New Zealand Dollar Caught in Crossfire of Asia’s Coronavirus Battle

- Written by: James Skinner

- NZD slipping through FX rankings this year.

- As Asia losses weigh amid new virus wave.

- Aids GBP/NZD break into 1.95-1.98 range.

Image © Adobe Stock

- GBP/NZD reference rates at publication:

- Spot: 1.9687

- Bank transfers (indicative guide): 1.8998-1.9136

- Money transfer specialist rates (indicative): 1.9074-1.7540

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The New Zealand Dollar has slipped through the major currency rankings already in recent months but now faces being further eclipsed as coronavirus-inspired sluggishness in some Asia Pacific currencies threatens to lift the trade-weighted Kiwi and hold back NZD/USD.

New Zealand’s Dollar was an outperformer on Thursday when commodity and risk currencies rebounded from losses against the U.S. Dollar which came in a volatile overnight session following the release of minutes from the April monetary policy meeting of the Federal Reserve (Fed).

“As expected, New Zealand’s strong economic rebound from the pandemic saw a significant upgrade to New Zealand 2021 Budget’s fiscal projections,” says Carol Kong, a strategist at Commonwealth Bank of Australia, referring to the New Zealand government’s latest budget update also released overnight.

The Kiwi’s fractional intraday lead follows earlier sluggishness however and comes with it still featuring as the worst performing major of the week and month.

The New Zealand Dollar had been an outperformer coming into 2021 but was close to the bottom of the bucket by Thursday, with NZD/USD having risen just 0.2% for the year-to-date despite generally supportive market conditions.

Above: NZD/USD shown at daily intervals alongside GBP/NZD.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

New Zealand’s economy has continued its rebound from last year’s collapse while investors’ expectations for a broadening global recovery in 2021 have seen the market maintain a steady bid for commodity assets and positively correlated currencies like the Kiwi this year.

But NZD/USD has struggled to make headway having spent much of the three months to Thursday consolidating below 0.73, after being dragged below the level from highs above 0.74 in late February, despite this being a period in which the negatively correlated U.S. Dollar declined broadly against other currencies.

“NZ data has been strong recently (employment, building consent, business confidence), and the medium-term outlook for the USD remains negative (as the Fed remains accommodative, global growth improving further, and commodity prices continuing to rise),” says Imre Speizer, head of NZ strategy at Westpac.

The Kiwi’s lacklustre performance has taken many in the analyst community by surprise and not least because of its occurrence in a period where investors have seemingly become more confident in wagering the Reserve Bank of New Zealand will lift interest rates next year, with neither this nor multi-year highs for agricultural commodity prices being enough to rejuvenate the currency.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

“Fresh support from interest rates for the NZD is unlikely in the near term but we do expect the Fed’s stance and higher US inflation to weigh on the USD and for commodity prices to be supported, helping the NZD,” says David Croy, a strategist at ANZ.

Curiously, the Kiwi has not been alone in its lethargy as the Australian Dollar has also frustrated a bullish market this year, with both seeing a pattern of price action that is indicative of an under-appreciated constraint on the market, and one which now risks being made worse by the latest coronavirus developments in the Asia Pacific region.

“The surge of Covid-19 cases in Taiwan and Singapore are serving as warnings for the rest of Asia as both economies were seen as having strong Covid-19 management,” says Eddi Cheung, a strategist at Crédit Agricole CIB.

Asian countries including Japan, Singapore, Taiwan and Malaysia among others have in recent days reimposed varying degrees of restrictions on their economies or announced plans to do so in response to renewed waves of coronavirus infections, triggering weakness in their currencies which could be having an under-appreciated impact on the New Zealand Dollar.

