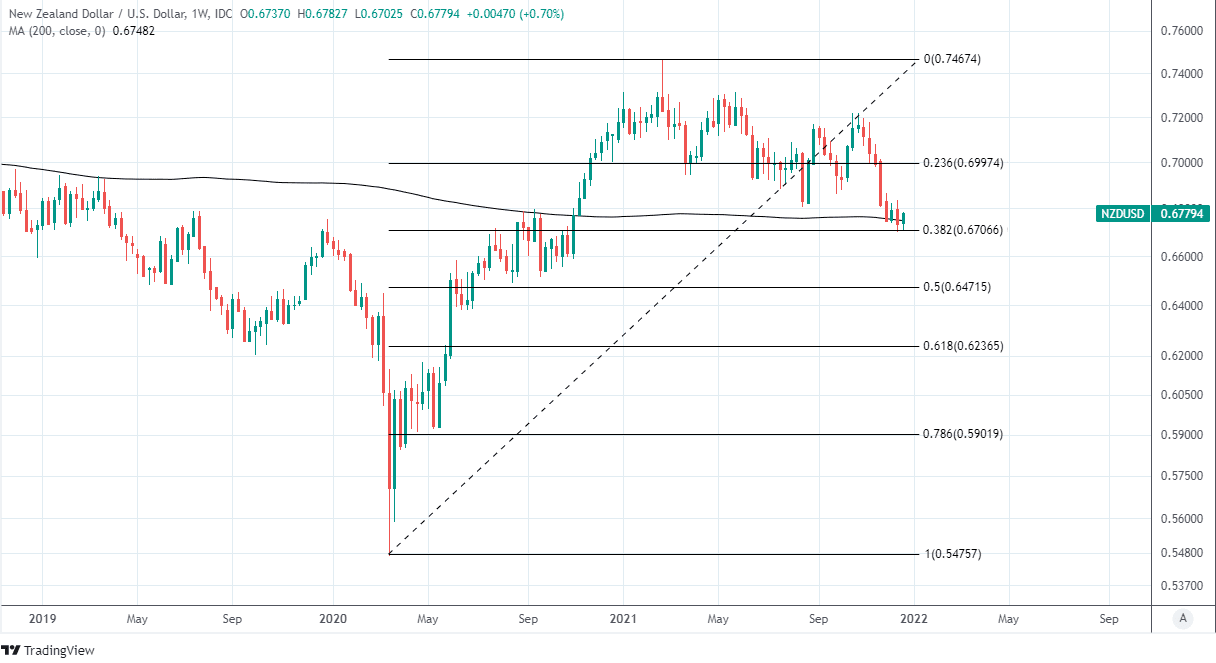

That emerging layer of resistance could potentially mark the top for Sterling if it transpires over the coming weeks that the highly influential and often negatively-correlated NZD/USD rate is able to hold above the major support at 0.6707 that it has tested repeatedly in December.

The latter would potentially signal a turning point for the Kiwi that could frustrate the Pound-to-New Zealand Dollar rate’s ability to climb further.

“We see push and pull forces in play going into year-end. USD positioning remains long and a further unwinding & profit-taking can support the Antipodeans. However, risk appetite may stay muted,” says Calvin Tse, North American head of FX strategy at Citi.

“AUD and NZD should trade closely to the broad risk sentiment with AUD exhibiting a slightly higher beta,” Tse and colleagues wrote in a Monday note.

Above: Pound to New Zealand Dollar rate shown at daily intervals.

- GBP/NZD reference rates at publication:

Spot: 1.9562 - High street bank rates (indicative band): 1.8877-1.9014

- Payment specialist rates (indicative band): 1.9425-1.9464

- Find out about specialist rates, here

- Set up an exchange rate alert, here

New Zealand’s Dollar was the worst performing major currency during the month to December 22, a period in which global markets were blindsided by the emergence of the latest mutated strain of the coronavirus.

“Germany and Portugal have become the newest European nations to introduce post-Christmas restrictions in a bid to control the spread of the Omicron variant. Measures include the limitation of socialising to 10 people, as well as the closure of some bars and nightclubs,” says Scott Petruska, chief currency strategist at Silicon Valley Bank.

The advent of Omicron has already seen the UK government rush to reimpose limits on some business and social activities, making it just the latest in Europe to readopt damaging containment measures at a point when economic recoveries from the last round were already losing momentum.

The risk of similar responses elsewhere has darkened the global growth outlook going into year-end and weighed heavily on the currencies most sensitive to changes in investors’ appetite for risk, such as the Kiwi.

“Although NZD could also benefit from improved Chinese growth sentiment, it cannot count (unlike AUD) on an ongoing rally in a main commodity (like iron ore for AUD),” says Francesco Pesole, a strategist at ING.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

“We think this leaves NZD a bit more vulnerable to the hostile risk environment, although we think the 0.6700 support in NZD/USD should hold by the end of the year,” Pesole and colleagues said in a research note this week.

While some European countries had ramped up restrictions further this week, the New Zealand Dollar was making its second consecutive attempt at lifting off from 0.6707 by Wednesday in price action that saw the U.S. Dollar submerged beneath widespread losses.

Stock and commodity markets were buoyant and risky currencies found demand following a third move by policymakers in Beijing to support the Chinese economy following an almost year-long moderation of its recovery, this time through a reduction in the loan prime rate from 2.85% to 2.8%.

However, once into the new year monetary policies of the Reserve Bank of New Zealand and Federal Reserve will be back in focus and a likely key influence on the Kiwi Dollar as well as the trajectory of the Pound-to-New Zealand Dollar rate.

“We expect a regular 25bp per meeting hike cadence from the RBNZ next year, but it is not clear that it will ever bring a bid to the kiwi,” says Greg Anderson, global head of FX strategy at BMO Capital Markets, writing in a pre-holiday review of BMO’s forecasts.

Above: NZD/USD at weekly intervals with 200-week moving-average and Fibonacci retracements of 2020 recovery indicating areas of technical support.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

New Zealand’s Dollar was a straggler among major currencies for December but also underperformed many in the G10 contingent for 2021 overall too and despite the Reserve Bank of New Zealand (RBNZ) having begun what it suggests would be a steep cycle of interest rate rises.

The RBNZ lifted its cash rate twice in the final quarter, taking it up to 0.75%, and suggested the benchmark could be raised to more than two percent next year as part of an effort to ensure that inflation eventually returns to the midpoint of the one-to-three percent target band.

The pricing-in of the RBNZ’s rate hiking cycle did little to disrupt 2021’s downtrend in NZD/USD and didn’t prevent the Pound-to-New Zealand Dollar rate from rising just more than three percent this year from what was close to post-Brexit referendum lows around the end of 2020.

“We think rate hikes and buoyant export markets for NZ's agricultural commodities should prevent NZD from falling as steeply against the greenback as EUR or JPY, but we would only project NZDUSD as likely to tread water on a 3M basis. Our 3M outlook for NZDUSD is 0.68,” BMO’s Anderson also said.

Whether or not the RBNZ’s cycle of interest rate rises is able to go ahead next year in light of the risks posed by the latest strain of the coronavirus is likely to be a key influence on the New Zealand Dollar in 2022.

Should the NZD/USD downtrend persist next year it would potentially extend the GBP/NZD recovery, although if it rises back to 0.68 in line with BMO’s forecasts then the Pound-to-New Zealand Dollar rate would be likely to top out around the turn of the year.

BMO Capital Markets forecasts the Pound-to-New Zealand rate will decline steadily back toward 1.90 by the end of the first quarter 2022.