New Zealand Dollar Could be "Structurally Higher" if RBNZ has to Consider House Prices

- Written by: James Skinner, Additional Editing by Gary Howes

- RBNZ asked to consider house prices in policy decisions

- Call by Govt. has major implications for NZD

- Markets expectations for further rate cuts at RBNZ reduced

© Adobe Stock

- GBP/NZD spot rate at time of publication: 1.9118

- Bank transfer rate (indicative guide): 1.8450-1.8584

- FX specialist providers (indicative guide): 1.8832-1.8947

- More information on FX specialist rates here

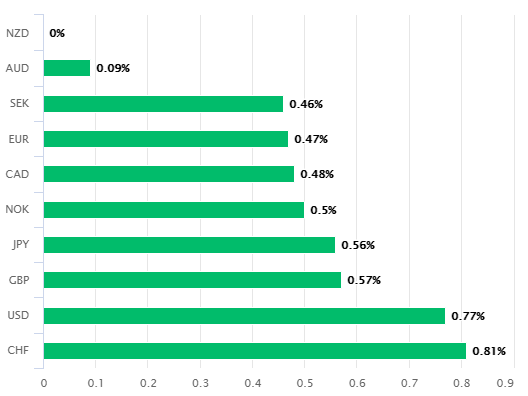

The New Zealand Dollar outperformed major currencies in a global rally of risk assets on Tuesday although the Kiwi currency had been given a headstart when Finance Minister Grant Roberston aired concerns about rising house prices, leaving the Reserve Bank of New Zealand (RBNZ) under a spotlight.

New Zealand's finance minister worried on Tuesday that rising house prices could "distort the effectiveness of our overall economic rebuild," before announcing that he's written to the RBNZ board seeking advice about how the monetary policy process could address the problem.

"New Zealand’s stronger-than-expected economic performance has flowed through to housing," Robertson says. "Tools that are now being used by the MPC were not envisaged at the publication of the February 2019 Remit. I believe it is right that we consider how these tools might be impacting the housing market, with particular regard to housing price inflation."

RBNZ officials were quick to respond, informing the finance minister that rate setters already take into account house price developments when setting policy. The bank also noted that rising prices are a mostly matter for other parts of officialdom, but otherwise agreed to mull over the question.

"If the RBNZ were forced to include house prices in its remit, then this would be a significant structural change in monetary policy and lead to a less dovish central bank in absolute terms as well as relative other central banks going forward. It would also lead to a structurally higher NZD, which is something the Labour government would also like to avoid," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

Above: New Zealand Dollar performance against major currencies on Tuesday. Source: Pound Sterling Live.

"The exchange of letters is more intriguing given that it is on the eve of RBNZ’s Financial Stability Report and Press Conference tomorrow," says Tim Riddell, a London-based strategist at Westpac.

The New Zealand government appears to be concerned about the effect that the RBNZ's policy of cutting interest rates and boosting quantitative easing in order to support the economy is having on house prices.

"Since the RBNZ has cut rates and introduced QE house prices have soared in NZ and created an awkward situation for the government – the economy is in recession, but house prices and thereby inequality are growing," says Marinov.

The market appears to be judging that the government's concern about house prices and interest rates will likely see the RBNZ step back from threatening further cuts, which is on balance supportive of the currency's outlook.

"The risks seem very much skewed higher for the NZD as the market rejects the notion of a negative OCR," says David Croy, a strategist at ANZ. "New Zealand is seen as being able to better bridge the gap to a vaccine."

New Zealand outperformed other major economies at containing the coronavirus and its resulting economic recovery has appeared stronger than officials and the market had anticipated, which has entrenched an already best-in-class government balance sheet.

This has burnished the attractiveness of the New Zealand Dollar at a time when commodity currencies were already experiencing a filip of demand associated with vaccine optimism and an anticipated global economic recovery next year.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

New Zealand's Treasury said on Tuesday it expects debt-to-GDP to come in around 27% for 2020, down from the 30% forecast issued with the national budget. British national debt crossed the 100% threshold in the third-quarter.

Despite the strength of the economy, the RBNZ has only recently begun to step back from overt threats to cut the cash rate below zero in 2021 as part of a bid to support the economic recovery and keep Kiwi exchange rates in check, which is a policy that would have risked driving house prices even higher. The bank cut its cash rate to 0.25% in March and has set out a plan to buy as much as NZ$100 bn of Kiwi government bonds in order to drive down financing costs across the economy.

Robertson acknowledged on Tuesday the role that an "overly restrictive planning system" has played in driving house prices up by double-digit percentages in the last year, while RBNZ Governor Orr noted in the bank's response how it has sought to reign in financial speculation using so-called macroprudential measures to curb high risk lending.

Record low interest rates, which have put downward pressure on mortgage rates, are threatening the value of cash savings and driving increased demand for real assets including residential property around sought after locations.

The Real Estate Institute of New Zealand said earlier this month that median house prices rose 19.8% from NZ$605,000 (£316,000) in October 2019 to NZ$725,000 in October this year. That saw the average price in the metropolis of Auckland cross the NZ$1 million threshold for the first time.

"Lower rates are needed to try to keep inflation up….but lower rates push house prices through the roof, and so the opposite is needed. What’s a central bank to do? Of course, there are always macro-prudential measures to limit mortgage lending," says Michael Every, a global strategist at Rabobank. "Expectations of negative RBNZ rates have withered and NZD is up, as it logically should be – which is just what exporters don’t want to see."

Above: NZD/USD at weekly intervals with Fibonacci retracements of January 2018 downtrend, selected moving-averages.

"NZD/USD is eroding the December 2018, January and March 2019 highs at 0.6939/70 as previously forecast. Above it the June 2018 high can be found at 0.7061 and the 78.6% retracement at .7111. This is regarded as the last defence for the .7436 2018 high," says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank.

New Zealand's Dollar led major currencies in a global advance on the U.S. Dollar Tuesday as stock markets and risk assets in general basked in relief after President Donald Trump's instructed the General Services Administration to begin work associated with a transition to a new administration from January.

The incumbent still contests the outcome of the election and persists with challenges to it in multiple states, although that didn't deter investors from celebrations, which may have been bolstered on Tuesday when the incoming Joe Biden announced former Federal Reserve Chair Janet Yellen as Treasury Secretary in the next administration.

Global markets and the commodity sensitive Kiwi were lifted while the Pound underperformed following strong gains to open the week on Monday, which were ignited by both progress toward a coronavirus vaccine and speculation suggesting a Brexit agreement with the EU could be near.

"Five years of crippling Brexit uncertainty and a badly handled pandemic have pushed the UK from a growth leader among major advanced economies to one of the worst performers. But with luck, its prospects could finally be turning up. Reacting to the rising chance of a UK-EU agreement as well as progress on the virus front, we upgrade our key calls for the UK economy," says Kallum Pickering, a senior UK economist at Berenberg. "Although it is still early days, key data for the final quarter of 2020 are so far coming in a little better than expected relative to our initial projection of a 5.5% qoq contraction in real GDP...Further out, upside risks to global economic momentum and productivity are offset by the possibility that the UK’s Conservative government could succumb to party political pressures and pursue austerity prematurely."

Above: GBP/NZD at weekly intervals with Fibonacci retracements of post-referendum recovery and selected moving-averages.