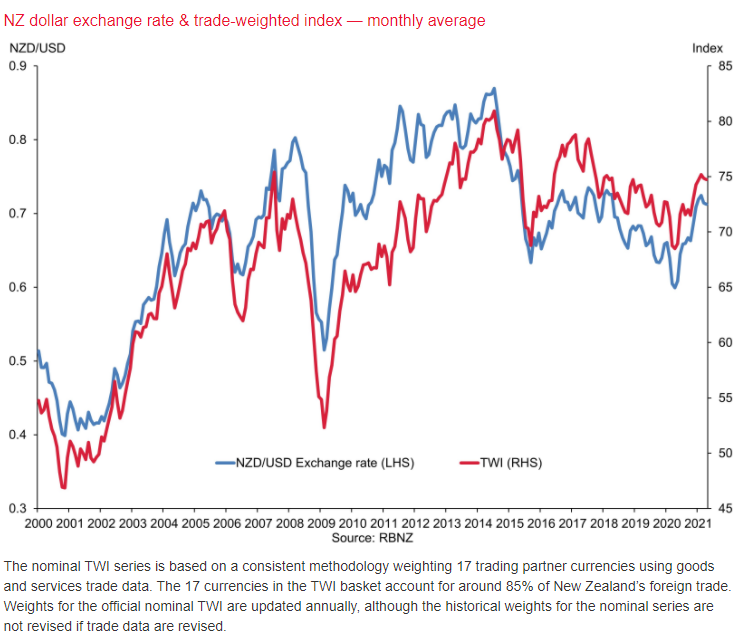

Above: RBNZ graph showing NZD/USD alongside trade-weighted NZD.

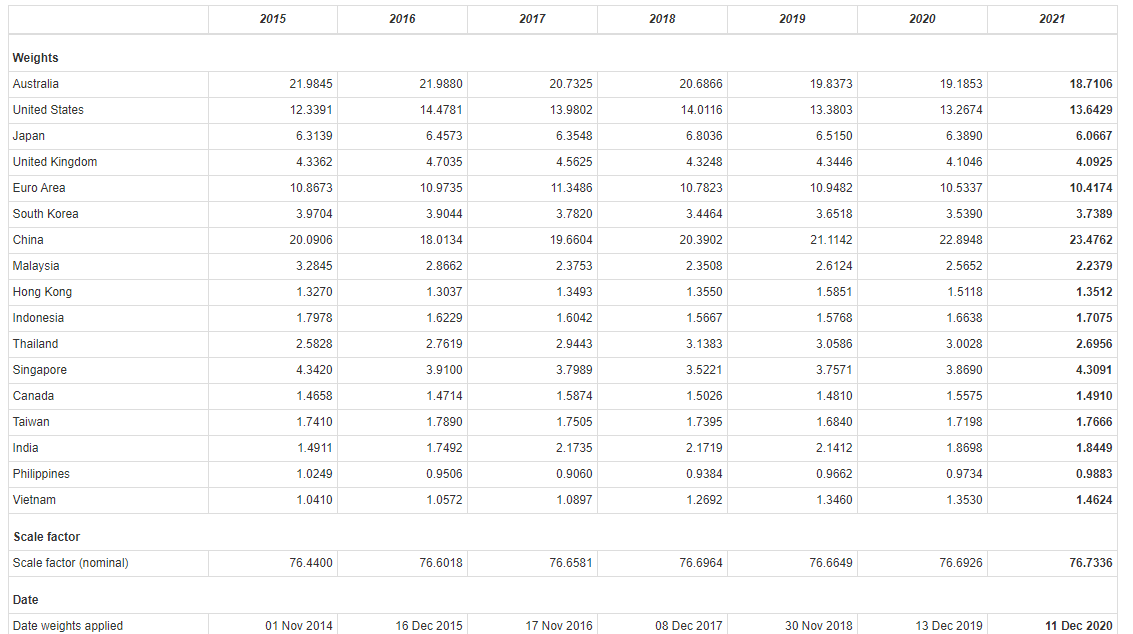

Asia Pacific currencies make up a large part of the trade-weighted New Zealand Dollar - the Kiwi measured against currencies of New Zealand’s largest trade partners - which was already near to three-year highs before the latest pandemic developments in Asia and only a handful of steps away from posing a challenge to the Reserve Bank of New Zealand.

Recent losses for these currencies would have lifted the trade-weighted New Zealand Dollar if not for intervening gains in the Chinese Renminbi and Euro-Dollar rate, and could yet lift the trade-weighted Kiwi further even if NZD/USD does nothing at all in the meantime.

This would be unless Europe’s single currency and the Renminbi continue to advance against the U.S. greenback, which would happen only slowly if it even happens at all, gains for which may be the only way of reviving the now-flagging NZD/USD uptrend and of eventually pulling the Pound-to-New Zealand Dollar rate lower from recent highs.

Pressure on Asia Pacific currencies and the result threat of an uplift to the trade-weighted New Zealand Dollar may be why NZD/USD has underperformed other major exchange rates in recent weeks, which has enabled GBP/NZD to break above 1.95 and recently trade as high as 1.9750.

“NZD/USD continues to survive tests of the bottom of the range in the low 0.71s. We expect a break of the top at 0.7300 during the next week or two, which will then signal a multi-month move towards 0.7600,” says Westpac’s Speizer.

Above: Components and weightings of trade-weighted New Zealand Dollar.